After a blistering six-day winning streak that lifted the Dow more than 1500 points, futures markets suggest a modest rest at the open today. Normally we would expect a pullback or, at a minimum, some consolidation after such a robust move. However, with the market hopeful of another 1.9 trillion-dollar deficit spend, we can’t rule out the possibility that indexes could continue to inflate. Today begins the Trump impeachment trial, and with a big day of earnings and the Job opening report, we have plenty to inspire substantial price action. Plan your risk carefully.

Overnight Asian markets closed green across the board with modest gains. European markets trade with modest declines this morning. U.S. Futures suggest a modestly lower open as the bulls take a little breather after the volatile stampede higher that set record highs in four indexes.

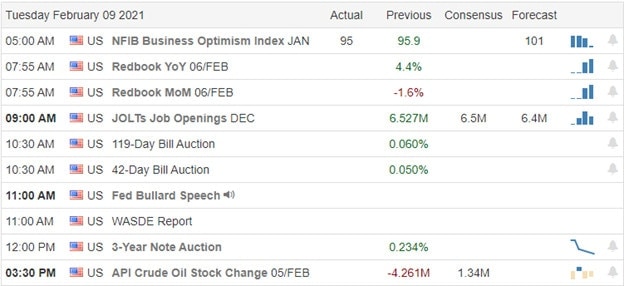

Economic Calendar

Earnings Calendar

On Tuesday’s earnings calendar, we have 90 companies stepping up to report. Notable reports include TWTR, CGC, AKAM, CNC, CSCO, CEIX, COTY, DD, ENOH, FISV, FOXA, IT, GLUU, GT, HAIN, HBI, HMC, INCY, J, LYFT, MAT, NRZ, PAA, REYN, SPGI, THC, TRVG, WELL, & YELP.

News & Technicals’

It was a big day for the bulls yesterday, pushing all four indexes to new record highs. After a six-day winning streak that saw the Dow rally more than 1500 points has the T2122 4-week new high/new low ratio suggesting a short-term overbought condition. However, with the Democrats intending to pass the 1.9 trillion stimulus package as soon as possible, the market could undoubtedly inflate higher. According to reports, this will not be a bipartisan effort as the President had suggested. They also plan to press ahead on a $15 an hour minimum wage despite deficit concerns, have unveiled a one-year plan to send up to $3,600 per child to all households, and proposed a plan to forgive up to $50,000 in student debt. Today also begins the impeachment trial of former President Trump, so we have a lot of potential political news to move the market this week.

As I write this report, the U.S. futures point to a modest pullback at the open after posting a robust six-day rally as the fear of the Reddit retail frenzy faded. Index trends are certainly bullish but don’t rule out the possibility of a little rest as we wait for the next stimulus deal. With so many stocks in an extended condition, it’s a little hard to be a buyer because of the additional risk to a logical stop-loss. Remember to take some profits and avoid overtrading. Today we have the Job openings report and a big round of earnings to us on our toes. Plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.