We have had a very busy week of earnings with mostly encouraging results but also some manor disappointments to challenge traders. However, this week pales in comparison to the challenges we face next week with nearly 1300 companies reporting and an economic calendar brimming with market-moving reports including the FOMC meeting. It might be wise to consider that as you plan your risk into the weekend.

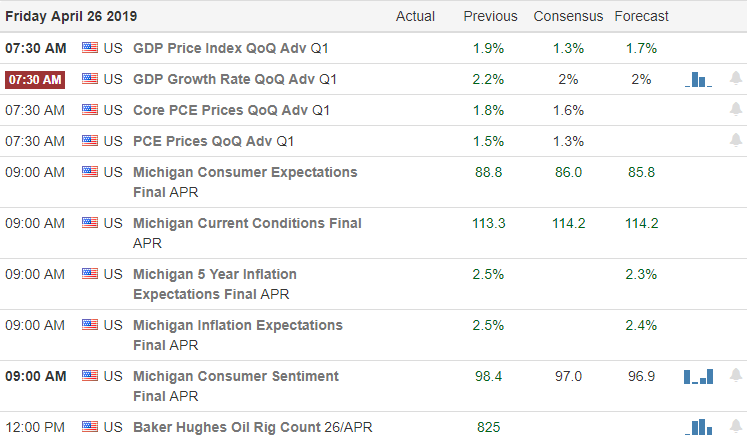

Asian markets closed mostly lower overnight with European markets trading mixed an nearly flat. As a result, US futures have mixed results ahead of the GDP report at 8:30 AM Eastern that could well set the tone for the day. Worries of an economic slowdown could be quelled with a strong GDP number or cemented if the number comes in weak. Let’s buckle up hoping for the best but prepared for the worst keeping mind the challenge traders face next week mean we will have to be focused and at the top of our game.

On the Calendar

On the Earnings Calendar we have a little break with only 88 companies reporting but with about 1300 companies reporting next week we must stay focused on reporting dates. Among the notable reports today are, AZN, AN, BLMN, CVX, CL, DB, XOM, BEN, GT, SNY & WY.

Action Plan

Although we have a slightly lighter day on the earnings calendar we will still have to say on our toes with several notable reports. The market will also have to digest the GDP report scheduled to release at 8:30 AM Eastern this morning. If the GDP happens to show growth as many analysts are suggesting it could be just the catalyst needed for the bulls to break through the resistance highs on the SPY. Of course a decline in the number could cement the worries of an economic slow down bringing out the bears. Stay on your toes!

Thought the sharp pullback in the DIA yesterday was disappointing it managed to hold just above an important support level. The SPY and QQQ remain in upward trends and continue to look technically strong with the QQQ leading the indexes. As we move quickly toward the weekend remember to take some profits and carefully consider the risk you carry into the weekend because next week is a massive week of earnings and economic news including the FOMC. I wish you all a great weekend.

Trade Wisely,

Doug

Comments are closed.