Commercial Real Estate Defaults (CRE)

The Hidden Danger That Could Derail the Stock Market Recovery

Commercial real estate (CRE) is a $20 trillion industry that plays a vital role in the US economy. It provides space for businesses to operate, jobs for millions of workers, and income for investors and lenders. However, the industry is facing a wave of defaults that could have serious repercussions for the stock market and the broader economy.

A default occurs when a borrower fails to repay a loan or meet other contractual obligations. In CRE, defaults are usually triggered by a decline in property income, a drop in property value, or a rise in borrowing costs. Any of these factors can make it difficult for property owners to service their debt or refinance their loans when they mature.

Why

The Covid-19 pandemic has exacerbated these risks for many CRE sectors, especially office and retail. The shift to remote work and online shopping has reduced the demand for physical space, leading to lower occupancy rates and rents. According to Green Street, office and retail property values have fallen by 25% since last year, while hotel values have plunged by 40%.

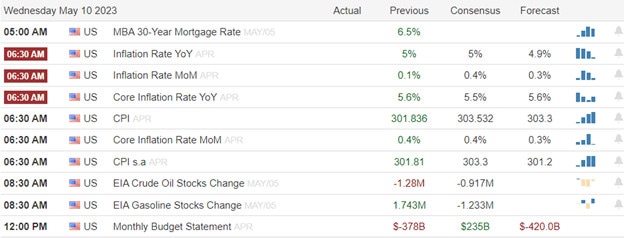

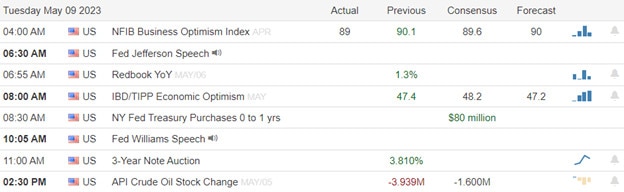

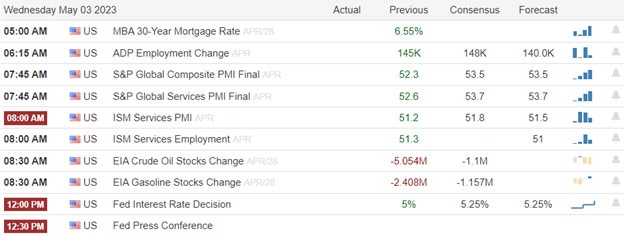

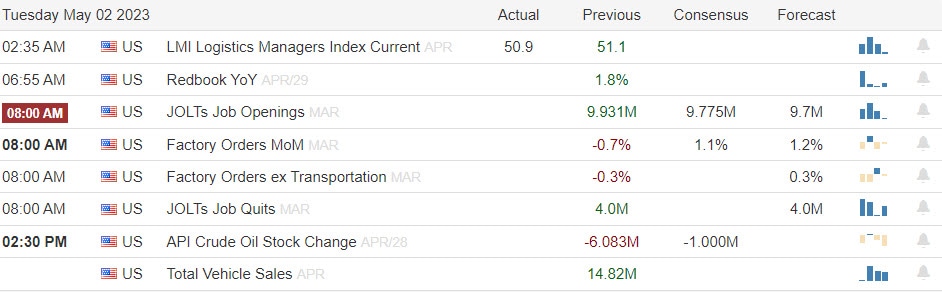

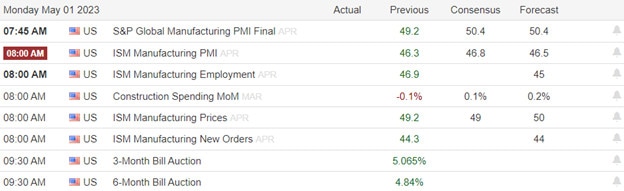

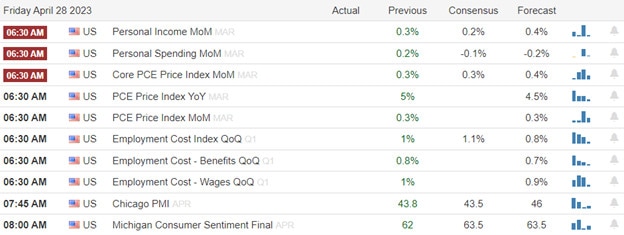

Meanwhile, the Federal Reserve’s efforts to fight inflation by raising interest rates have also hurt the credit-dependent industry. Higher interest rates increase the cost of borrowing and refinancing, as well as reduce the attractiveness of CRE as an investment relative to other assets. According to Morgan Stanley, about $1.5 trillion of CRE debt is set to mature over the next two years, posing a significant refinancing challenge for many borrowers.

Possible Impacts

The impact of CRE defaults could spill over to the stock market in several ways. First, defaults could erode the earnings and capital of banks and other lenders that hold CRE loans on their balance sheets. According to Goldman Sachs, about 80% of all bank loans for commercial properties come from regional banks, which are more exposed and vulnerable to liquidity shocks.

Second, defaults could trigger fire sales of distressed properties, putting further downward pressure on property values and impairing the collateral of other loans. This could create a negative feedback loop that amplifies losses and contagion across the financial system.

Third, defaults could undermine the confidence and sentiment of investors and consumers, leading to a pullback in spending and investment. This could weigh on the growth and profitability of various sectors that depend on CRE activity, such as construction, hospitality, retail, and business services.

Conclusion

In short, CRE defaults could pose a significant threat to the stability and performance of the stock market and the economy. While the Fed and other regulators have taken steps to monitor and mitigate these risks, such as providing relief measures and conducting stress tests, the situation remains uncertain and volatile. Investors should be prepared for more turbulence ahead.

Doug