Last Friday as we headed into a 3-day weekend the six-day winning streak broke with a modest decline. Is this a temporary pause or could we be at or near a summer market high as we wait for the next round of earnings? Currently, the SP-500 10-year P/E ratio is 29.8 which is 47.4% above the modern-ear market average of 20.2 suggesting an overbought condition. However, investor enthusiasm for risk may still push the index toward a 4500 print. We have a light day on both the earnings and economic calendar with a bit of follow-through selling pressure showing up in the pre-market.

Asian markets traded mixed with modest gains and losses, however, the tech-heavy HSI fell 1.54%. European markets trade red across the board this morning following Monday’s declines. Ahead of a light day of earnings and economic reports U.S. Futures point to a lower open to begin our holiday-shortened week.

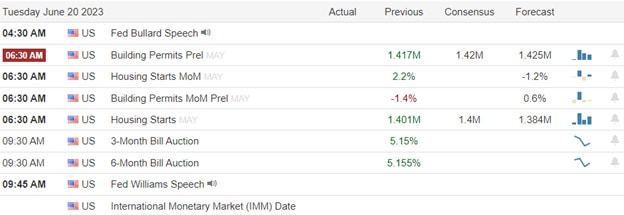

Economic Calendar

Earnings Calendar

Notable reports for Tuesday FDX & LZB.

News & Technicals’

The situation in Ukraine has escalated as Russian forces continue to launch air strikes on several cities and towns. The Ukrainian government has declared a state of emergency and activated its air defense systems. However, it admits that its counteroffensive is proving challenging due to the overwhelming number of Russian troops and aircraft. The international community has condemned the Russian aggression and called for an immediate ceasefire and dialogue.

The Bank of England faces a difficult decision as it prepares to announce its latest policy stance on Thursday. The central bank has to balance the risks of rising inflation and labor shortages against the uncertainties of the post-pandemic recovery and the potential impact of new variants of the coronavirus. The latest inflation data, due on Wednesday, is expected to show a further increase in consumer prices, adding to the pressure on the Bank to tighten monetary policy sooner rather than later.

The S&P 500 six-day winning streak broke on Friday which had lifted it to new highs for the year closing only slightly in the red. The big question is, have we put in a top or is this just a short-term pause in the overall rally? Investors have high hopes that the Fed is done raising rates despite the fact the committee suggested their terminal rate is 50 basis points higher as they work for the 2% target. The rally was more broad-based recently with more sectors and stocks joining the upward trend, but the Nasdaq still led the way, posting its best weekly performance since late January. Hopes of more stimulus from China and a weaker dollar also helped the bullish mood. Asian markets followed suit, as the Bank of Japan kept rates steady. Meanwhile, government bonds fell as the 10-year Treasury yield climbed to 3.77%.

Trade Wisely,

Doug

Comments are closed.