The bears make a rare appearance leaving behind some concerning candle patterns, but I suspect they will find it very difficult to gain much momentum with a possible record high in the SP-500 so close at hand. Remember bearish candle pattern requires follow-through to be valid, and this morning the bulls are pushing hard in the futures to punish traders that took early short positions. Institutions want that new record headline, and it seems unlikely they will give up this close to making it happen.

Asian markets had mixed but mostly bullish results during the night, and European markets whip around mixed this morning over the possible return of the virus. US point to a substantial overnight reversal of yesterday’s bearish close with the Dow expected to gap up more than 225 points.

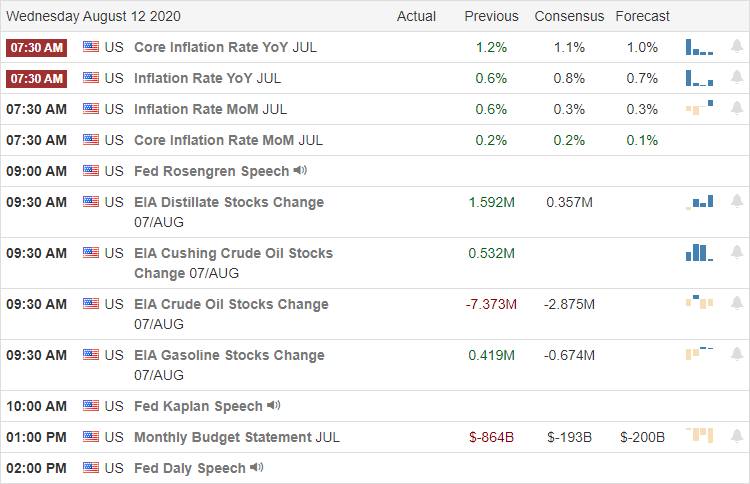

Economic Calendar

Earnings Calendar

On the Hump Day earnings calendar, we have 87 companies stepping up to reports quarterly results. Notable reports include LMND, CSCO, EAT, CHU, ENS, FOSL, GMAB, YY, JMIA, LYFT, PING, SDC, SPTN, TCEHY, VFF, WPM, & ZTO.

News & Technical’s

Presidential candidate Joe Biden has chosen California Senator Kamala Harris for his running mate this fall. If Biden wins in the fall, he will be the oldest elected president at 78 possible, putting Harris teed-up for a run for the top job after one term. President Trump announced a deal Moderna of 100 for 100 million doses of coronavirus vaccine as Russia comes under considerable criticism for rushing the widespread use of a vaccine after test just 100 individuals. As a result of COVID economic impacts, the UK is now in recession with a record economic plunge over 20%. Yesterday Florida reported a record 276 death caused by the virus on Tuesday. A grim reminder we have a long way to go in our battle with the disease. Congress remains deadlocked on the next stimulus bill continuing to point fingers at one another to pass the blame for the delay.

Yesterday’s price action left a few questions for the traders to ponder as the bears made a rare appearance in the afternoon session to snap 8-straight days of a market rally. They left behind concerning candlestick pattern, but this morning the bulls are fired up again, pointing to a substantial gap up. I think it’s improbable the bears will have a chance to gain much momentum with the SPY so close to setting a new record high. In-fact the selling yesterday may have picked up just enough short interest to pull off a quick short squeeze to help secure that new record high headline. That said, once the new record is achieved, a rest or pullback in the market is not out of the question. Stay focused, and flexible.

Trade Wisely,

Doug

Comments are closed.