Friday was another indecisive day in markets as SPY and DIA opened flat while QQQ opened 0.18% lower. At that point, SPY spent the entire day in a very slow, gradual rally. Meanwhile, DIA sold off modestly the first 10 minutes and then traded sideways the rest of the day not far below the open level. At the same time, QQQ followed the SPY lead with a long, slow rally that lasted all day. However, since it started lower on a larger gap the move closed it just above the prior close. This action gave us white-bodied Spinning Tops in the SPY and QQQ and a black-bodied Spinning Top in the DIA. All three major index ETFs remain well above their T-line (8ema) despite the 3–4-day consolidation. This all happened on far-below-average volume in all three major index ETFs.

On the day, all 10 sectors were in the green with Energy (+2.18%) way out front and leading the way higher while Consumer Defensive (+0.05%) lagged behind the other sectors. At the same time, the SPY gained 0.12%, DIA lost 0.17%, and QQQ gained 0.02%. The VXX fell more than 1.54% to close at 18.56 and T2122 spiked up again to the overbought territory at 94.94. 10-year bond yields dropped again to 4.439% and Oil (WTI) spiked 4.03% to close at $75.84 per barrel. So, Friday was another holding pattern day with markets waffling sideways all day. We were able to relieve over-extension by marking time (giving the T-line time to make up ground), which was greatly needed. However, for the most part, it was just an indecisive pause day in a Bullish rally.

The major economic news reported Friday was limited to October Building Permits, which came in above expectations at 1.487 million (compared to a forecast of 1.450 million and even above the September value of 1.471 million). This was a 1.1% month-on-month increase after September had given us a 4.5% decrease over August. At the same time, October Housing Starts also came in above predicted at 1.372 million (versus a forecast of 1.345 million and the September reading of 1.346 million). This amounted to a 1.9% increase from September which itself had seen a 3.1% increase over August.

In Fed Speak news, Boston Fed President Collins stated the FOMC may need to worry less about inflation and let the benefits of strong employment spread to workers. She said, “The labor force participation rate for prime-aged workers is higher today than it was just before the pandemic … If labor supply expands to meet demand in tight labor markets, then higher levels of economic activity in such times may not generate added price pressures requiring tighter monetary policy.” “Unemployment rates that are persistently higher by race, or by place, as they have been for a long time, reflect underutilization of our country’s labor resources, and that adversely affects national productivity and prosperity.” Elsewhere, Chicago Fed President Goolsbee pointed to housing prices as the key to sealing the country’s path to 2% inflation. Goolsbee said, “If we hit the targets that we expect to hit, then we would be on path to get to 2%, and that’s what I call the golden path — no recession, and inflation gets down — but that housing inflation is the thing we should really keep an eye on.” Later, Fed Vice-Chair Barr told Bloomberg that current economic readings align with the Fed’s goal of getting to a 2% inflation target. Even later, Collins spoke again, echoing Barr’s sentiments by saying there has been “promising news” lately on the economic data front but also said she would not take additional tightening off the table yet. Finally, San Francisco Fed President Daly indicated patience was in order, with no need to hike or cut rates at the moment. She said, “We can take our time to do it right.” However, at the same time, Daly wanted to communicate the Fed’s “resolve” to get to the 2% target.

In stock news, union members at both STLA and F voted to ratify the UAW contracts that had been tentatively agreed in October. This brings the UAW vs Big-3 saga to an end for another four years. Elsewhere, DCI announced a 12 million share buyback program on Friday. Later, Reuters reported that C employees now expect major layoffs and a management change announcement on Monday. Meanwhile, the CEO of AI leader OpenAI (ChatGPT) announced he is stepping down Friday after the company board lost confidence in his direction. (It is worth noting that MSFT is the largest shareholder of OpenAI and controls multiple board seats.) Later, the CFO of NKLA resigned after less than a year on the job, saying he “wished to pursue other interests.” After the close, Reuters reported that GM is continuing its on-street testing of Cruise robotaxis in Dubai and Japan, despite parking its entire fleet in the US. Also after the close, AMZN announced it would be cutting “several hundred” jobs from its Alexa voice assistant unit, citing a greater focus on AI (which presumably can provide the same service).

In stock government, legal, and regulatory news, the CFPB handed Wall Street banks a rare win from the consumer protection agency. The CFPB proposed cracking down on Big Tech firms by regulating electronic payment and “digital wallet” providers such as AAPL, GOOGL, and PYPL. This is a boon for V, MA, JPM, C, BAC, WFC, and other more traditional payment processors. At the same time, DRMA received FDA approval on the protocols to be used for a phase III study of their acne treatment. Later, the Financial Times reported that NOC is pulling out of a competition to supply the UK military with narrowband military satellite communications. Meanwhile, PAYC was hit with a class action lawsuit. The suit alleges that the company and its executives made misleading statements about one of its products leading to be surprised by a significant miss on its Q3 report. Later, the NASDAQ announced that MDRX is under investigation due to its failure to submit financial documents, including its FY2022 Annual and Quarterly reports as well as Quarterly reports in 2023. After the close, the FDA flagged insufficient data in voting 12-1 against an MRK late-stage drug for chronic cough.

