To rephrase a line from Forest Gump, Earnings are like a box of chocolate’s; You never know what you’re going to get. Positive big tech reports lift MSFT into the trillion dollar club and FB shares leap 7% despite the expectation of a huge FTC fine. As a result NASDAQ futures point to modest gap up open with the Dow futures point to triple point gap down after a disappointing MMM earnings miss.

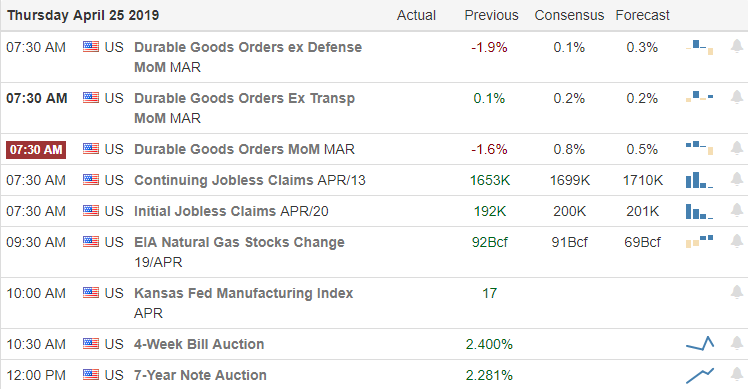

Asian markets struggled with stimulus concerns closing mostly lower overnight and the European markets are modestly lower across the board this morning amid their earnings reports. With about 300 companies reporting today and a Durable Good report at 8:30 AM Eastern we still have a lot of random chocolate’s to try and digest this morning. It’s never a dull moment during earings session so tighten up that seat belt it could be a bumpy ride ahead.

On the Calendar

Today is the biggest day of the week in the Earnings Calendar with around 300 companies reporting. Some of the notable reports today include, AMZN, MMM, ABBV, AFL, MO, BCS, BMY, COF, CERN, LFC, CLF, CMCSA, CUBE, DHI, DLR, DFS, F, FCX, HSY, ITW, INTC, IRM, MAT, RTN, SFLY, LUV, SBUX, SIVB, UBS, UPS, VLO, WM and XRX.

Action Plan

After reporting very strong earnings after the bell yesterday MSFT joined the very few companies to reach the Trillion market cap company. FB jumped 7% as investors shrug off the possibility of a 5 billion dollar FTC fine for privacy violations. After reporting a huge earnings miss and their largest quarterly loss ever TSLA shares seems to hold firm near yesterdays close. What’s a little confusing is that futures are currently pointing to gap down open of more than 100 points after the big tech’s reported so well. Forest Gump should have said, earnings are like a box of chocolate’s; you never know what you’re going to get!

Asian markets closed mix but mostly lower as China wrestles with more stimulus concerns. European markets are in the red across the board this morning currently holding only modest declines. The big news this morning is the huge earnings miss from MMM currently indicating more than a 20 point decline from yesterdays close. Ouch! With so many companies reporting today anything is possible by the open and remember we still have the Durable Goods report at 8:30 Eastern to also digest before the open. Buckle up it could be a bumpy road ahead this morning.

Trade Wisley,

Doug

Comments are closed.