Tech Sector 35th record high.

As I mentioned yesterday, don’t expect the bulls to give up easily. After bears enjoyed a brief burst of energy, the bulls rushed back in pushing the tech sector to its 35th record high this year led by AAPL closing above a 2 trillion market cap for the first time in history. However, there is an interesting imbalance with the majority of the SP-500 stocks in decline, while the tech giants continue to lift the index. A unique COVID season condition that one has to wonder how much longer it can continue. I guess only time will tell, but it would be wise to remember bears still exist, and it would be foolish to become overly complacent.

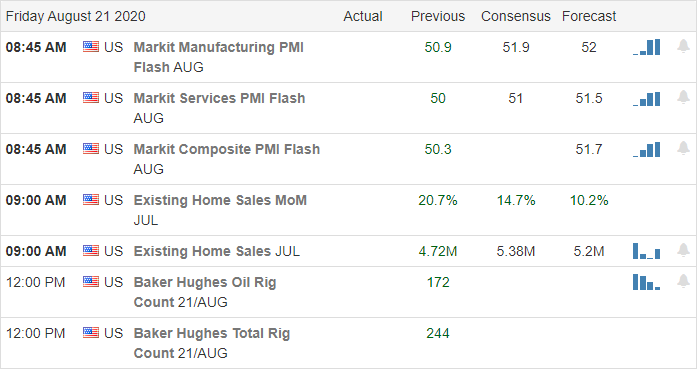

Asian markets close the trading week on a bullish note rising modestly across the board overnight. European markets, however, trade flat to slightly lower this morning with disappointing PMI reading. US futures were bullish most of the night, but this morning has slipped slightly negative ahead of earnings, a PMI report, and Existing Home Sales. Plan your risk carefully as we slide into the weekend.

