We start the week off with a little break in the middle easte goeplitical tensisons easing oil prices and setting up a morning gap. However, espect this week to be very volitile as earnigns reports ramp up to include some of the tech titians. At the end of the week we will get a GDP and a Core PCE inflation report likely to create some uncertainty as we wait. Bond yeilds this morning are already higher this morning in anticipation so watch carefully for the possible opening gap whipsaw we experienced every day last week.

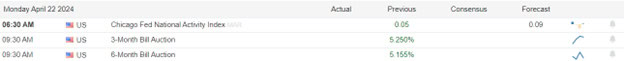

Economic Calendar

Earnings Calendar

Notable reports for Monday. Before Bell ACI, AZZ, BOH, TFC, VZ, & ZION. After The Bell, AGNC, ARE, BRO, CADE, CDNS, CALX, CLF, CR, ELX, GL, HSTM, HXL, IBTX, MEDP, NUE, PKG, PNFP, SAP, & SSD..

News & Technicals’

Tesla, the electric vehicle (EV) manufacturer spearheaded by CEO Elon Musk, has implemented significant price reductions across several key markets, including China and Germany. This strategic move follows similar price cuts in the United States and comes amidst a backdrop of declining sales figures and escalating competition within the EV sector, particularly from Chinese manufacturers. The decision to lower prices marks a notable shift for Tesla, which reported a decrease in global vehicle deliveries for the first quarter, an occurrence not seen in almost four years, signaling a potential recalibration of its market approach in response to the intensifying industry dynamics.

In a significant development, Ukraine was granted a crucial respite over the weekend when the U.S. House of Representatives, after prolonged deliberations, endorsed a substantial $61 billion foreign aid package. The passage of this bill marks a pivotal moment, as it now advances to the Senate, where it is anticipated to receive the green light from the Democratic majority. The approval by the Senate is expected imminently, within the week, setting the stage for President Joe Biden’s final ratification. This legislative action is not just a procedural triumph but a lifeline for Ukraine, which urgently requires enhanced air defense systems, artillery, and ammunition. These resources are deemed essential for Ukraine to potentially shift the dynamics of the ongoing conflict.

Despite Huawei’s recent advancements in semiconductor technology, China still lags significantly behind the United States in this critical field, as stated by Secretary Raimondo. The gap underscores the complex landscape of global tech leadership, where breakthroughs are measured not just in isolated achievements but in sustained, cutting-edge innovation. The Biden administration asserts that its policies on chip exports are proving effective, reflecting a strategic approach to maintain the U.S.’s competitive edge and safeguard national security interests. As the semiconductor industry becomes increasingly intertwined with geopolitical concerns, the U.S. is poised to continue its vigilant stance on the export of these pivotal technologies.

The upcoming week heralds a pivotal juncture in the financial calendar, with a host of the globe’s most colossal corporations poised to unveil their earnings. An estimated 30% of the S&P 500 firms are on the docket to disclose their financial health. The current earnings season has presented a dichotomy of outcomes. On one hand, an impressive over 73% of reporting entities have surpassed analysts’ projections. On the other, the aggregate growth for Q1 appears to be treading water, with projections indicating a stagnant year-over-year growth, contrary to the anticipated 3% increase pre-season, as per FactSet’s insights. This mixed bag of financial revelations underscores the unpredictable nature of market performance amidst a fluctuating economic landscape. Expect a very volitle week of price action and watch for big point whipsaws particularly after the morning gaps.

Trade Wisely,

Doug

Comments are closed.