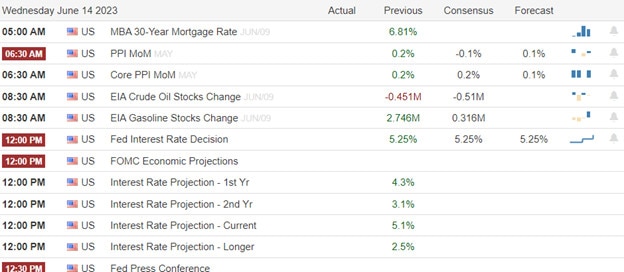

The lowest CPI reading in 2 years inspired the bulls and investors cheered pricing the market with an expectation the Fed will pause hoping this is the end of the rate hiking cycle. Today at the 2 PM announcement and the following press conference we will find out if the hawks have left the building or not. Before that excitement keep in mind we have Morage Apps, PPI, and Petrolem numbers likely adding to the emotional volatility of the day. Be prepared it could get wild if Powell surprises the market or continues to suggest the rate hike cycle may not be over just yet.

Asian market closed mixed with we slept with the Nikkei hitting fresh new highs and the HSI leading the sellers in the tech-heavy index. However, European markets trade higher across the board this morning with the FTSE MIB leading the way up 1.38% at the time of this writing this report. With a light day of earnings and a busy day on the economic calendar U.S. futures currently trade mixed but could and will likely change significantly based on the pending data reaction. Buckle up, emotions are high so plan for significant volatility.

Economic Calendar

Earnings Calendar

The only notable report for Wednesday is LEN.

News & Technicals’

Advanced Micro Devices (AMD) has revealed its new A.I. chip, the MI300X, which is designed to challenge Nvidia’s dominance in the fast-growing artificial intelligence market. The MI300X is AMD’s most advanced graphics processing unit (GPU), the category of chips that are used to build cutting-edge AI programs such as ChatGPT. The MI300X can use up to 192GB of memory, which means it can fit even bigger AI models than other chips. AMD said the MI300X will start shipping to some customers later this year and will be more meaningful in 2024. AMD’s CEO Lisa Su said AI is the company’s “largest and most strategic long-term growth opportunity” and that GPUs are enabling generative AI.

Vodafone and CK Hutchison have agreed to merge their UK mobile businesses, creating the country’s largest mobile operator with more than 27 million subscribers. The deal, which was announced on Wednesday, will give Vodafone a 51% stake and CK Hutchison a 49% stake in the combined group. The new group will be led by Vodafone UK’s current CEO Ahmed Essam and will invest £11 billion over 10 years to build “one of Europe’s most advanced standalone 5G networks”. The merger is expected to face scrutiny from competition regulators, who have previously blocked a similar deal between Three and O2 in 2016.

Investors cheered as the latest inflation data showed a slowdown to 4% in May, the lowest rate in over two years and in line with expectations. The market is priced for the belief that the Fed will keep rates unchanged at today’s rate announcement at 2 PM Eastern. Although Powell is not known for surprising the market, if he should do so and raise rates expect a very disappointed market that may unleash the bears. Cyclical sectors and small-cap stocks led the gains, while bond yields rose. Asian markets also got a boost from hopes of more stimulus from China. Oil prices bounced back 3% after a sharp drop on Monday.

Trade Wisely,

Doug

Comments are closed.