A turbulent 3-day weekend of Easter terror attacks in Sri Lanka and Mueller report political drama ahead of a big week of earnings report has the futures pointing to a gap down open this morning. With several markets around the world closed today and the likelihood that many traders and investors have extended their holiday; there is the possibility of light and choppy price action after the morning rush.

With about 800 companies scheduled to report earnings this week plan for an extra dose of price volatility and don’t be surprised to large morning gaps. The big question to be answered is whether or not the earnings will inspire the market to new record highs or if the analyst’s concerns of an economic slowdown come to fruition in the company results? Though we may have had a turbulent 3-day weekend of news the turbulence may just be beginning as earnings season heats up. Stay focused on price action and plan your risk carefully for the possibility of bumpy air ahead.

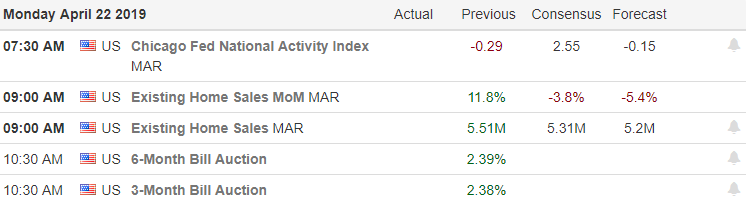

On the Calendar

On the Earnings Calendar we have nearly 80 companies reporting earnings today but we will have more than 300 reports on Thursday. As the 2nd quarter earnings season heats up make sure to check reporting dates for all current holdings and those you’re considering for a buy.

Action Plan

Easter terror attacks in Sri Lanka, Mueller report political drama, rising oil prices, Boeing facing claims of Dreamliner Mfg. issues, and a parked Tesla apparently blowing up are just a few of the stories popping up during the long weekend. There are several markets closed around the world today as Easter holidays continue. Futures are slightly under pressure this morning pointing to a gap down of more than 50 Dow points. After the morning rush there is a possibility of light and choppy price action as may traders and investors have likely extended their holiday vacation.

With earnings season heating up this week we should expect increased price action volatility and the possibility of large daily gaps. Check those earnings dates on companies you hold or are thinking about buying and plan your risk carefully. I think the big question to be answered is will earnings finally break resistance highs propelling the markets to new records or will earnings point to the economic slowdown many analysts suggest. Only time will tell so stay focused on price action for clues and respect support and resistance levels as you plan you risk moving forward.

Trade Wisely,

Doug

Comments are closed.