Bears are once again on the prowl!

With the smell of fresh blood in the air after the disappointing results, NFLX reported yesterday the nearly forgotten bears are once again on the prowl. NFLX has warned they would miss expectations and it makes you wonder what might lay ahead with the many other company warnings that were issued. Technically speaking the bullish trends in the DIA, SPY and QQQ remain intact, but we should expect price action to become much more volatile as earnings reports increase over the next couple weeks.

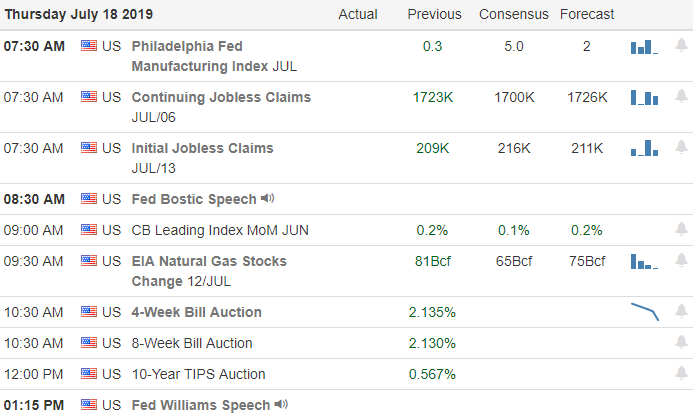

Asian markets closed lower across the board overnight, reacting to earnings and growing trade war tensions. European markets are currently mixed but mostly lower, citing trade uncertainty and tech earnings concerns. US Futures have recovered significantly from overnight lows ahead of the 8:30 AM eastern Jobless Claims report and the Philly Fed Business Outlook Survey which both have the potential of moving the market. I would expect challenging price action in weeks ahead, so plan your risk carefully.

