It’s all about the earnings and it would seem the entire world is waiting on the edge of their seat to see the results. Asian markets closed mixed but mostly lower as they wait and European index are also pensive this morning waiting on the wave of earnings results out this morning. The trends in the DIA, SPY and QQQ continue to hold but thus far have lacked the inspiration to attack all-time highs. If earnings are good enough that may be exactly what we do.

However if earnings disappoint than the small-caps currently the weakest of the indexes could lead us lower and already showing weakness. Expect significant volatility over the next few weeks with the possibility of large morning gaps in either direction as traders and investors digest the results. As always set aside your bias and focus on the price action. What we want the market to do is not relevant. How we exercise our discipline to trade the market reaction is what matters. Which direction we go is all about the earnings!

On the Calendar

We have a big day on the earnings calendar with nearly 150 companies reporting results today. Notable reports include, CP, CNC, CIT, KO, EBAY, EW, FITB, FE, HOG, HAS, PG, IRBT, JBLU, LMT, NUE, SHW, SIX, SNAP, STT SYK, AMTD, TXN, TRU TWTR & VZ.

Action Plan

After a day of anemic price action markets around the world continued to trade very cautiously overnight. Asian markets closed mixed but mostly lower waiting for the US earnings and reacting to rising oil prices. European markets currently indicate the same caution with mixed but mostly lower results as they wait for the earning deluge. As a result the US early morning futures are modestly lower across the board but that likely to significantly change as earnings roll out fast a furiously in the pre-market.

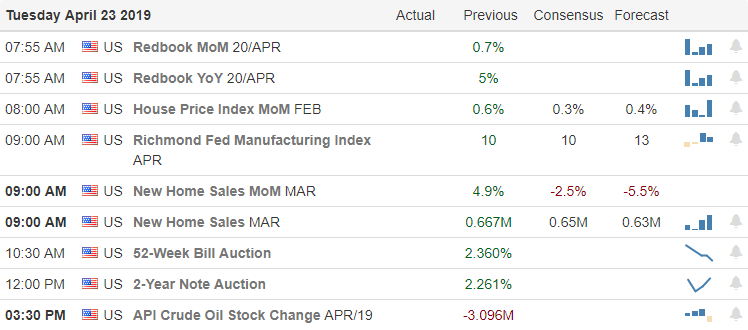

Existing home sales came in short of expectations yesterday despite the lower interest rates. With that in mind the New Home Sales report at 10 AM Eastern gains in significance and could move the market today should it also miss expectations. Technically speaking the DIA, SPY and QQQ are in good shape holding trends while still looking for inspiration to challenge price resistance levels. IWM on the other hand is a different story trading well below all-time highs and currently dealing with a failed new high. Will earnings prove strong enough to lift the market? Only time will tell.

Trade Wisely,

Doug

Comments are closed.