Hurry-Up-And-Wait

Although the bulls pushed to test overhead index resistance and downtrend levels, the bullish energy faded into the close as we hurry up and wait for Powell’s Senate testimony this morning. Recent inflationary economic data will likely inspire some tough questioning from the committee. Will we see a tough-talking hawkish Chairman or the gentle dovish version still touting a soft landing that supports the current rally? Expect considerable price volatility as traders and investors hang on every word looking for the path forward. Anything is possible, so plan carefully.

Asian markets traded mixed with modest gains and losses, awaiting the chairman’s congressional testimony. However, European bulls work to add to recent gains, apparently expecting dovish Fed comments. U.S. futures also try to put on a brave face suggesting a modestly bullish open, hoping Powell’s comments will support the recent index surge upward with Fed pivot ringing in its ears.

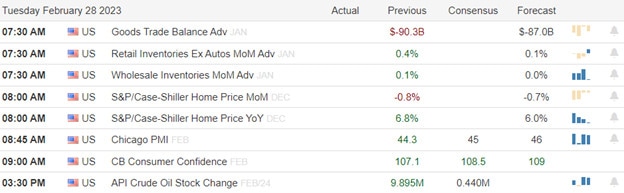

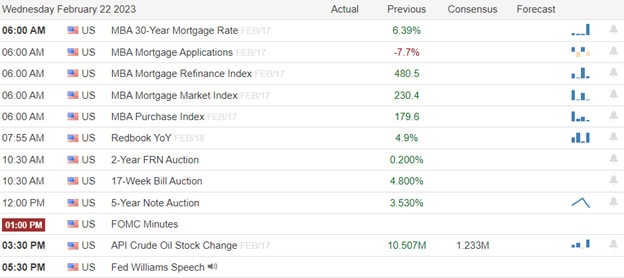

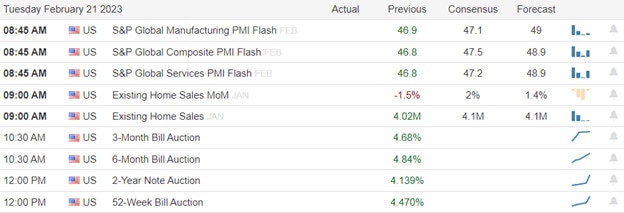

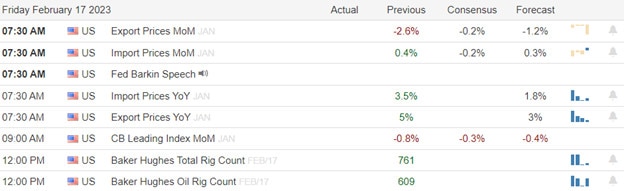

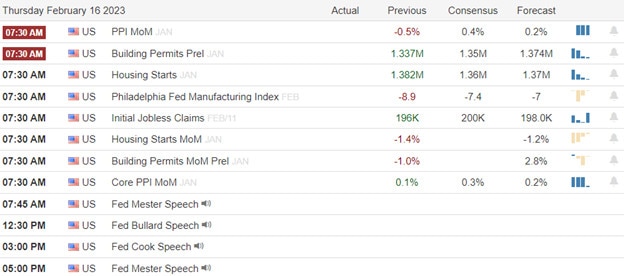

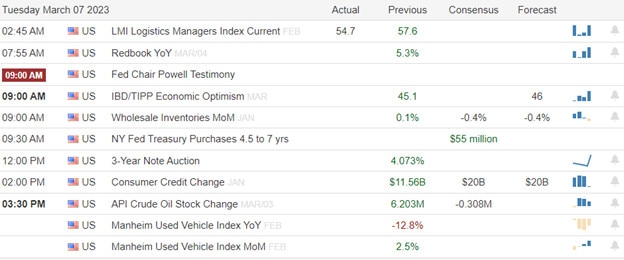

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include CASY, CRWD, DKS, DOLE, JKS, SWIM, MANU, SE, SQSP, SFIX, SUMO, THO, & WTI.

News & Technicals’

Best Buy has struck a deal to sell devices and handle the installation of a program that allows patients to get hospital care at home. The consumer electronics retailer is expanding its healthcare business as sales of other consumer electronics slow. CEO Corie Barry said on an earnings call that Best Buy expects sales in its health division will grow faster than the rest of the business this fiscal year.

Return-to-office plans fall short leaving commercial real estate empty and at risk of default. CEO Corie Barry said on an earnings call that Best Buy expects sales in its health division will grow faster than the rest of the business this fiscal year. He added that the Covid-19 pandemic forced millions of people to work from home for the first time, and they don’t necessarily want to go back.

Meta is planning more cuts after its first round of layoffs, possibly affecting thousands of jobs. The layoffs could begin this week and affect thousands of employees. The cost-cutting comes in addition to previously announced plans to lay off 13% of Meta workers. Meta CEO Mark Zuckerberg is pitching 2023 as the “Year of Efficiency.”

Monday’s market was essentially a hurry-up-and-wait event as bulls attempted to crack resistance and downtrend levels early in the session. However, uncertainty about the pending Powell testimony faded enthusiasm, leaving shooting star patterns across the indexes. As the Senate committee grills the Fed chairman, what he says will be far less important than how the market interprets his answers. Recent economic reports could spark a bit more hawkish-sounding Powell, disappointing a market that wants to hear dovish statements to support the current rally. The charts suggest big price swings are possible, so expect considerable volatility, whipsaws, and reversals as investors try to guess what comes next as Powell speaks.

Trade Wisely,

Doug