Fueled by Fed, vaccine, and stimulus hopes the market shrugged off the very disappointing private payrolls numbers as the Dow surged more than 370 points, and the SP-500 closed only 2% below new record highs. Today we face another big day of news-driven price action with more than 400 earnings reports and Jobless Claims. As this rally stretches-out, remember profit-taking could begin at any time, so stay focused. Although weak, the bears still exist, so be careful not to be lulled into complacency.

Asian markets closed mostly lower overnight, and European indexes are modestly lower across the board after the Bank of England holds rates steady. US Futures have pulled back from overnight highs as we wait on earnings and jobless data before the open. It’s been a wild bullish party every day this week. The question will the party go on, or will the hangover begin soon?

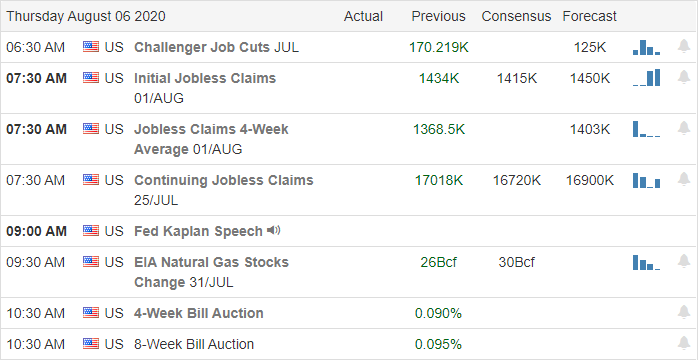

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we now have more than 400 companies fessing up to quarterly results. Notable reports include AL, AEP, APLE, BLL, BHC, BDX, BKNG, CAH, CUBE, DBX, FSLR, FLIR, FLO, GCI, GPRO, GWPH, HL, ILMN, IRM, KTB, MAIN, MELI, MUR, MYL, NWSA, NLOK, NCLH, PZZA, PLUG, POST, RMAX, QSR, STMP, TMUS, TM, TTD, TRIP, VIAC, WIX, YELP, & ZTS.

News & Technical’s

Even with a very disappointing ADP, private payrolls number, the market continues to rally energetically as if jobs no longer matter in the economy. With the Dow closing up 373 points and SP-500 only 2% from new record highs the VIX struggles to decline, and the Absolute Breadth Index displays a remarkable divergence to the bullish price action. How much longer this condition can continue to exist is anyone’s guess, but one thing for sure, the bulls continue to stampede higher with little to no regard for valuation. Keep an eye on AAPL as it nears a 2 Trillion market cap accounting for a full 6.5% of the entire SP-500. After another day of wrangling, Congress remains deadlocked on the next Stimulus plan. Some have suggested a Friday deadline to get to an agreement, and the President has promised an executive order should they fail. Gold and Silver continue to rally sharply as the debasement of the US dollar continues, and worry of substantial future inflation grows.

Today we will get the latest reading on Jobless Claims with consensus estimates looking for a slight rise in applicants this week. However, whatever the number is, I’m not sure it will matter as the market continues to ride the massive wave newly printed money. As you plan your day, remember we will get the Employment Situation number before the market opens on Friday. Consensus suggests an improvement in the unemployment rate of 11.1% last month to 10.5%. Even with the improvement, it isn’t easy to correlate the current market valuation with such a high level of unemployment. As this multi-day rally stretches-out, stay vigilant to price action watching for the possibility that profit-taking could begin at any time.

Trade Wisley,

Doug

Comments are closed.