Big bank earnings lifted indexes to new record highs, but the intraday whipsaw left behind some concerning candle patterns as the news-driven price volatility challenges traders. Emotions are very high, and with the flood of inexperienced money that entered the market over the last several months, that is likely to continue. Institutions say this the economic growth in this quarter could rival that of 1984 as we ride the tidal wave deficit fueled stimulus spending. Stay with the trend and enjoy the party as long as it lasts but be warned, the risk is high as the indexes continue to stretch beyond logical limits.

Asian markets traded mixed but mostly lower, struggling for direction. European markets surge to new records as they monitor earnings this morning. U.S. futures point to a substantial gap higher after yesterday’s volatile whipsaw, likely setting new records at the open. I suspect wild price volatility will be with us for several weeks, so plan your risk wisely.

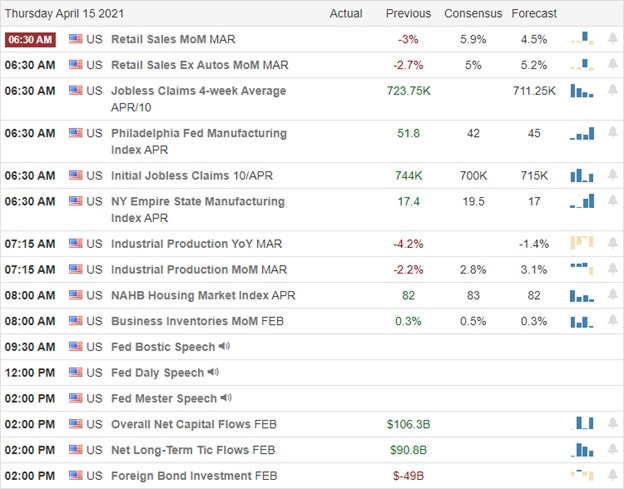

Economic Calendar

Earnings Calendar

We ramp up slightly today on the earnings calendar, with more than 50 companies stepping up to report quarterly results. Notable reports include TSM, AA, BAC, BLK, SCHW, C, DAL, JBHT, PEP, PPG, RAD, USB, UNH, & WIT.

News & Technicals’

The beginning of earings fueled new record highs as the big banks topped expectations, and that trend continues today, with BAC already beating estimates. Besides a busy earnings day, we have an economic calendar chalked full of potential market-moving reports to keep traders and investors busy. Instructions say this could be the strongest quarter of economic growth since 1984, and it would seem that no price is too high as in this stimulus-fueled buying frenzy. President Biden announced that U.S. troops will leave Afghanistan by September 11th though some suggest this action will only worsen the situation.

After a nasty whipsaw yesterday that left behind some concerning daily candle patterns, the bulls are back on the job this morning. Traders will have many data points to track this morning with earnings and a jam-packed economic calendar. I think it would be wise to plan for significant price volatility in the weeks ahead as the index charts continue to extend. Logic would suggest a market pullback could begin at any time, but there is little logic in this buying frenzy pushed by a tidal wave of deficit spending. Although market conditions like this typically end in a punishing selloff trying to fight it is unwise. Remember, a market can remain irrational much longer than we can remain liquid. Don’t chase; avoid overtrading, resist complacency but stay with the trend riding this wave as long as it lasts.

Trade Wisely,

Doug

Comments are closed.