Chip shortages are forcing General Motors and Ford to temporarily shut down some American production plants ranging from weeks to several additional weeks in already idle facilities. The Amazon union vote at an Alabama warehouse looks as if it is failing as the vote count widened to deny unionization. Keep an eye on those Treasury yields that are once again pushing higher this morning as inflation worries linger.

Overnight Asian closed the week mixed but mostly lower as the volatile whips continue in Hong Kong slipping more than 1%. European markets trade mixed with modest gains and loss with German health minister calling for a nationwide lockdown due to the third wave surge in infections. However, after a few days of choppy consolidation, U.S. futures currently point toward a bullish open and more record highs ahead of PPI numbers.

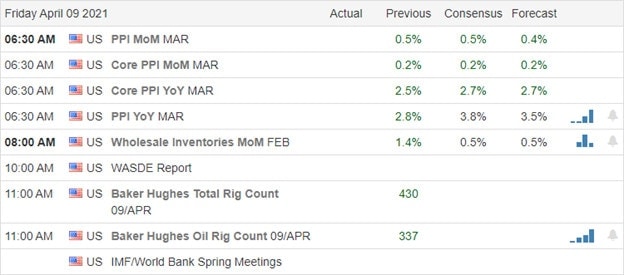

Economic Calendar

Earnings Calendar

We have a very light day as we wrap up the 1st quarter earnings with just 12-companies listed on the calendar with most unconfirmed. The only notable report I see is JKS.

News & Technicals’

Due to chip shortages, GM and F are cutting production at several American plants. The temporary plant closures range from a week to several additional weeks for plants currently idled. In Germany, the health minister is calling for a nationwide lockdown after reporting over 30,000 new infections on Wednesday and 26,000 on Thursday. According to reports, Biden’s China policy is tougher on financial firms than President Trump’s policies. The Cowen Washington Research Group analyst Haret Seiberg says delisting of Chinese companies will happen because Beijing is unwilling to allow the U.S. to inspect company audits. Treasury Yields are bumping higher this morning to 1.666% on the 10-year, with the 30-year rising to 2.343 as inflation concerns linger.

The index charts remain very bullish with no clues in the price action that the bears have any teeth at all. However, traders should note the very extended condition of the current rally and the possible danger if the market were to stumble. That said, it seems every big institution is singing in a chorus that the market boom will continue despite the incredibly high P/E ratios. As for me, I will stay with the trend, but I will also guard myself against complacency and avoid the urge to overtrade due to this very extended market condition. Let’s enjoy the ride while it lasts, but always remember what goes up will eventually come down and likely in a swift and very painful correction. Have a fantastic weekend, everyone!

Trade Wisely,

Doug

Comments are closed.