Crossed 5,000

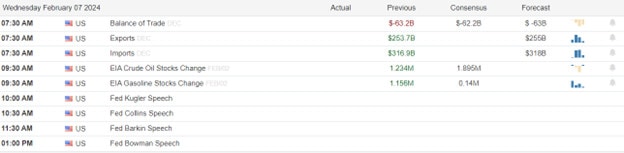

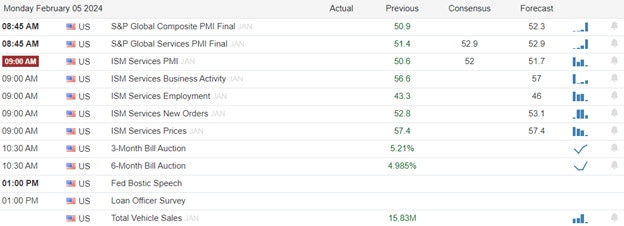

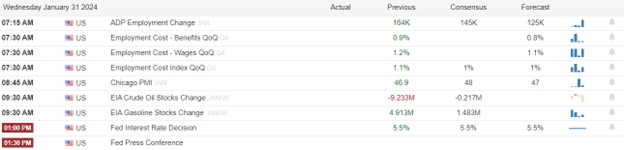

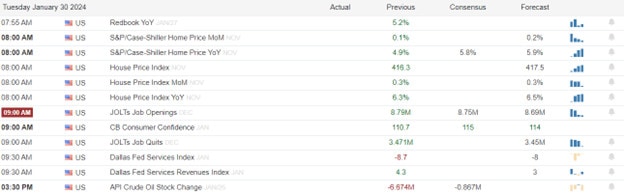

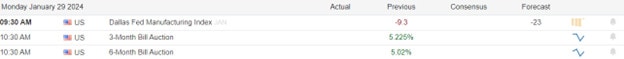

The bulls celebrated as the SP-500 crossed 5,000, a psychological level that can serve as a significant level of support or resistance. The Nasdaq led the rally pushed by the tech giants that continued their parabolic rise. This week anything is possible with a CPI report on Tuesday, a slew of reports grouped into Thursday, and then a PPI report on Friday as we slide into a 3-day weekend. Of course, we will toss in a bunch of earnings reports and some Fed speeches to keep the price volatility challenging.

Many of the Asian markets were closed to their extended celebration of the Lunar New Year. However, European markets traded mostly higher this morning with only the FTSE moving slightly lower. Ahead of a Tuesday CPI, U.S. futures suggest a flat maybe slightly bearish open perhaps resting after the record highs made on Friday. Buckle up it could be a wild week as the data is revealed.

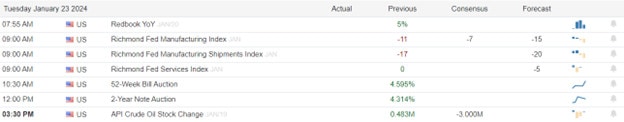

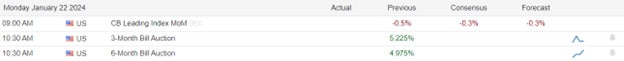

Economic Calendar

Earnings Calendar

Notable reports for Monday include ANET, CAR, BLKB, BHF, CDNS, FRT, GT, HPP, LSCC, MNDY, MEDP, & OTTR.

News & Technicals’

Russia’s economy is expected to grow faster than previously anticipated, according to the International Monetary Fund (IMF). The IMF revised its projection for Russia’s GDP growth in 2024 from 1.1% to 2.6%, citing improved domestic demand and higher oil prices. However, Russia’s economic recovery is also driven by its massive military spending, which has increased sharply since the outbreak of the war. The IMF’s managing director, Kristalina Georgieva, warned that Russia’s economic model is unsustainable and resembles the Soviet era, with heavy reliance on state-owned enterprises and low diversification.

Elon Musk, the billionaire entrepreneur and founder of Tesla and SpaceX, is facing a legal battle with the U.S. Securities and Exchange Commission (SEC) over his takeover of Twitter in 2022. A U.S. judge has ordered Musk to appear in court and answer questions about his acquisition of the social media giant, which the SEC suspects was a case of securities fraud. The SEC claims that Musk manipulated the stock price of Twitter by buying shares before announcing his intention to buy the company with borrowed money. Musk, who has a history of clashing with federal regulators, denies any wrongdoing and argues that he has the right to challenge the SEC’s authority.

Germany, the largest economy in Europe, is facing a bleak economic outlook for 2024. The latest data shows that the country’s GDP contracted by 0.2% in the fourth quarter of 2023, marking the second consecutive quarter of negative growth. Economists warn that Germany may slip into a technical recession this year, as the recovery from the pandemic is hampered by various challenges. These include the impact of trade tensions, rising energy costs, and political instability both at home and abroad. While some economists hope that the worst is behind, they remain pessimistic about the prospects of robust growth in 2024.

The EU, which claims to be a leader in environmental protection, is facing a backlash from its citizens over its climate policies. Farmers across Europe have been protesting against the EU’s plans to reduce pesticide use and greenhouse gas emissions, arguing that they would harm their livelihoods and competitiveness. As a result, the European Commission, the EU’s executive branch, has decided to abandon its proposal to cut pesticide use by half. Moreover, the Commission has also excluded the agricultural sector from its ambitious goal of slashing greenhouse gas emissions by 90% by 2040. These moves have raised doubts about the EU’s commitment and credibility in tackling the climate crisis.

The U.S. stock market mostly rose on Friday with the Dow lagging slightly, as the S&P 500 crossed 5,000, reaching new record highs. Big round numbers like this tend to serve as strong psychological support levels if prices hold above but also tend to serve as strong resistance levels if prices happen to fall below. Small-caps, consumer discretionary, and technology sectors led the market, as oil prices also increased. The 10-year Treasury yield edged higher on Friday, continuing the rise in interest rates since last week, as bond markets delayed their expectations for Fed rate cuts. This week will be highlighted by a CPI number on Tuesday followed by a reading on PPI Friday which just happens to be the February option expiration before a 3-day weekend. Of course, we will continue to have notable earnings events to add to the price action volatility. Stay with the upside trend but continue to raise your stops should the market stumble on one of these data points.

Trade Wisely,

Doug