Consumer Sentiment

The worst consumer sentiment reading in more than ten years didn’t dissuade the bulls at all as they worked a nice Friday rally. Retail will be in focus this week, with earnings from WMT, TGT, and HD, as well as last month’s retail sales figures coming our way Tuesday morning. It will be interesting to see if inflation and supply chain issues hampered the early holiday sales events. With consumer debt hitting record highs, my guess is no, but we will soon find out. Although the indexes remain very elevated, stay with the trend because the bulls seem to have no inflation concerns and want the party to continue.

Overnight Asian markets closed with modest gains through China fell slightly even as their retail sales topped expectations. European markets currently trade with modest gains and losses, as if searching for inspiration. However, U.S. futures point to a bullish open, with the Dow suggesting a 100 point gap. Nevertheless, with new price resistance above, don’t rule out the possibility of a lower high or even a pop and drop pattern to occur if the bears find a reason to fight.

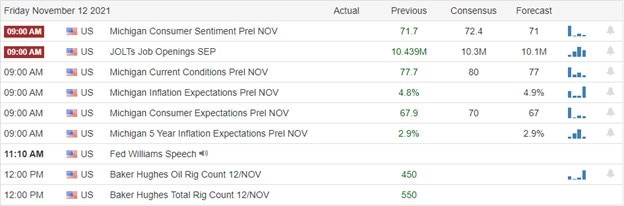

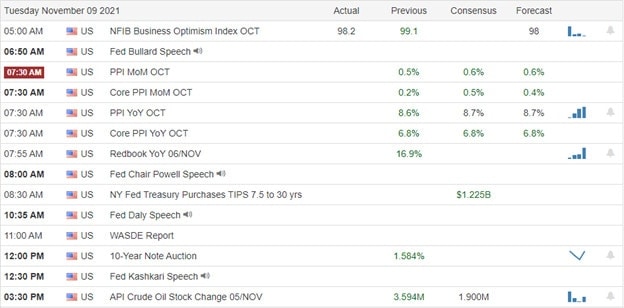

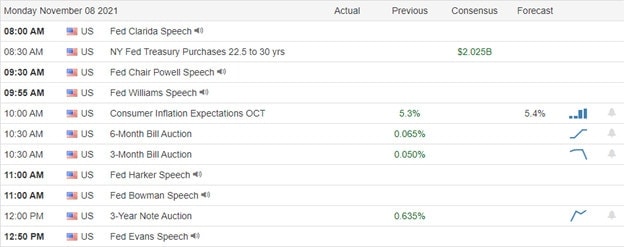

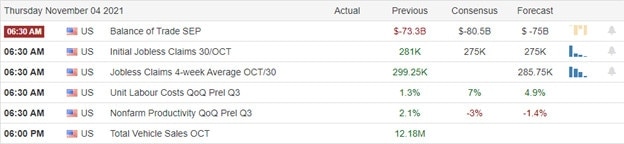

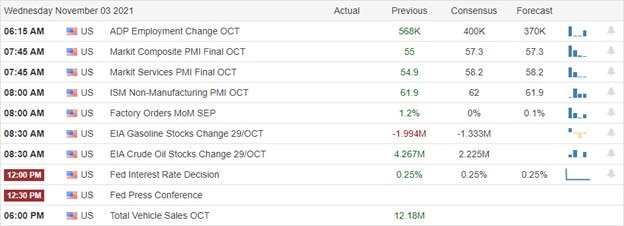

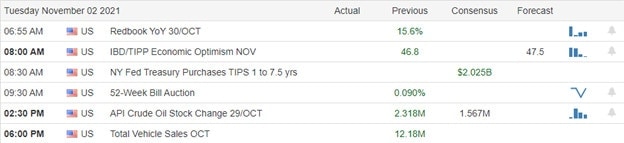

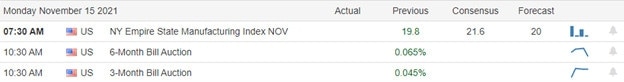

Economic Calendar

Earnings Calendar

We have a busy day on the Monday earnings calendar with nearly 300 companies listed, but many of them unconfirmed. Notable reports include AAP, AND, AXON, SCPR, IBIO, JJSF, LCID, MGIC, OTLY, PLBY, RXT, STAF, COOK, TSN, WMG, STAF, COOK, TSN, WMG, XSPA.

News & Technicals’

Consumers will be a big focus for markets in the week ahead, with government retail sales data Tuesday and earnings from Walmart, Target, and Home Depot, among others. In addition, investors are watching the meeting between President Joe Biden and China President Xi Jinping Monday night for signs of any warming of relations on trade and other issues. According to contracts signed by four states, Apple requires states to maintain the systems needed to issue and service credentials at taxpayer expense. The agreement, obtained through public record requests from CNBC and other sources, mainly portrays Apple as having a high degree of control over the government agencies responsible for issuing identification cards. Apple has “sole discretion” for critical aspects of the program. Last week, the European Commission, the executive arm of the EU, projected a GDP rise of 5% for both the EU and the euro area this year. Some EU nations have started to see a high number of Covid-19 infections recently, mainly in countries where vaccination rates are still relatively low. Austria and the Netherlands have imposed new social restrictions in the last few days. Treasury yields look lower this morning, with the 10-year falling to 1.546% and the 30-year dipping to 1.9232% in early morning trading.

The indexes enjoyed a Friday rally choosing to ignore the worst consumer sentiment reading in more than ten years. However, the VIX declined, and big tech rallied strongly to end a volatile week of price action. This week we have a big focus on retail with earnings from WMT, TGT, and HD with a reading on Retail Sales figures Tuesday morning. The SP-500 P/E Ratio eased slightly with last week’s selling but remained strongly overvalued at 98% above the historical average. The Buffett Indicator is a whopping 215% market value ratio to GDP, holding 72% above the historical average. That said, the bulls seem to have no concern with the premarket activity working to inspire prices higher. So stay with the trend and enjoy the party as long as it lasts!

Trade Wisley,

Doug