Although the Fed skipped a month in raising rates their hawkish look forward added uncertainty to the path forward. The Dow experienced a huge whipsaw while a handful of tech stocks managed to hold the QQQ in the green for the close. This morning traders face a busy morning of economic data that could move the market substantially as investors react to a complex summer outlook. Bond yields surged higher after the Fed decision pressuring an already strained financial sector. Whipsaws and price volatility are expected to remain challenging as the data rolls out this morning.

While we slept Asian markets traded mixed in reaction to the Fed decision but the tech-heavy HSI surged 2.17%. European market trade was mostly lower this morning expecting a rate increase from the ECB. Ahead of a busy morning of economic reports U.S. futures trade modestly lower but as the data is revealed anything is possible depending on the possible inspiration of the bulls or bears.

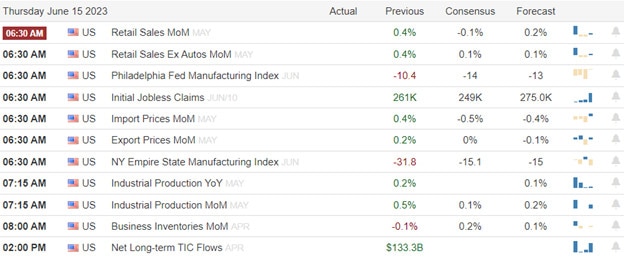

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ADBE, JBL, and KR.

News & Technicals’

After two weeks of labor unrest that disrupted trade at 29 West Coast ports, a tentative agreement was reached on Thursday night between the Pacific Maritime Association and the International Longshore and Warehouse Union. The six-year deal covers 22,000 workers who handle about half of the nation’s cargo. The terms of the agreement were not disclosed, but both sides expressed relief and gratitude for the assistance of Acting U.S. Secretary of Labor Julie Su. The port congestion caused by worker slowdowns and stoppages is expected to take several days to clear out.

The war in Ukraine has escalated as Russian mercenaries clashed with the Kremlin over their role and strategy in the conflict. The leader of the Wagner Group, Yevgeny Prigozhin, has refused to sign a contract with the Russian Defense Ministry, which wants more control over the volunteer formations. Meanwhile, Ukraine and its allies are holding a meeting in Brussels to discuss how to bolster Kyiv’s air defenses and artillery against Russian aggression. The meeting comes after Ukraine launched a counteroffensive last week to reclaim some of the territory occupied by Russia. The war has killed at least 10 people and wounded dozens more in Kyiv’s hometown of Kryvyi Rih, where Russian missiles hit civilian buildings.

The Federal Reserve’s decision added uncertainty keeping rates unchanged while raising the terminal rate expectations. The Fed suggested, however, that it might hike rates two more times, as its latest “dot plot” showed a higher fed funds rate target of 5.6%, up from 5.1% in March. Chair Powell said in his remarks that he hoped inflation would start to ease soon, as he saw some signs of a cooling in the labor market. It was a mixed day for stock markets on Wednesday, as the S&P 500 and Nasdaq managed to end the day higher, while the Dow Jones finished lower. Meanwhile, bond yields rose after the Fed meeting, as markets wondered if the Fed would tighten more than expected. The 2-year Treasury yield jumped by 0.10% to 4.68%, almost 1.0% above its lows in mid-May. Today we have a very busy economic calendar filled with possible market-moving reports. Plan for substantial volatility, whipsaws, and big point moves as the traders react to the data.

Trade Wisely,

Doug

Comments are closed.