Bears Woke Up

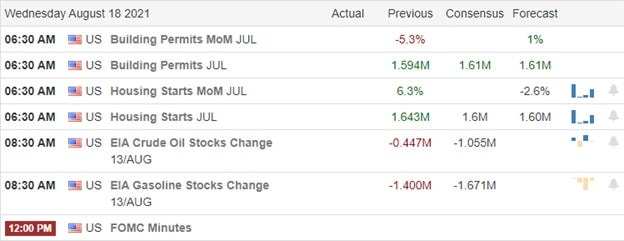

After a disappointing retail sales number, the bears woke from their summer hibernation to reverse the previous rally that set new records. Though the whippy price action likely shook trader confidence at the end of the day, the bullish trends in the DIA, SPY, and QQQ remain. However, with housing number before the open and the FOMC minutes later this afternoon, prepare for another day of volatile price action that likely favors quick intraday traders.

Asian markets mostly rallied overnight after the reserve bank of New Zealand keeps rates unchanged. However, European markets trade mixed but mostly lower as they monitor inflation data. The U.S. futures point to mixed open ahead of economic and earnings data, but that could quickly change depending on the housing numbers. So hang on tight; the ride is about to take another lap.

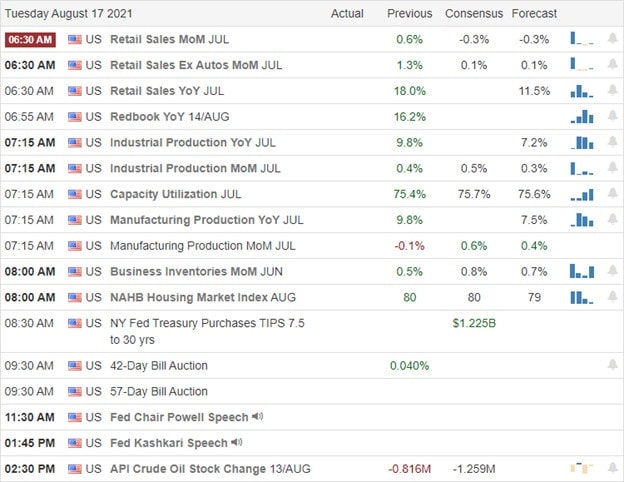

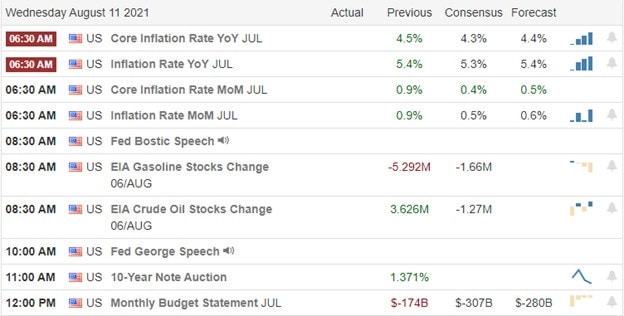

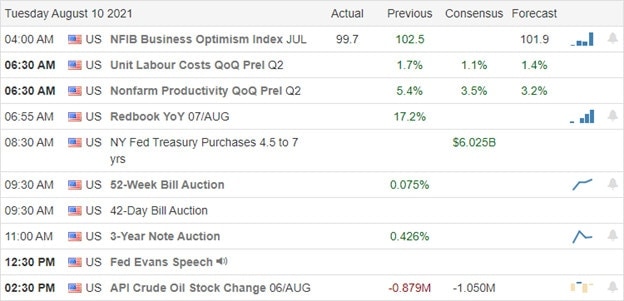

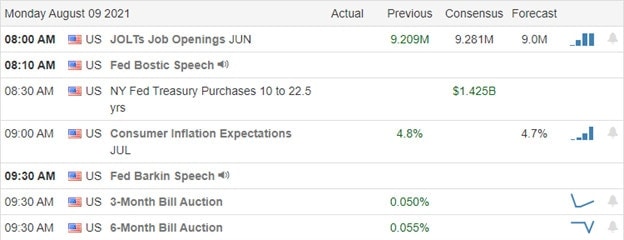

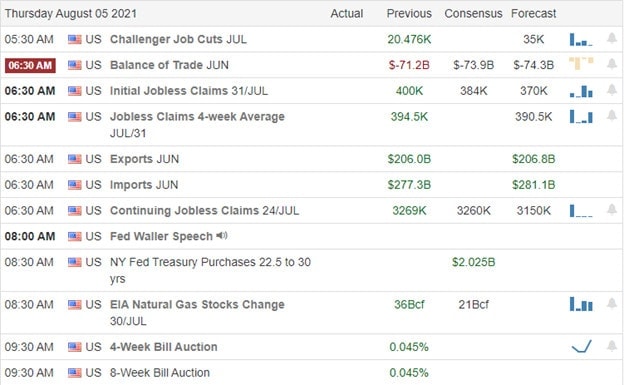

Economic Calendar

Earnings Calendar

We have 35 companies listed to report on the Wednesday earnings calendar, with many of them as unconfirmed. Notable reports include CSCO, ADI, BBWI, EAT, PLCE, NVDA, LITE, LOW, KEYS, RRGB, SNPS, TGT, TJX, VIPX, & ZTO.

News & Technicals’

Lowe’s beat on the top and bottom line this morning, and the stock is priced higher this morning, trying to recover some of yesterday’s losses. Target also topped earnings targets and raised forecasts, but the retailer is trading lower in the premarket. After the bell, CSCO, NVDA, and HOOD will report their results. Treasury yields rose this morning as we wait on the FOCM minutes later this afternoon. The 10-year gain nearly two basis points to 1.275%, and the 30-year rose to 1.933%. Europe is scrambling to formulate an Afghanistan refugee plan, trying to avoid repeating the 2015 crisis. An emergency meeting of the most affected countries did not invite the United States after the Taliban seized control of the country.

The bears woke from their summer hibernation yesterday after the very disappointing retail sales number. The pullback included some violent intraday whipsaws that ended the day printing bullish hammer patterns with the afternoon rally. Please remember that hammer patterns required a bullish follow-through to be valid, so be careful rushing in to buy the dip. Before the bell, we have another potential market-moving report with the Housing Starts and Permits, expecting a minor pullback in the consensus. Finally, after some moring price volatility, we could see price action become light and choppy as we wait for the release of the last FOMC minutes. I think it’s unlikely that we will learn anything more about the possibility of a Fed taper, but if we do, there could be another shot of wild price swings in reaction. That said, after yesterday’s selloff, the DIA, SPY, and QQQ bullish trend suffered little to no damage though I can’t say the same for trader confidence.

Trade Wisely,

Doug