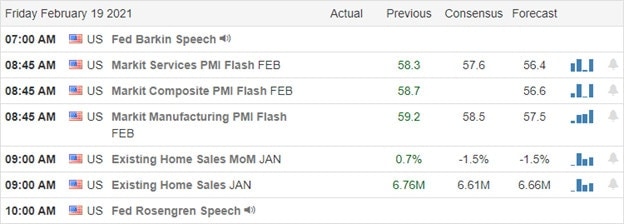

Indexes briefly reacted negatively yesterday with jobless claims rising and housing starts declining, suggesting the so-called recovery is struggling. However, combat that Jannet Yellen came out with a go-big promotion for more stimulus and futures turned bullish this morning. Today we have a relatively light day on the earnings calendar with readings on PMI and Existing Home Sales after the open. Though the price action this week suggests some uncertainty, the overall trends remain bullish. With our next stimulus fix on the way, soon stay with the trend and ride the wave as long as it lasts.

Overnight Asian markets recovered early losses to close with modestly mixed results. European markets trade cautiously higher this morning, with a focus on earnings. U.Ss futures recovered from overnight lows, pointing to a modestly bullish open ahead of earnings and economic reports. Price action remains somewhat choppy, so plan your risk carefully as we slide into the weekend.

Economic Calendar

Earnings Calendar

We have a lighter day on the Friday earnings calendar with just over 40 companies fessing up to quarterly results. Notable reports include AEE, DE, DTE, ERF, E, MGA, & MGI.

News & Technicals’

The indexes experienced a little selling yesterday, reacting to higher than expected joblessness and a substantial decline in housing starts. However, this morning futures are trying to shake off the weakening recovery after Janet Yellen pitches for the massive 1.9 trillion stimulus package. Facebook made the news again, banning thousands of Australian accounts after deciding to block publishers from sharing and viewing news content on its site. The #deletefacebook hashtag is trending across other social platforms.

Although the indexes price action has experienced a lot of chop this week, the overall bullish trends continue to hold. Without question, the economic data has raised some uncertainty. Still, with the market now addicted to newly printed money and the promise its next fix is just around the corner, the economy’s condition no longer seems to matter. I believe this will end badly in the long run, but for now, all we can do as traders stay with the trend. That said, we must remain disciplined, avoid overtrading with a fear of missing out and chasing already extended stock prices. An outsider looking at our index charts would have to assume that the pandemic was the best thing that’s ever happened to our economy! However, we all know that is not the case. Stay focused and flexible, sticking to your trading rules, and be prepared should the market stumble.

Trade Wisely,

Doug

Comments are closed.