Will the choppy price action continues this week? Rising treasury rates and jobless claims coupled with declining housing numbers added some uncertainty to the market condition. However, the indexes held onto bullish trends and price supports with the hope of big stimulus checks next month. The QQQ and SPY are the most concerning at the moment, leaving behind dark cloud cover candle patterns that suggest more lows are possible. A big week of earnings and economic data will keep us on our toes and likely continue price volatility.

Asia markets traded mostly lower overnight after China left the benchmark lending rate unchanged. European markets trade lower across the board this morning, and U.S. futures point to a bearish open as treasury yields continue to rally. Buckle up it could be a bumpy ride this morning.

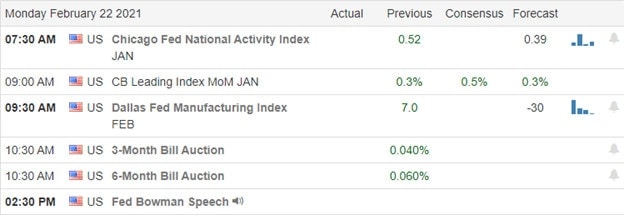

Economic Calendar

Earnings Calendar

We have 38 companies reporting quarterly results this Monday. Notable reports include AL, ACC, AWR, AU, BCC, CTB, CVI, FANG, DISCA, DISH, EXR, FIVN, DGOT, HTA, LSI, MRO, NHI, NLS, OXY, OKE, PANW, REAL, O, RSG, RCL, RIG, WMB, & ZI.

News & Technicals’

Every day last week started with a gap up open that immediately found sellers directly after. Overall there was little to no bearishness, just a week of a week choppy consolidating price action raising a little uncertainty. Higher jobless claims and a significant shift lower in housing as worries of rising rates battled with the expectation of more stimulus. With treasury yields climbing this morning, the bears show a bit of feistiness this morning, suggesting a lower open. Following a United Airlines engine failure, Boeing removed 24 777 aircraft from service as the FAA orders inspections. During the night, China keeps benchmark lending rates unchanged. After a brutally cold week, Texas residents are suffering once again with enormous energy bills.

Although trends remained bullish last week, choppy price action raised considerable uncertainty. The QQQ tested and held a key support area, but it looks as if it will gap below it this morning. Both the SPY and QQQ left behind dark cloud cover candle patterns raising some concern of a possible follow-through as we begin a new week. Today we have a very light economic calendar, but earnings reports will keep us on our toes. Though we have some bearishness showing this morning keep in mind with big stimulus checks expected next month, we can’t rule out the possibility of a buy the dip rally. Stay focused, avoid making rash decisions while waiting to see if the bears have the wherewithal to push on lower.

Trade Wisley,

Doug

Comments are closed.