We continue to set index records with stock, with P/E ratios burgeoning as the bulls continue their ravenous appetite for risk. The chart technical’s and the price action show no clues that the trend is ready to stop. However, it would be unwise to assume we will never pull back and chase already extended stocks so late in the rally. So today, expect choppy action ahead of the FOMC decision on taper and prepare for the typically wild volatility directly after the announcement.

Asian markets traded mixed but mostly lower overnight with modest gains and losses. European markets also trade flat this morning as they wait on the Fed and the news that the Bank of England may soon raise rates. With a massive day of earnings data, ADP, and the Fed decision later this afternoon, the U.S. futures point to a mixed open with modest gains and losses as we wait.

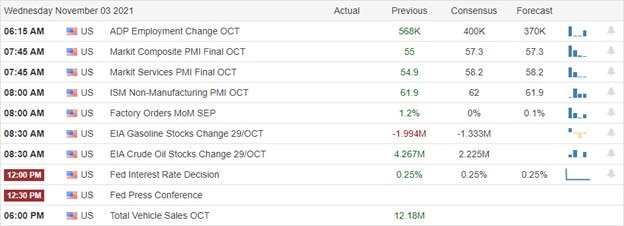

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have more than 300 expected to report today. Notable reports include ALG, ALB, AMRN, APA, AAWW, BKNG, BWA, CPRI, CF, CAKE, CLH, CVS, DISCA, ELF, EA, EMR, ET, ETR, ETSY, EXC, FSLY, FSR, FOXA, FDP, GDDY, HR, HFC, HST, TWNK, HUBS, HUM, H, IAG, INFN, IR, KTOS, LCI, LBTYA, LL, MRO, MAR, MAR, MBI, MET, MGM, NCLH, NVO, NUS, OMP, PETQ, PXD, PBI PBPB, QRVO, QCOM, QLYS, RYN, RCII, ROKU, SMG, SBGI, SWN, RGR, SPWR, TTWO, TRUE, WING, & XP.

New & Technicals’

The Regional Comprehensive Economic Partnership or RCEP will come into force in January 2022. Australia and New Zealand were the latest to ratify the world’s largest trade agreement. Other countries that have ratified RCEP include Brunei, Cambodia, Laos, Singapore, Thailand, Vietnam, China, and Japan, according to Australia’s Department of Foreign Affairs and Trade. Policymakers have intimated that a hike is imminent, but the nine-member MPC will need to determine whether to tighten policy this week or wait until its mid-December meeting. Markets are uncertain about the timing, with analysts suggesting the vote is likely to be split. However, at Monday’s close, market data showed that derivatives traders were pricing in a 64% probability of a 15 basis point rate hike this week, Berenberg highlighted in a note Tuesday. Zillow said it’s winding down its homebuying unit, called Offers, which competes with Opendoor. The company said it’s cutting 25% of its workforce in eliminating the unit after reporting disappointing earnings results. Ahead of the FOMC decision, U.S. Treasurys pulled back in early morning trading, with the 10-year dipping to 1.5243% and the 30-year sliding to 1.9335%.

Another day and more records set in the DIA, SPY, and QQQ as the ravenous appetite for risk appears to have no bounds. Though the extension in the indexes seems extreme, there is no sign that it’s ready to stop. The current SP-500 P/E Ratio is more than 96% above the historical average, suggesting a strongly overvalued condition. The only time this level was higher in history was the 1999 internet bubble when it reached 132%. So, that would suggest the party may still have plenty of life but let’s not forget the ramifications of such an extension when the party’s over. Today we will be in wait and see mode until the FOMC decision and the question is answered on a taper. At the risk of sounding like a broken record, be careful chasing already extended stocks and be ready for the typical Fed volatility whip after the announcement.

Trade Wisley,

Doug

Comments are closed.