Bears Attacked Tech

Yesterday some of the tech sector giants experienced some selling pressure as the bears attacked suggesting this overbought area of the market may finally find some profit takers. Bond yields proved stubborn despite an otherwise choppy market day on lower-than-average volume. That, however, could change today with the pending economic reports that may prove to be market-moving creating some price volatility. Watch for whipsaws, and possible end-of-quarter window dressing as the uncertainty of the FOMC’s next actions and investors ponder current valuations in light of the pending third-quarter earnings season.

Asian markets ending the day mixed while we slept led by Hong Kong rising 1.88%. European markets trade mixed and choppy this morning as they wait on the ECB comments that have recently talked hawkishly on their inflation fight. U.S. futures currently point to a modestly bullish open ahead of possible market-moving economic data that could inspire the bulls or the bears so be prepared for just about anything.

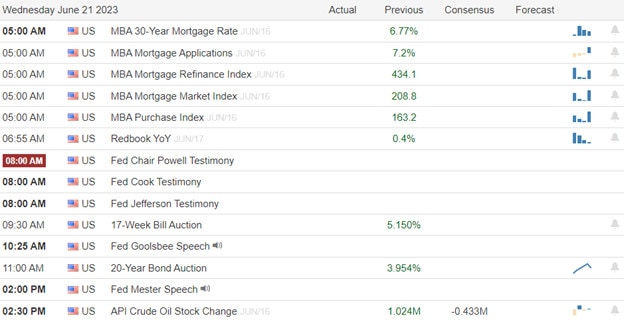

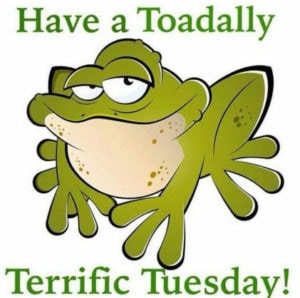

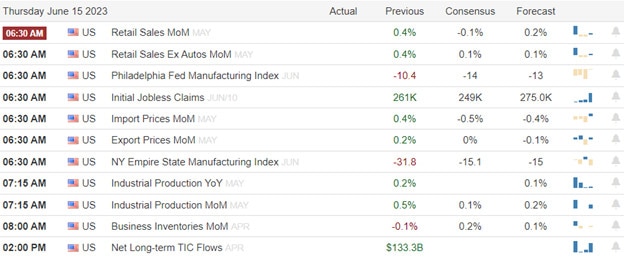

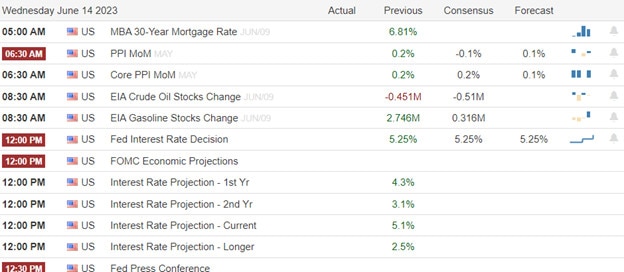

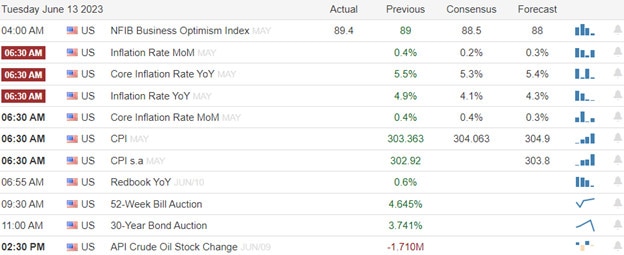

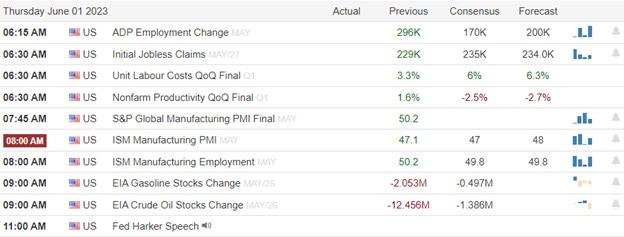

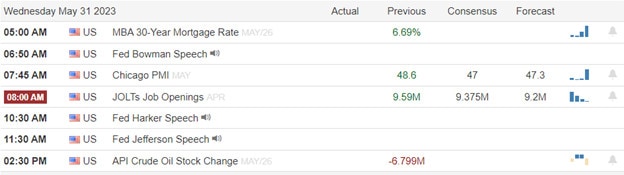

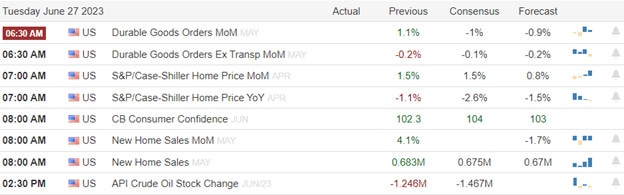

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AVAV, JEF, SCHN, & WBA.

News & Technicals’

Lordstown Motors, a startup company that builds electric pickup trucks, has filed for bankruptcy protection and sued its former partner Foxconn, the world’s largest contract electronics manufacturer. The lawsuit accuses Foxconn of fraudulent conduct and breaching an agreement to invest up to $170 million in Lordstown and to handle the manufacturing of its vehicles at an Ohio factory that Lordstown bought from General Motors in 2019. Lordstown claims that Foxconn willfully and repeatedly failed to execute the agreed-upon strategy, leaving it with no choice but to seek Chapter 11 protection in Delaware. Foxconn has not yet responded to the allegations.

Retatrutide is a novel drug candidate from Eli Lilly that targets three hormones involved in regulating appetite and blood sugar: GLP-1, GIP, and glucagon. It is a weekly injection that has shown promising results in treating obesity and type 2 diabetes. According to new results from two phases 2 trials, retatrutide helped patients lose up to 24% of their weight after almost a year, the highest reduction seen in the obesity drug space to date. The researchers also reported that the weight loss did not appear to plateau after 48 weeks, suggesting that longer treatment could lead to more benefits. Retatrutide also improved blood sugar, cholesterol, and blood pressure levels in patients with type 2 diabetes. Retatrutide has an overall safety and tolerability profile similar to other hormone-based therapies for obesity.

The S&P 500 lost 0.5% on Monday, as the bears attacked some of the tech giants that have served as the market leaders this year. The Dow also slipped 13 points, while the Nasdaq fell 1.2% retreating from its overextended condition. 10-year Treasury yields dipped below 3.7% in the morning before recovering slightly by the end of the day. However, Monday’s market action was mild overall on lower than average volume. Today’s direction could be determined by the economic calendar news with Durable Goods, Consumer Confidence, and New Home Sales figures that could inspire the bulls and bears. Keep in mind Europe is waiting for an ECB rate decision.

Trade Wisely,

Doug