The choppy dull days of the last couple of weeks could be over as the market reacts to big bank reports and Coinbase IPO. I worry that we have pushed prices so high that companies will have to report near perfection to support their current valuations. I wonder if the massively hyped Coinbase IPO will disrupt the market as traders pull funds from other stocks as they rush to fund their IPO purchase, fearing they will miss out. Fasten those seatbelts it may prove to be a very wild ride in the days and weeks ahead.

Asian markets traded mixed but mostly higher overnight, with Hong Kong surging 1.44%. European markets seem to be taking a wait-and-see approach this morning, trading hovering near the flatline. As earnings roll out, U.S. futures are trying to hold on to a positive open, but gains at this point look to be very modest. However, anything is possible, so stay on your toes as we react to the news.

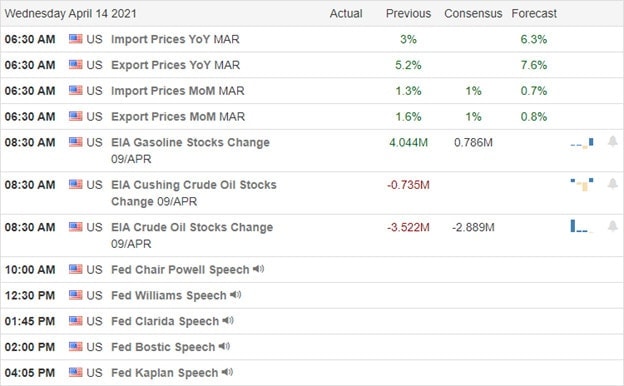

Economic Calendar

Earnings Calendar

We officially kick off the 2nd quarter earnings today with 17 companies listed on the calendar ready to fess up to quarterly results. Notable reports include BBBY, JPM, GS, HOFT, INFY, LOVE, SJR, & WFC.

News & Technicals’

Today we have the potential for wild price volatility with big bank reports and the IPO of Coinbase. On the earnings front the due to the substantial rally we have experienced in anticipation, companies will need to report very near perfection to support current prices. With so much hype surrounding the Coinbase IPO, it could prove a significant market distraction disrupting stock prices as traders pull money out of other stocks to fund their purchase of this record-setting new issue. I obviously don’t know what happens next, but we may soon long for the dull choppy days of the last week as price volatility ramps up in news-driven reports.

With the SPY and QQQ setting new record highs, their charts appear significantly extended and almost parabolic over the last three weeks of trading. Clearly, the rising infection rate and the pulling of the JNJ vaccine are of no concern to this market. The hotter than expected CPI also proved to be of no consequence as traders chase into stocks with no price too high apparently. I have to admit this makes me very nervous that the market could be running at full speed toward a very steep cliff. However, I have seen many times in my trading career that an overly exuberant market can last much longer than anyone would expect. That said, as retail traders, the best we can do is stay with the trend being careful not to chase already extended stocks and guard against overtrading and complacency.

Trade Wisely,

Doug

Comments are closed.