The FOMC woke sleeping bears after using the term “economic uncertainly” due to the business impacts of the coronavirus pandemic. They also mentioned the need for more government stimulus, which we all know is likely on the way, assuming Congress will eventually get its act together once they get over point fingers at one another trying to assign blame to the other party. After a historic rally, a little resting consolidation or pullback is healthy for the market, assuming the bulls defend price support levels.

Asian markets closed in the red across the board after announcing they will resume trade talks with the US. European markets are also in a bearish mood this morning, reacting to the Fed statement of uncertainty. US Futures point to a lower open but have bounced off of overnight lows ahead of earnings and potentially market-moving economic reports.

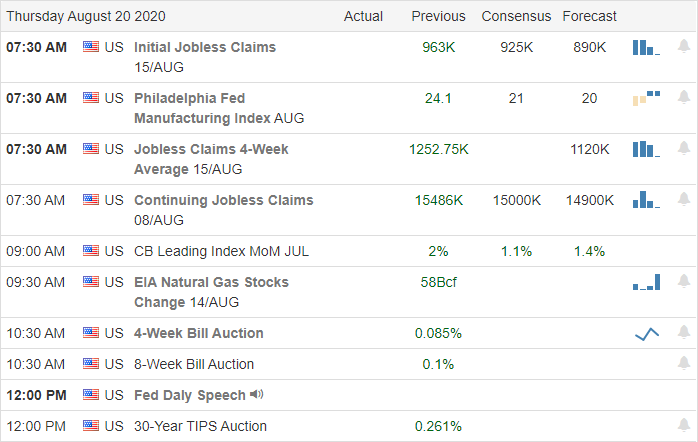

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have 32 companies stepping up to report quarterly results. Notable reports include BABA, BJ, EL< GFI, MLCO, & ROST.

News & Technical’s

Wednesday started strong setting new record highs and pushing AAPL briefly above 2 Trillion in market cap, but comments from the FOMC brought out some profit takers. Minutes from the last FOMC meeting used the words “economic uncertainty” ahead due to coronavirus business impacts. Honestly, I don’t understand how that could have been a surprise to the market, but it seems to have woke up the bears at least temporarily. The Fed also mentioned the need for more government stimulus, which is likely on the way, assuming Congress will eventually get its act together and come to an agreement. Chinas commerce ministry announced early Thursday that they would go back to the trade negotiation table with the US helping to lift US futures off of overnight lows.

Technically speaking, yesterday’s pullback should raise the awareness that the market will not go up forever, but so far, indexes remain in bullish trends and above price support levels. However, it should be no surprise that the markets are significantly extended, and consolidating rest or a pullback is overdue if only to allow moving averages to catch up. Healthy markets test support and trends, so don’t fear a possible pullback. Lowered prices set up new opportunities.

Trade Wisely,

Doug

Comments are closed.