Index Whipsaws

In the wake of the U.S. index whipsaws in an FOMC decision reaction, the Hang Seng index in Hong Kong emerged as the frontrunner, registering a notable 2.4% increase. This uptick was further accentuated in the technology sector, with the Hang Seng Tech index experiencing a significant 4.4% surge. Meanwhile, Mainland China markets were closed in observance of the Labor Day holiday.

European markets experienced a modest downturn on Thursday morning, in response to the U.S. FOMC’s recent decision and the impact of various corporate earnings reports. The Stoxx 600 index saw a slight decline of 0.25% as of 11 a.m. in London, indicating a mixed bag of sectoral performance. While bank stocks showed resilience with a 0.5% rise, the oil and gas sectors weren’t as fortunate, witnessing a 1.35% fall.

U.S. stock futures indicate a bullish gap this morning as investors’ anticipation grew for the upcoming corporate earnings. However, the initial enthusiasm was tempered by the end of Wednesday’s volatile price action. The Dow managed to eke out a modest gain, closing approximately 0.2% higher, while both the S&P 500 and Nasdaq Composite receded, ending the day down by nearly 0.3%.

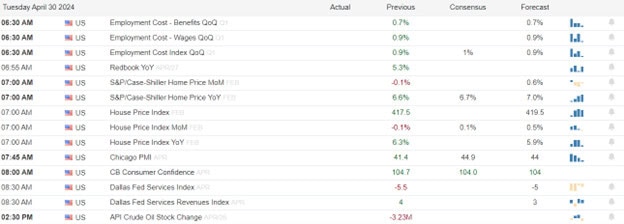

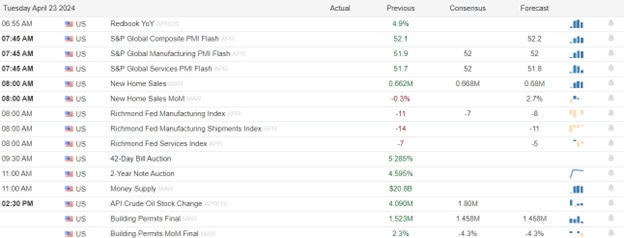

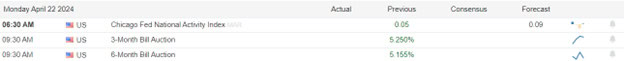

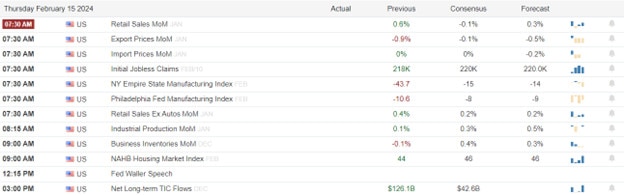

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include AGCO, AGIO, ATUS, APO, APTV, MT, ARES, ARW, BAX, BDX, BWA, BTSG, GOOS, CAH, CHD, CNK, CNHI, CGNX, COP, CMI, CYBR, D, DRVN, ENOV, ES, EXC, EXLS, RACE, FTDR, ULCC, HWM, HII, IDA, INMD, NSIT, ICE, IDCC, IQV, IRM, ITRI, ITT, JHG, K, KRP, KIM, KTB, LAMR, LANC, LNC, LIN, LXP, MBUU, NRMA, MCO, MUR, OGN, PH, BTU, PTON, PENN, PNW, PBI, PWR, REGN, SABR, SEE, SHAK, SSTK, SWI, SO, SWK, CI, TPB, UTZ, WNT, VMC, WD, W, WEN, WRK, XPEL, XYL, & ZTS.. After the bell include AAPL, AAON, ACCO, AES, AMH, AMGN, ACA, ASUR, BECN, BBAI, BILL, BJRI, SQ, BKNG, BFAM, CABO, CPT, CIVI, NET, COHU, COIN, ED, CTRA, DVA, DRH, DLR, DLB, DKNG, LOCO, EOG, EXPE, FRT, FIVN, FND, FTNT, FOXF, GDDY, HOLX, HUN, ILMN, KRC, LYV, MTZ, MSI, MP, OHI, OTEX, OPEN, PCTY, PXD, POST, KWR, RMAX, RGA, RKT, RYAN, SIMO, SM, SWN, TNDM, TXRH, X, OLED, VIAV, WK, WW, XRH, & XPOF.

News & Technicals’

Jeffrey Gundlach, CEO of DoubleLine Capital, provided a revised outlook on Wednesday, suggesting that there may be at most one interest rate cut by the end of the year. This statement came in the wake of the Federal Reserve’s policy meeting, where Chair Jerome Powell made a pivotal announcement that virtually eliminated the prospect of an interest rate hike in the near future. Following Powell’s remarks, the financial markets reacted swiftly; treasury yields plummeted to their lowest points of the session, while stock prices soared to their highest, reflecting investor sentiment that the next move by the Fed would steer clear of increasing rates.

The perception of China among Americans has notably shifted, with 42% now considering China as an adversary of the United States—a significant increase from just 25% two years prior. This sentiment is echoed in Pew Research findings, where for the fifth consecutive year, approximately 80% of respondents harbored unfavorable views towards China, and nearly half of that group expressed a very unfavorable stance. Notably, older Republican demographics, alongside individuals dissatisfied with the U.S.’s economic climate, exhibited the strongest opposition toward China. This data underscores a growing trend of skepticism and concern regarding U.S.-China relations among the American populace.

Carvana’s stock experienced a remarkable surge, soaring over 30% in after-hours trading on Wednesday. This leap was fueled by the company’s announcement of record-breaking results and a profitable first quarter. A key metric, the gross profit per unit (GPU), stood at an impressive $6,432, capturing the attention of investors. Additionally, Carvana reported an adjusted EBITDA profit margin of 7.7% for the quarter. These strong financial indicators are the fruits of a strategic shift implemented over the past two years, emphasizing profitability in response to previous bankruptcy worries in 2022. The company’s pivot from aggressive expansion to financial stability appears to be paying off, as evidenced by these positive outcomes.

Peloton is set for a leadership transition as CEO Barry McCarthy prepares to step down, marking the end of his tenure that began in February 2022. McCarthy, who previously held executive roles at Netflix and Spotify, was instrumental in steering Peloton through a period of transformation aimed at cost reduction and revitalizing growth. Despite his departure from the CEO role, McCarthy will continue to influence Peloton’s strategy, serving as a strategic advisor until the year’s end. In the interim, the company will be guided by two of its board members who will assume the roles of co-CEOs, ensuring continuity in Peloton’s journey towards sustainable growth.

Trade Wisely,

Doug