While the severe cold is slowing down most of the country, the bulls remain undeterred, with the futures pointing more index records at the open. Although we have a short market week of trading, we have a week chalked full of earnings and economic reports for traders to digest. Expect price volatility to remain high as a result. Be careful chasing the morning record-setting gap with a fear of missing out. Please make sure we see follow-through buying and not the dreaded pop and drop that we can sometimes experience at market highs. Stay focused and flexible.

Overnight Asian markets rallied with lead by the HIS up nearly 2% on the day. However, European markets are trading nearly flat and have fluctuated throughout the morning, seemly concerned about the extending risk rally. The U.S. Futures don’t share that concern with the bulls charging forward, likely to set new records in the DIA, SPY, and QQQ at the open. Fasten your seatbelts as the buying frenzy continues.

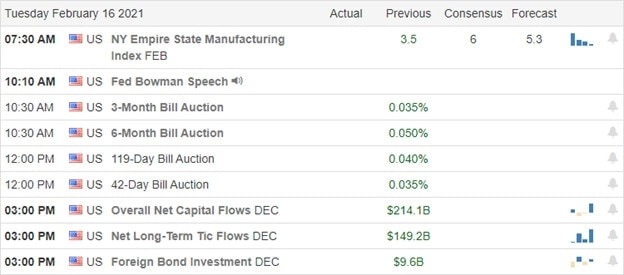

Economic Calendar

Earnings Calendar

As we begin a short market week, we have about 80 companies stepping up to report quarterly results. Notable reports include AAP, A, ALX, ACC, AIG, ANDE, AN, CAR, BYD, CLR, DENN, DVN, ECL, ES, EXAS, EXPD, GEO, INVH, LZB, LPX, OXY, PLTR, RNG, TRU, VNO, YNDX & ZTS.

News & Technicals’

As ugly cold snap grips, the country’s oil hits pandemic highs, with rolling blackouts due to the massive demand for power. However, the cold has not dampened the spirit of the bulls as they pushed sharply higher overnight. The 30-year Treasury yield is holding above 2%, a level not seen in nearly a year. Not satisfied with the Trump acquittal, Speaker Pelosi has announced an independent 9/11-style commission on the Capitol riot. According to reports, Australia will support the proposed media law on Facebook and Google. The new law would require the media giants to pay for the news created by other agencies. Google has threatened to turn off its search app in the country should it pass. Should other countries join in with this tactic, it would have far-reaching impacts on social media.

Though the market experienced a little price weakness last week, the futures are fired up this morning. If current prices hold until the open, the DIA, SPY, and QQQ will set new record highs a the open, with a sharp gap-up move. Trends are decidedly bullish, but I suspect the T2122 indicator will suggest a very extended condition at the open. Before chasing in with a fear of missing out, let’s make sure we see follow-through buying rather than getting caught in a classic pop a drop price pattern. We have a busy week of earnings and economic calendar news, so continue to expect wild price volatility while trying to price in the next round of government stimulus.

Trade Wisely,

Doug

Comments are closed.