Overnight, Asian markets were mixed but leaned toward the green side. Hong Kong (+1.86%) was way out front with South Korea (0.86%) a distant second leading the way higher. Meanwhile, Japan (-0.59%), Singapore (-0.42%), Malaysia (-0.26%), and India (-0.19%) were the only losing exchanges. In Europe, we see a similar picture taking shape at midday. The CAC (+0.15%) leads the more plentiful green list while the DAX (-0.28%) and FTSE (-0.29%) pace five losing exchanges in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a mixed, flat start to the day. The DIA implies a -0.03% open, the SPY is implying a +0.02% open, and the QQQ implies a +0.12% open at this hour. At the same time, 10-year bond yields are back up to 4.482% and Oil (WTI) is up 1.5% to $77.05 per barrel in early trading.

There is no major economic news scheduled for Monday. The major earnings reports scheduled for before the open are limited to NIU. Then, after the close, A, BRBR, CENT, CENTA, KEYS, TCOM, and ZM report.

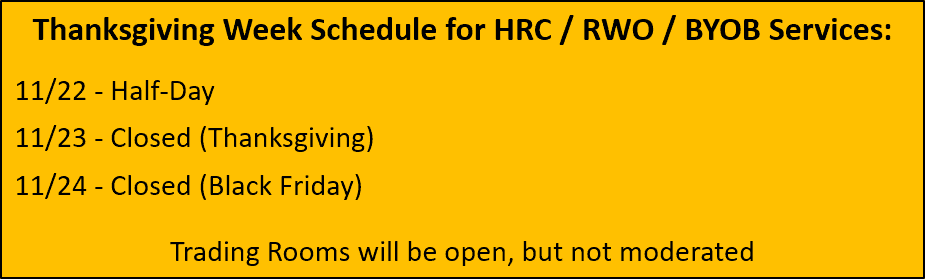

In economic news later this week, on Tuesday we get October Existing Home Sales, FOMC Meeting Minutes, and the API Weekly Crude Oil Stock Reports. Wednesday, Oct. Core Durable Goods Orders, Oct. Durable Goods Orders, Weekly Initial Jobless Claims, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-year Inflation Expectations, Michigan 5-year Inflation Expectations, and EIA Weekly Crude Oil Inventories are reported. There is no major economic news scheduled for Thursday with markets and Federal agencies closed for Thanksgiving. Finally, on Friday, we get S&P US Mfg. PMI, S&P US Services PMI, and S&P Global Composite PMI.

In terms of earnings reports later this week, on Tuesday we hear from ANF, AEO, ADI, BIDU, BBY, BURL, CAL, DKS, DY, IQ, J, KSS, LOW, MDT, NJR, YSG, ADSK, GES, HPQ, JWN, NVDA, and URBN. On Wednesday, DE reports. There are no reports on Thursday. Finally, on Friday we hear from HTHT.

In miscellaneous news, Elon Musk’s mouth has him in trouble again. Last week he made a comment widely seen as antisemitic. This has caused another mass exodus (see what I did there?) of major advertisers from his renamed Twitter platform. This includes AAPL, DIA, IBM, WBD, LGF.A, ORCL, CMCSA, PARA, etc. One analyst told Bloomberg Friday that this hit has likely taken that company down to about one-third the value it had when he bought it just over a year ago. Then, on Saturday, a major investor in TSLA called for the board to place Musk on leave “for a month or two.” Elsewhere, in bad news for climate change deniers, the USDA has been forced to revise the national Plant Hardness Map (map indicating what plants can be grown in each area). The entire country shifted a bit more toward tropical with half the country shifting an entire zone since 2012. This is a result of the climate being 2.5 degrees warmer on average than it was a decade ago.

With that background, it looks like all three major index ETFs are looking to continue their consolidation…at least based on their premarket candles. All three are flat and have printed small, indecisive candles at this point of the early session. The SPY, DIA, and QQQ all remain well above their T-line (8ema) and 50smas. So, the Bulls are in control of both the short-term and 4-5-month trend. In terms of extension, the T-lines (8emas) are now catching up with all three major index ETFs. However, the T2122 indicator has now back up in the upper end of its overbought range. So, we have some slack to work with but we are still leaning toward the need of pause or pullback. With that said, keep in mind that the market can remain overbought longer than you can last predicting a reversal too soon.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Comments are closed.