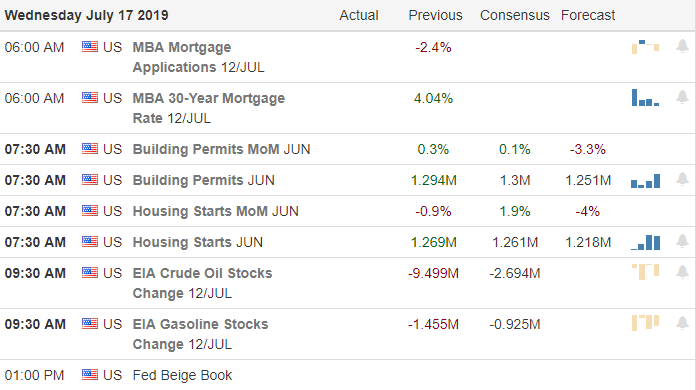

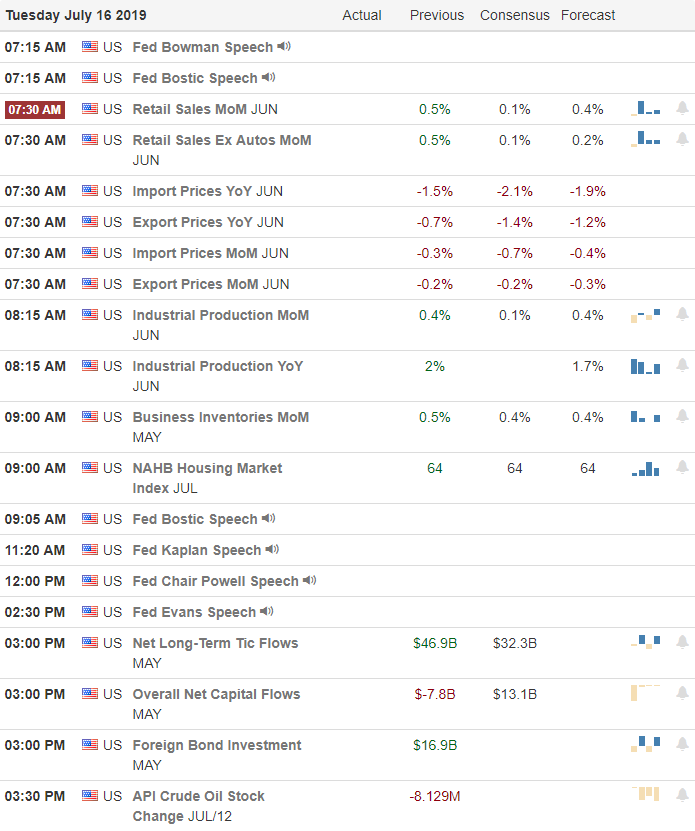

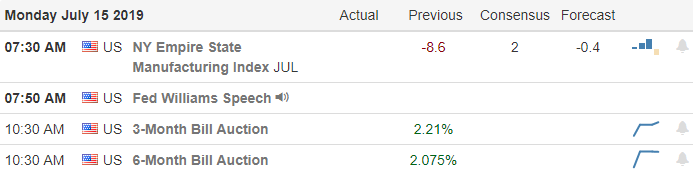

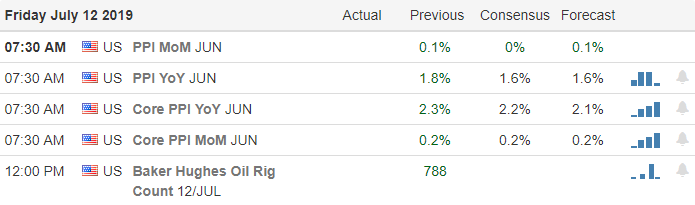

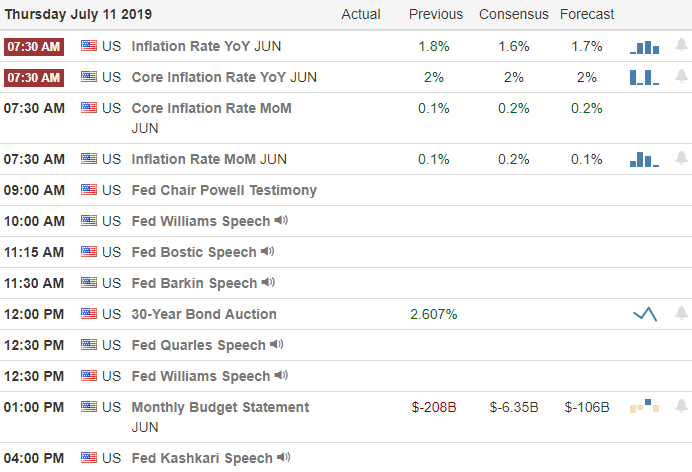

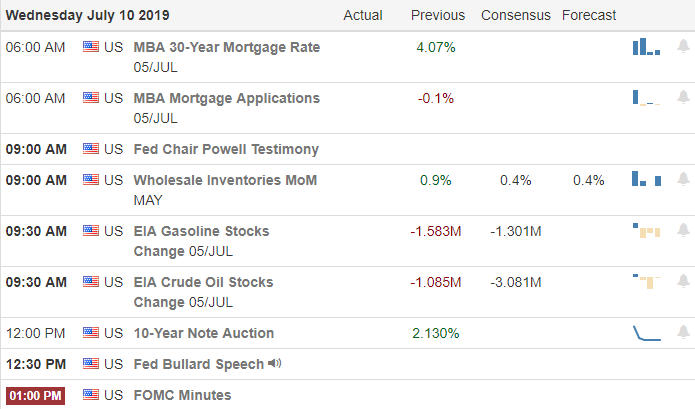

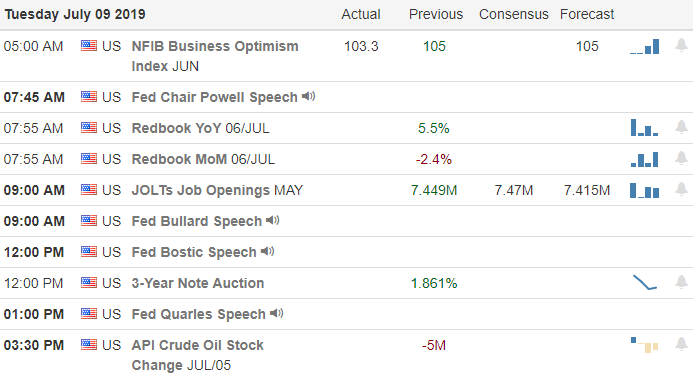

On the Calendar

On the Thursday Earnings calendar, we have 90 companies stepping up to report quarterly results. Among the notable reports ALLY, BBT, COF, CHWY, DHR, DOV, ETFC, GPC, HON, ISRG, MTB, MS, MSFT, NVS, NUE, PM, PPG, SKX, SWKS, STI, TSM, UNP, and UNH.

Action Plan

NFLX earnings disappointed traders after the bell yesterday reporting a significant decline in domestic subscribers. Shares of the streaming service are indicated to open nearly 40 points lower this morning pulling the QQQ down to test breakout support levels. It may also elevate the concerns of all the other tech companies that have warned about missing expectations this season. Perhaps an even more damaging report came for CSX yesterday sending the railroad sharply lower raising significant concerns for the overall transport sector.

With another big round of earnings reports this morning and the tech giant MSFT reporting after the bell, we should expect an increase in volatility. As of the close of yesterday overall trends of the DIA, SPY and QQQ remain bullish, but with the scent of blood in the air, hungry bears will be on the prowl. As I write this, the bulls are trying to put on a brave face with the futures recovering significantly from overnight lows and currently suggesting modestly bearish open. I would not be at all surprised to see a retest of the overnight lows depending on the morning earnings results and the 8:30 AM Economic Calendar reports.

Trade Wisely,

Doug