In a Sunday interview, Jerome Powell said the extremely dovish policies would continue and that it is the Fed is highly unlikely to raise rates this year. With the last hour buying surge Friday, the DIA, SPY, and QQQ all set new closing records by the close. Last week was overall a frustratingly choppy price action punctuated by the Monday gap and Friday late-day surge. This week we kick off 2nd quarter earnings with the indexes in a short-term, very extended condition adding significant danger for retail traders. Anything is possible, so buckle up it could be a wild ride this week.

Overnight Asian markets saw red across the board even as shares of BABA rose 6.5% after being fined. European markets trade mixed but primarily flat this morning. With a light day of earnings and economic reports, U.S. futures have rallied well off overnight lows as the premarket pump begins. Prices could remain light and choppy until we get the big bank reports beginning on Wednesday. Plan your risk carefully.

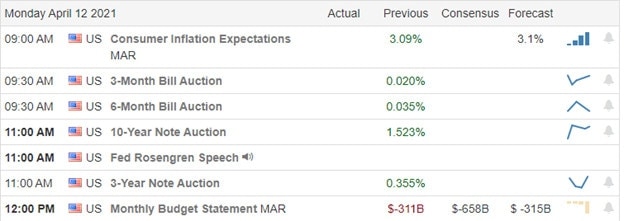

Economic Calendar

Earnings Calendar

We have 12 companies listed on the Monday earnings calendar coming forward with their quarterly results. Notable reports include APHA & MIND.

News & Technicals’

On the news program 60 Minutes, Jerome Powell reaffirmed the Fed’s commitment to loose monetary policy. He went on to say, “it’s highly unlikely we would raise rates anything like this year.” According to reports, MSFT could announce a deal as early as today, the acquisition of NUAN. NUAN stock is indicated sharply higher this morning as a result. Despite a $2.8 billion anti-monopoly fine leveled by Chinese regulators, shares of BABA are popping 6% this morning following a 6.5% rally in Hong Kong overnight. On the pandemic front, Regeneron to request FDA clearance on an antibody-drug as a preventative treatment, Britain’s Pub drinkers return as lockdown eases, and Chinese vaccines don’t have very high protection, according to a top health official.

Last week’s price action started with a considerable gap on Monday and ended with a buying surge in the last hour of trading on Friday. However, the price action between those sharp moves was frustratingly light and choppy. Although the DIA. SPY and IWM show extreme bullishness; the charts also display an extremely extended condition after nearly 2-weeks of buying, creating a parabolic move that’s a long way from good price support levels. That said, with the Fed standing on the gas peddle and the 2nd quarter earnings season kicking off on Wednesday, there is no reason to believe that the market will not continue to extend. Until then, choppy price action is likely to continue.

Trade Wisely,

Doug

Comments are closed.