Index prices whipsawed higher with the SPY, QQQ, and IWM surging as investors seemed to say they didn’t care or didn’t believe the higher-than-expected CPI figures. The VIX declined sharply as fear disappeared in a rush to hurry up and buy. This morning we learned that both the U.K. and Japan have slipped into technical recession though both of their markets continued to move higher. On tap is a very busy earnings and economic calendar so plan for considerable price volatility as traders and investors digest the data. As you plan forward remember we have a pending PPI report on Friday before slipping into a 3-day weekend.

Overnight Asian markets not still in celebration of the lunar holiday closed mostly higher with Japan stretching above 38,000 for the first time since 1990 though also slipped into recession according to their GDP figures. European markets trade with bullishness across the board this morning despite learning that the U.K. also slipped into recession. Ahead of a big day of data U.S. futures look to extend yesterday’s gain suggesting a bullish open but anything is possible as the data is revealed.

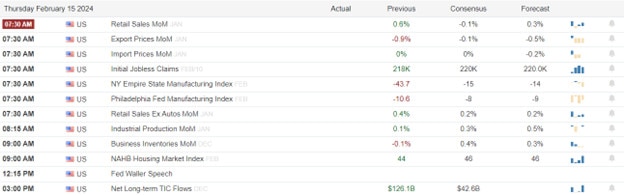

Economic Calendar

Earnings Calendar

Notable reports for Thursday include COIN, DKNG, AEM, AMAT, ARCH, BJRI, BE, CBRE, COHU, CON, CROX, DE, DLR, DASH, DBX, GPC, GLOB, HBI, H, IDA, IR, NSIT, IDCC, IRWD, LH, LECO, LTC, LXP, MERC, OGN, PENN, RS, ROKU, SABR, SHAK, SN, SWAV, SQ, SWAV, SO, SPWR, SKT, TXRH, TTD, TOST, TNET, USFD, VNT, WD, WEN, WFG, YELP, YETI, & ZBRA.

News & Technicals’

Japan, the Asian economic powerhouse, has lost its position as the world’s third-largest economy to Germany, as it entered a recession in 2023. Japan’s nominal GDP, which measures the value of goods and services produced in the country, increased by 5.7% in 2023 compared to 2022, reaching 591.48 trillion yen, or $4.2 trillion. However, this was not enough to keep up with Germany, which grew its nominal GDP by 6.3% in 2023, hitting 4.12 trillion euros, or $4.46 trillion. Germany, the largest economy in Europe, benefited from its strong export sector and fiscal stimulus, while Japan suffered from the impact of the pandemic and natural disasters.

Cisco, the world’s largest maker of networking equipment, announced that it would slash 5% of its global workforce, or about 4,250 jobs, as part of its restructuring plan. The company said the job cuts were necessary to adapt to the changing market conditions and customer needs. Cisco also lowered its revenue and earnings guidance for the current quarter and the full year, citing weak demand and increased competition. The company’s shares fell by more than 7% after the news.

TSMC, the world’s leading chipmaker, saw its stock price soar to a new record on Thursday, after Morgan Stanley raised its price target on Nvidia, one of its major customers. Nvidia, a dominant player in the artificial intelligence (AI) chip market, has been benefiting from the strong demand for its products across various sectors. TSMC, which makes chips for Nvidia and other tech giants like Apple, has also been enjoying robust growth and profitability, as it leverages its technological edge and scale. TSMC’s shares closed at $142.5, up 3.6% from the previous day.

Stellantis, the maker of Jeep and Dodge vehicles, saw its profit decline in 2023, as it faced the impact of labor strikes that affected the Detroit Three automakers. The company’s adjusted operating income margin in North America dropped by 1% from the previous year to 15.4%, as it suffered from production losses and higher labor costs due to new contracts. However, the company still posted solid earnings for the full year, as it benefited from its global scale and diversified portfolio.

The prices whipsawed up on Valentine’s Day after a higher-than-expected U.S. CPI inflation report that sent indexes sharply lower. The SPY, QQQ, and IWM surged higher while the DIA finished the day strong after several substantial whipsaws through the session. A U.K. inflation that remained static helped the European market rally though today the GDP showed they have slipped into recession. Overnight the Nikkei closed above a 1990 high while at the same time, their GDP figures also indicated recession. Today we have a very busy economic calendar that includes Jobless Claims, Retail Sales, Industrial Production, Manufacturing Figures, Import/Export numbers, Inventory Data, Housing figures, and more for the investors to digest. The earnings calendar is also chalked full of notable reports so prepare for another wild price action day with a pending PPI report on the horizon.

Trade Wisely,

Doug

Comments are closed.