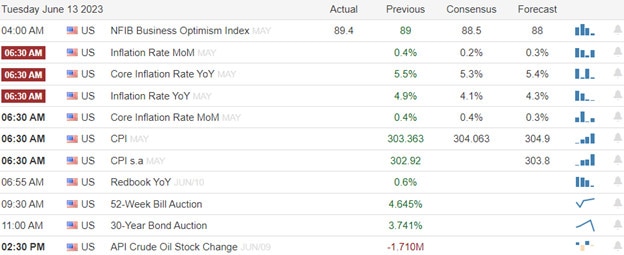

The bull run continued on Monday with high hopes the pending CPI number will weaken enough to give the Fed cover to pause rate increases Wednesday afternoon. Be prepared for a big potential move in the indexes particularly if the number happens to disappoint due to the tremendous anticipation. Interestingly the VIX rallied yesterday indicating an increase in fear even as the indexes surged higher. With no notable earnings reports to inspire bulls or bears, all eyes will key off the economic calendar reports.

Asian markets rallied led by Japan surging 1.80% and topping 33.000 at the close. European markets trade cautiously flat this morning as they wait on the central bank rate decisions. U.S. futures tick higher this morning as we wait on the results of the consumer price index that is highly anticipated to support at Fed rate pause.

Economic Calendar

Earnings Calendar

There are no notable earnings reports for Tuesday.

News & Technicals’

Investors cheered as stocks rose on Monday amid expectations that the Federal Reserve will pause its aggressive rate hikes at its next meeting on Tuesday. The Fed has raised its key interest rate 10 times since last year to combat inflation, which has soared to its highest level in decades. However, some economists believe that the Fed will signal that it is not done tightening monetary policy and that more rate increases are likely in 2023. The S&P 500 and Nasdaq Composite gained 0.93% and 1.53%, respectively, closing at their highest level in 13 months. The Dow Jones Industrial Average added 189.55 points, or 0.56.

Many are hopeful that the US consumer price index report on Tuesday will reveal a slowdown in inflation that will allow the Fed to skip a rate hike on Wednesday. This would be the first time they do not raise the key rate after 10 straight hikes since March 2022.

The U.K. saw its short-term borrowing costs soar to their highest level since the financial crisis on Tuesday after strong labor data fueled expectations of more interest rate hikes by the Bank of England. The yield on two-year government bonds, which influences mortgage rates, climbed above 4.75%, surpassing the peak reached during the market turmoil triggered by the former government’s “mini-budget” last year. The labor report showed that wages excluding bonuses grew by a record 7.2% in the February-April quarter, while employment hit a record high. The Bank of England is under pressure to raise interest rates further to rein in inflation, which stood at 8.7% in April.

The bull run continued around the world on Monday, with Japan and Europe leading the way, as investors anticipated a break in the Fed’s rate hike cycle. Growth-oriented sectors such as technology, communication services and consumer discretionary outperformed, extending their year-to-date rally. Bond markets were calm, with little movement in interest rates. The 10-year Treasury yield stayed close to 3.75%. The market mood improved as the day went on, as hopes grew that the Fed will skip a rate hike at its meeting on Wednesday.

Trade Wisely,

Doug

Comments are closed.