While index trends remain very bullish, uncertainty continues to swirl, making it very challenging for the market to see the light at the end of the tunnel. A delayed stimulus deal, mounting pandemic impacts, rising China tensions, and a very contentious election on the horizon is likely to keep volatility high and price action challenging in the months ahead. Though the bulls are clearly in control, don’t forget the bears still exist, so stay focused because this very news-driven market can quickly shift.

Asian markets closed mixed but mostly higher overnight, even as Japan’s economy shrank in the 2nd quarter. European markets trade in the green but have fluctuated as they cautiously monitor geopolitical tensions. US Futures point to a bullish open as the SP-500 continues to challenge overhead price resistance attempting to set a new record high.

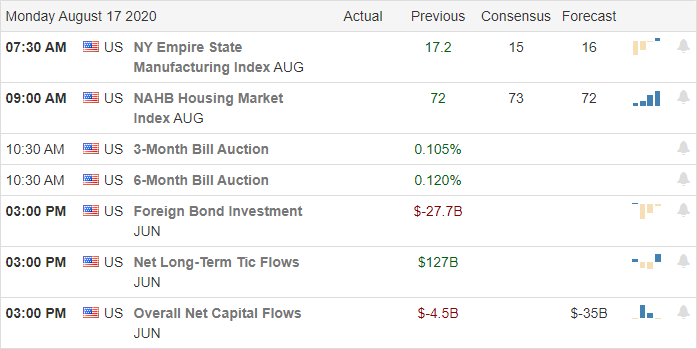

Economic Calendar

Earnings Calendar

With the majority of 3rd quarter earnings in the rearview, we have a much lighter week of reports with just 22 companies reporting this Monday. Notable reports include CRMT, FN, JD, & NAT.

News & Technical’s

After another low volume light choppy price action Friday, the SP-500 continues to struggle with overhead resistance and an elusive new record high. However, being this close, the last several days of consolidation builds upon the bullish trend, and I suspect institutions will likely push it though before that is a chance of any meaningful pullback. As the 2020 election nears, the Democrats call for the Postal chief to testify at an urgent hearing to discuss concerns over ballot handling after recent operations changes. Speaker Pelosi is planning to call the House back into session to vote on a Postal Service bill that’s likely to trigger a political firestorm. Just one more thing to deal with as this very divisive election season heats up. Federal bailout numbers of the airline industry swelled to more than $25 billion this year, but that may not be enough to prevent a massive wave of industry layoffs. As many as 75,000 could soon lose their jobs as the pandemic continues to impact airline operations. Boeing reported its second straight month of negative sales growth with far more order cancelations than new sales.

Although the technicals of the index charts remain quite bullish delays of the next stimulus bill, pandemic, tensions with China, and the ramp-up into the election silly season present considerable uncertainty for the overall market. I do suspect the SP-500 will soon make a new record high, but traders will have to stay on their toes as the market digests a likely very news-driven month ahead. Make no mistake; the bulls remain in control; however, this historic rally back to pre-pandemic highs remains quite volatile, and we should expect that turbulence to continue for the foreseeable future.

Trade Wisely,

Doug

Comments are closed.