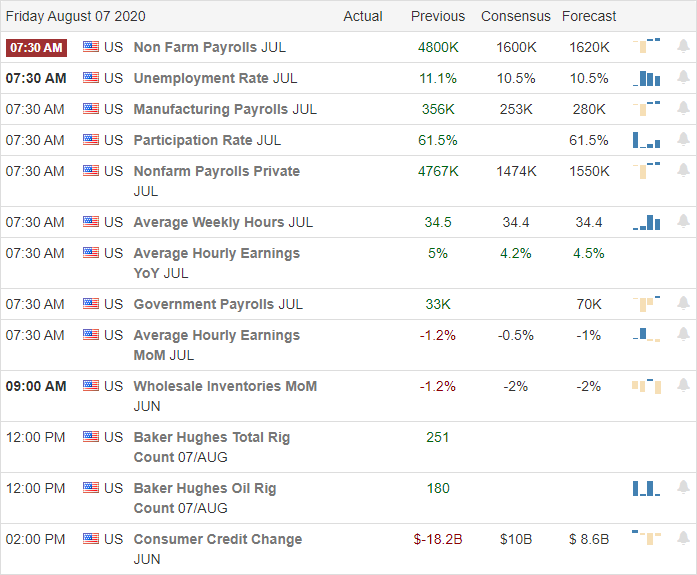

All eyes are on the Employment Situation number and rightfully so. A lot is riding on this number with estimates that range for 0 to 3 million jobs created. Although futures are currently pointing to a bearish open, anything is possible after the number releases an hour before the market open. An executive order banning all transactions in 45 with WeChat and TikTok is increasing tensions with China, and Congress left Washington for a week without a deal on stimulus, adding a bit more uncertainty as we slide into the weekend.

Asian markets closed in the red across the board last night in reaction to the rising tensions. European markets are choppy and flat this morning as they monitor jobs news and US-China relations. With a lot at stake as the US, market prices at or near record highs, anything is possible at the open as we react to the data. Fasten your seat belt and prepare for wild price action as we head into the weekend.

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have a lighter day, with 83 companies stepping up to report. Notable reports include KIM, MGA, VTR, & VIRT.

News and Technical’s

Another day of big tech buying pushing the NASDAQ to another record high topping the 11,000 level for the first time. The SPY is now less than 1.3 percent away from new record highs, and a lot will depend on the significant Employment Situation number at 8:30 AM eastern today. The estimates range between 0 jobs gained last month to 3 million with a consensus estimate of 1.4. Obviously, at the current elevation of the market, this number has the potential of creating considerable price volatility before the open. Congress adjourned and went home for a week without a deal on the heavily anticipated stimulus bill, with both sides blaming each other for the delay. Senator Sanders introduced a new bill called Make the Billionaires Pay Act. If passed, it will require the richest in the country fork over hundreds of billions to the government with the intent of funding health care for Americans for the next year. Tensions between the US and China continue to grow after the President signed an executive order banning transactions with WeChat and TikTok. The order takes effect in 45 days, causing the shares of Tencent (TCEHY) to drop sharply. There is no news yet of possible China retaliation.

The technicals of the index charts remain very bullish with nothing but very high prices to hint of possible profit-taking could start at any time. A lot is riding on the Employment Situation number. Futures are weak this morning as we wait for the report, but anything is possible at the market open. Buckle up; it could be a bumpy ride as we head into the weekend.

Trade Wisely,

Doug

Comments are closed.