After the very exuberant rally, the bulls have taken a breather and though the bears seem to be slightly more active they’ve not shown much aggressiveness as yet. Though the QQQ took the worst of the day with Jerome Powell suggesting more rate hikes are likely the indexes remain in bullish patterns suffering no technical damage. However, today we have a few possible market-moving economic reports, a handful of notable earnings along with plenty of Fed talk keeping the path forward uncertain. Prepare for just about anything as we wind down the quarter with a new round of earrings just around the corner.

Asian market continued to show some weakness in reaction to the Fed rate comments with the tech-heavy Hong Kong exchange once again leading the selling down 1.98%. European markets facing a BOE rate decision trade red across the board. Ahead of a handful of earnings and the busiest day this week of economic data U.S. futures point to a negative open as Jerome heads the hill to be grilled in Congress for a second day.

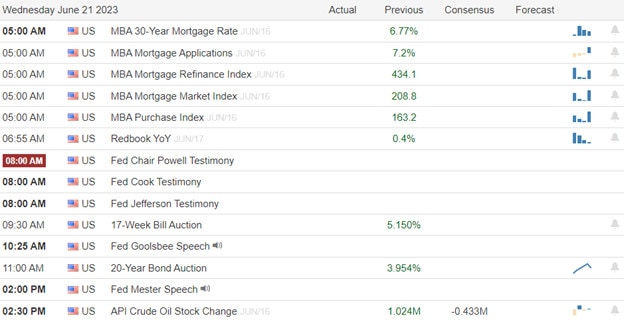

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ACN, DOOO, DRI, CMC, FDS, GMS, & SWBI.

News & Technicals’

As part of his first state visit to the U.S., Prime Minister Narendra Modi of India discussed a range of defense and technology partnerships with President Joe Biden and other U.S. officials on Thursday. The two leaders have also exchanged views on climate change, democracy, human rights, and the COVID-19 pandemic. Modi’s visit reflects the U.S. strategy of “friend-shoring”, which aims to reduce its dependence on China and strengthen its ties with other countries in the Indo-Pacific region.

Senator Jim Risch of Idaho, a Republican, has proposed a bill that would weaken the influence of unions in the U.S. labor market. The bill would make it illegal for unions to use labor slowdowns as a bargaining tactic, as they did in the recent West Coast port dispute, and impose heavy fines for such actions. The bill would also prevent unions from blocking port automation, which they fear would cost jobs and reduce wages. The bill faces strong opposition from Democrats and labor groups, who have defeated similar attempts in the past.

The online retailer Overstock.com has won the bid to acquire the brand name and online assets of Bed Bath & Beyond, the bankrupt home goods chain. The deal, worth $21.5 million, means that Bed Bath & Beyond’s physical stores will be shut down and its customers will be redirected to Overstock.com. The fate of Bed Bath & Beyond’s sister chain, Buy Buy Baby, will be decided in a separate auction next week.

So far this week the bulls have taken a breather in the past few days and the bears seem to be sniffing around a bit more though have yet to show much energy. Wednesday, the S&P 500 fell 0.5% and the Dow lost 102 points. The Nasdaq dropped more than 1%, as growth and technology stocks faced more selling pressure. Devoid of major economic news, investors were focused on the Fed’s policy outlook and the uncertainty that provides for the path forward. Asian and European markets have also seen some softness with possible stimulus on the way in China while ECB and BOE continue to see more rate increases as inflation remains stubbornly high. Today trades will look for inspiration in earnings reports, Jobless Claims, Existing Home Sales, Natural Gas & Peterloum numbers along with several Fed speaking including Jerome Powell.

Trade Wisely,

Doug

Comments are closed.