Low-Volume Buying

With some steady low-volume buying, the Dow 30 eventually pulled the other indexes out of their intraday consolidation as the dollar fell and bond yield inversion continued to extend. The Dow closed more than 1000 points off the low in just three trading days making for a high-risk situation if a pullback were to occur. The QQQ lags way behind as the most vulnerable index while the DIA continues to extend. With a big day of earnings data and the midterm results just around the corner, anything is possible Wednesday morning, so plan carefully.

While we slept, Asian markets finished the day mixed and cautious, waiting on the U.S. election results. Likewise, European markets trade flat to modestly bullish in a choppy session as the midterm results raise investor caution. However, in the norm of late, U.S. futures are pumping up the premarket, suggesting a bullish open with a deluge of earnings data on the horizon. Watch the significant overhead resistance levels, price volatility, and intraday whipsaws as the day unfolds.

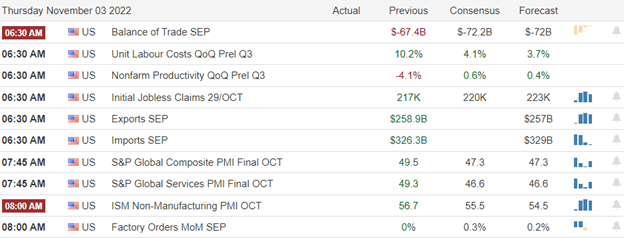

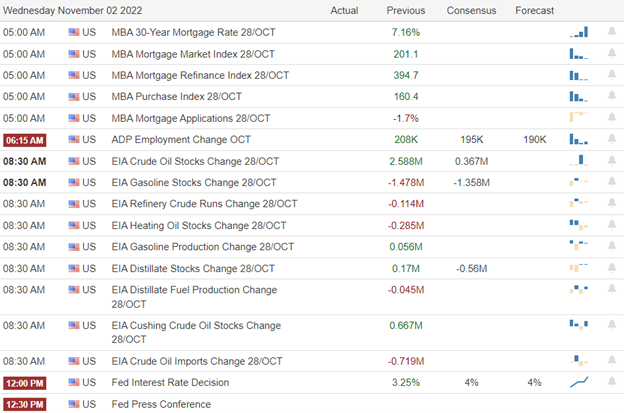

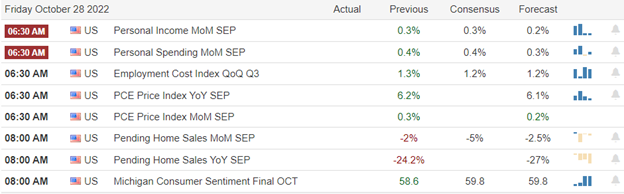

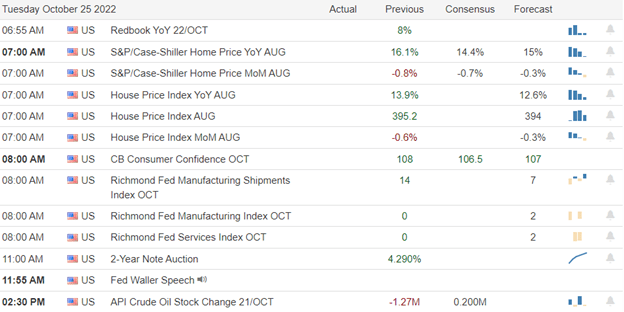

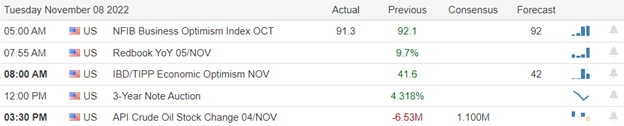

Economic Calendar

Earnings Calendar

Election day will be busy with earnings results, with over 160 companies confirmed to report results. Notable reports include DIS, DDD, AFRM, AKAM, BIRD, AMC, BLNK, BLDR, CEG, COTY, DD, ELAN, EXPD, GFS, GDRX, GO, GXO, HAIN, HALO, IAC, LMND, RIDE, LCID, LITE, MNKD, NEO, NWSA, NCLH, NVAX, OXY, OPK, PLNT, PLUG, SRG, SFM, SPWR, UPST, & WYNN.

News and Technicals’

Take-Two stock dropped more than 15% in extended trading on Monday after the company said its outlook in the current quarter and early 2023 would be significantly lower than expected. In addition, shares of Palantir fell Monday after the company released third-quarter earnings before the bell that missed analyst estimates for earnings but beat on revenue. Palantir’s revenue for the quarter increased 22% year over year, and its US commercial revenue grew 53%.

The German Port of Bremerhaven, Europe’s fourth largest auto hub, is seeing so much congestion due to driver shortages and overall trade volume that cars are piling up on land and at sea. As a result, Tesla, Chrysler, and Jeep parent companies Stellantis, Renault, BMW, and Volvo are all impacted. Leading vehicle carrier Wallenius Wilhelmsen has refused auto exports for October, November, and possibly into December.

Steady low-volume buying in the Dow eventually lifted the SPY and QQQ out of an intraday consolidation producing a bullish Monday even as bond yields continued to rise. Commodities had a good day, with oil and precious metals rallying as the dollar’s value declined. The SPY peaked above its 50-day average, but the QQQ lags significantly behind. The T2122 indicator is once again nearing an overbought condition, with the DIA the most extended with significant overhead resistance showing in all indexes. Today we will be subject to midterm election news and a blizzard of earnings data with a tranquil day on the economic calendar. Plan your risk carefully as election results are revealed this evening; anything is possible Wednesday morning in reaction.

Trade Wisely,

Doug