The bears made an appearance on Tuesday as the market ended lower despite the bullish attempt to recover in the afternoon session on a day short on earnings or economic data. The focus today will be on the string of fed speakers along with Jerome Powel beginning his 2-day congressional grilling on the hill. Although the market may experience some volatility during his testimony depending on how hawkish or dovish he sounds no policy changes from the Fed are likely to be revealed.

While we slept Asian markets closed mostly lower with Hong Kong once again leading the selling down 1.98% at the close. However, European markets trade mostly with modest gains at the time of writing this report despite U.K. inflation coming in hotter than expected at 8.7% indicating there is still more work to do by the ECB. U.S. futures focused on the uncertainty of Fed policy currently indicate a flat open as they wait on the Powell testimony in Congress at 10 AM Eastern.

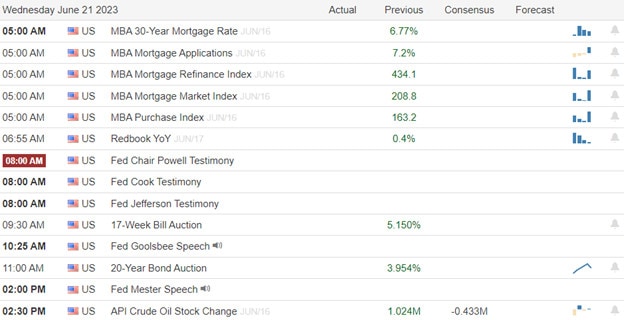

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include KBH, KFY, SCS, & WGO.

News & Technicals’

The relationship between the U.S. and China has deteriorated further after President Biden made a controversial remark about China’s leader Xi Jinping. Biden said he had “no illusions” about Xi and that he was “not a friend of democracy”. This comment angered China, which accused the U.S. of disrespecting its sovereignty and interfering in its internal affairs. The tension comes on the heels of a tense visit by Secretary of State Blinken to Beijing, where he tried to ease the friction caused by the U.S. shooting down a Chinese balloon in February. China denies that the balloon was used for spying and calls it a peaceful scientific experiment.

A new bill that aims to prevent big bank executives from getting excessive bonuses after their banks collapse or engaging in misconduct will be debated by the Senate Banking Committee. The bill called the RECOUP Act, is sponsored by the committee’s top Democrat and Republican, who say it will protect taxpayers and investors from bailing out failed banks. The bill would give regulators more power to claw back or cancel executive compensation if a bank violates the law or suffers major losses.

A Republican lawmaker is proposing a bill that would crack down on investment funds that factor in environmental, social, and governance issues, or ESG, in their decisions. Rep. Andy Barr, R-Ky., says his bill would protect investors from being misled by funds that claim to be ESG-friendly but do not disclose their criteria or performance. The bill is part of a broader Republican campaign to challenge what they see as “woke” investing that undermines American values and interests.

The stock market ended lower on Tuesday, losing some of the momentum from last week’s strong rally that extended the S&P 500’s streak of weekly gains to five. There was not much news or data to influence the market, which remained focused on the future of Fed policy. Interest rates edged down, with 10-year Treasury yields falling below 3.75%. Most sectors finished in negative territory, with energy and materials suffering the most as commodity prices declined. Today we have a parade of Fed speakers highlighted by the 2-day testimony in Congress from Jerome Powell. Although it is unlikely he will reveal any policy changes, it’s possible the market could experience price volatility depending on how hawkish or dovish he sounds.

Trade Wisely,

Doug

Comments are closed.