Today investors find themselves at a crossroads of anticipation and caution. The market has witnessed a rebound, with Big Tech companies poised to release their earnings, sparking a collective breath of optimism. This week is particularly crucial as it sees the convergence of financial disclosures from approximately 30% of the S&P 500 entities, setting the stage for potential market reassurance.

However, the recent past has painted a more sobering picture. Wall Street experienced a sharp decline, marking its worst performance since October, as the S&P 500 fell by 1.5%. This downturn was part of a broader trend, with the S&P 500 extending its losing streak influenced by slumps in major tech firms like Nvidia and Netflix.

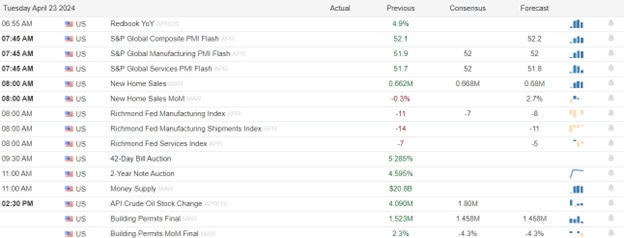

Economic Calendar

Earnings Calendar

Notable reports for Tuesday. Before the bell, BANC, DHR, EWBC, FBP. FCF. FI. FCX. GATX. GE. GM, HAL, IVZ, JBLUE, KMB, LMT, MSCI, NEE, NEP, PNR, PEP, PM, PII, PHM, DGX, RTX, R, SHW, SPOT, UPS, WRB, WBS, & XRX. After the bell reports includeTSLA, BKR, CNI, CB, CGSP, ENPH, EQT, EQR, HA, IEX, MTDR, MAT, RRC, STX, STLD, LRN, TXN, TRMK, VBTX, VICR, V, WSBC, & ZWS.

News & Technicals’

The upcoming days are set to be a defining moment for the U.S. technology sector as industry giants such as Tesla, Meta, Microsoft, and Google’s parent company Alphabet are on the cusp of revealing their latest financial figures. The earnings week is set to ignite with Tesla, the electric vehicle pioneer led by Elon Musk, announcing its results after Tuesday’s market close. This series of disclosures follows a tumultuous period for the tech market, evidenced by a 5.5% drop in the Nasdaq Composite last week. The sentiment in the market is one of cautious scrutiny, as noted by Nicolai Tangen, CEO of Norges Bank Investment Management, who highlighted the presence of speculative “froth” in the tech sector during his interview with CNBC. The true measure of this speculation, however, remains to be seen, casting a veil of uncertainty over the impending earnings announcements.

The dichotomy between hope and reality is further accentuated by the mixed results of the current reporting period. While a majority of companies have exceeded expectations, the overall growth for Q1 remains tepid, with FactSet data indicating a flat year-on-year trajector. This stands in stark contrast to the more than 3% growth that analysts had projected at the onset of the earnings season.

As investors navigate this complex environment, they remain vigilant, weighing the potential impact of upcoming earnings reports against the backdrop of recent market volatility. The question on everyone’s mind is whether the forthcoming financial revelations will serve as a catalyst for recovery or contribute to ongoing market trepidation.

Today’s stock market is an interplay of various economic forces with trader at the corssroads of hope and uncertainty. From the anticipation surrounding Big Tech earnings to the cautious reflection on recent downturns, investors are reminded of the inherent uncertainties that define the financial world. As we look ahead, it is clear that the market’s trajectory will be shaped by a multitude of factors, likely to create considerable emotion and price volitility.

Trade Wisely,

Doug

Comments are closed.