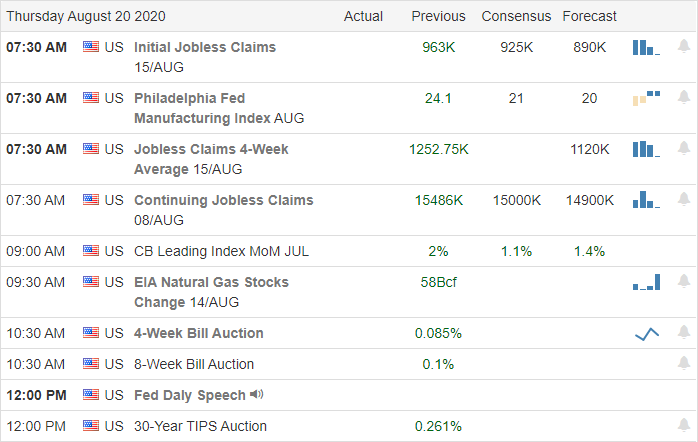

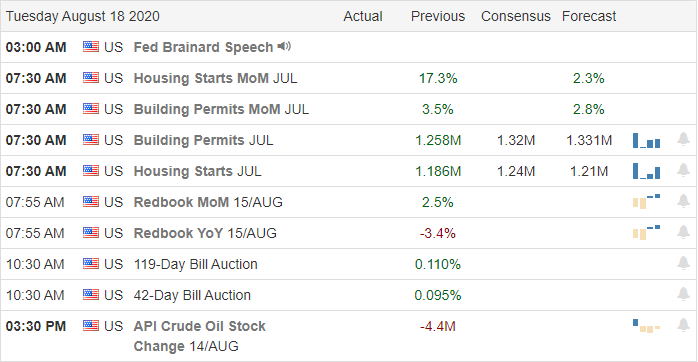

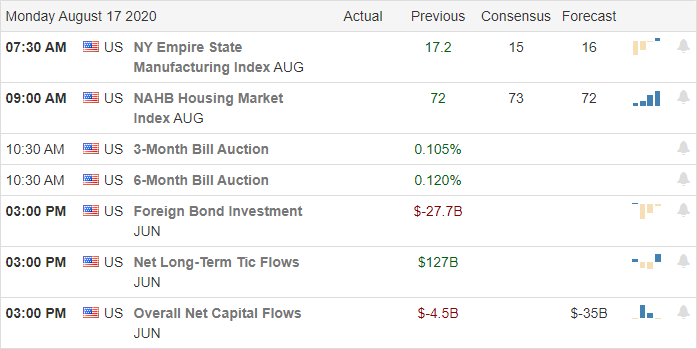

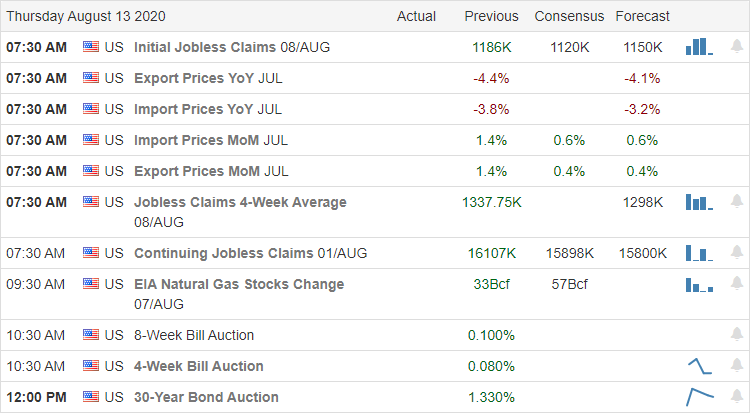

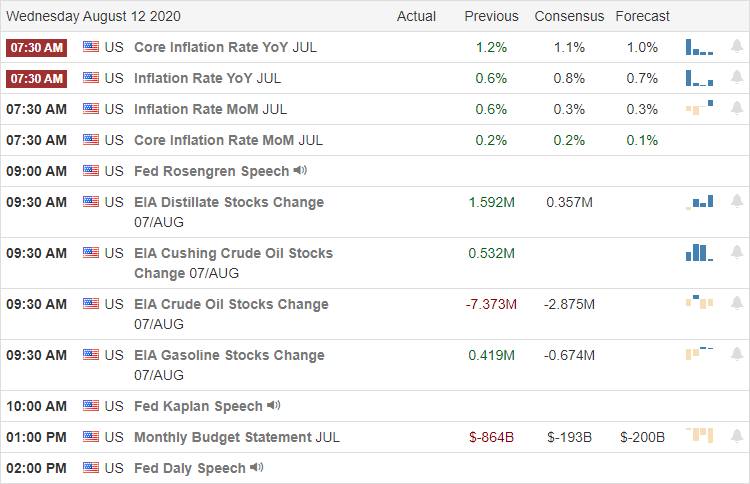

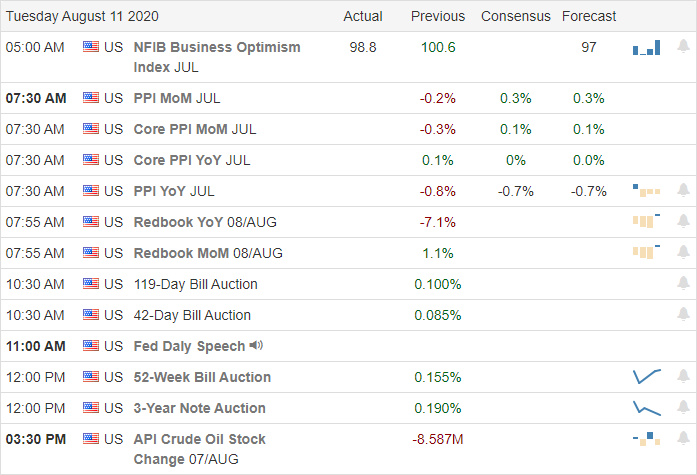

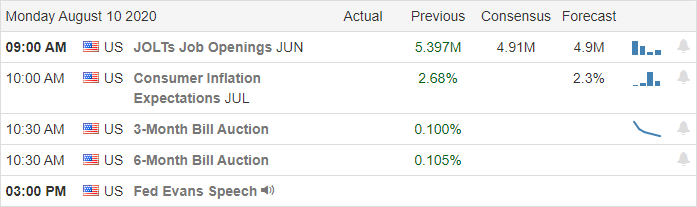

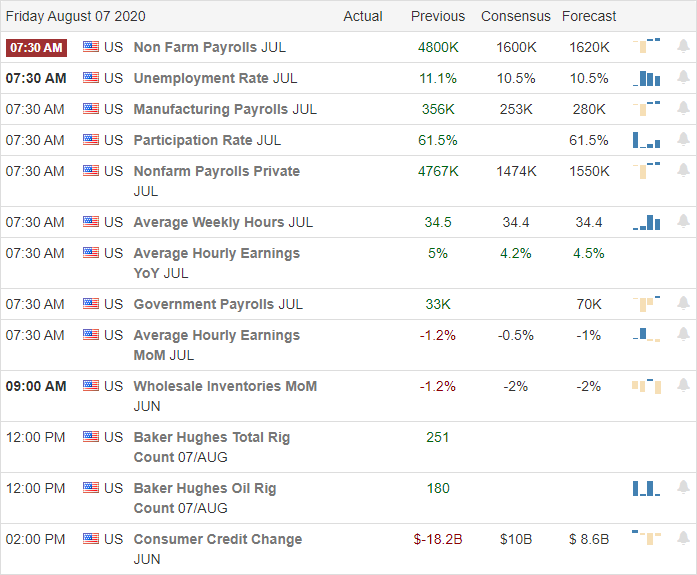

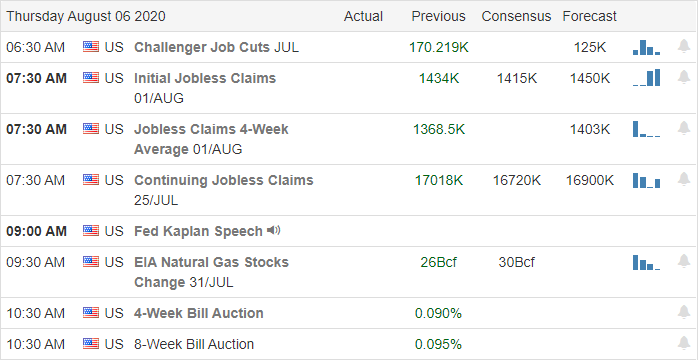

Economic Calendar

Earnings Calendar

On the Friday Earnings calendar, we have a rather light day with just 18 companies fessing up to quarterly results. Notable reports include BKE, DE, FL & PDD.

News & Technical’s

Though the bears began the day with a short burst of energy, the bulls stampeded back into control, pushing the NASDAQ up to its 35 record high this year. AAPL led the way yesterday closing for the first time above a 2 trillion market cap and showing no signs that the new high prices concern buyers. How much higher it can go is anyone’s guess. What is interesting is that we saw very few companies pushing the index higher yesterday as the vast majority continued to drift sideways or pullback. One has to wonder how much longer this unique COVID season condition lasts with such an extreme imbalance between the have’s, and the have not’s. That said, at this time, the indexes all remain in very bullish trends with equally bullish price patterns even as the Absolute Market Breadth Index continues to signal a significant divergence. While we continue to enjoy this impressive rally, never forget that the bears are still out there waiting for an opportunity to feed. Stay focused and plan carefully.

Trade Wisely,

Doug