Rate Uncertainty

The bears were a bit more active on Wednesday as rate uncertainty grew with hotter-than-expected retail numbers and Fed speeches continuing to suggest higher for longer than the market has anticipated. However, the SPY and QQQ left behind some hopeful candle patterns that a relief rally may be close at hand as long as earnings and economic data cooperate. Investors will look for inspiration in the housing, jobless, manufacturing, oil and gas reports along with more Fed speeches and earnings. Big point swings remain possible so plan your risk carefully.

While we slept Asian market ended mixed but mostly higher as Hong Kong relieved some of yesterday’s sharp selloff while China continued to linger near five-year lows. European markets are also taking a break from the recent selling showing green across the board this morning. U.S. futures suggest a substantial gap in the Nasdaq though the Dow and SP-500 trade flat ahead of earnings and economic data.

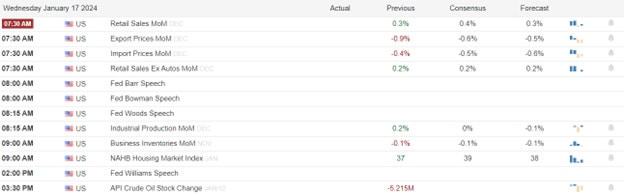

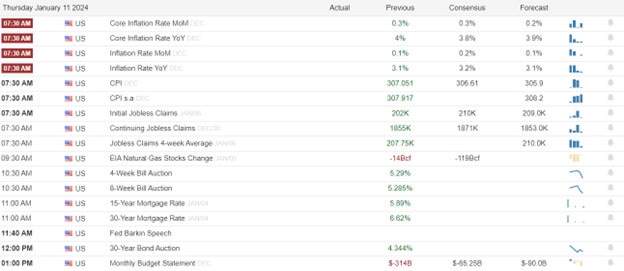

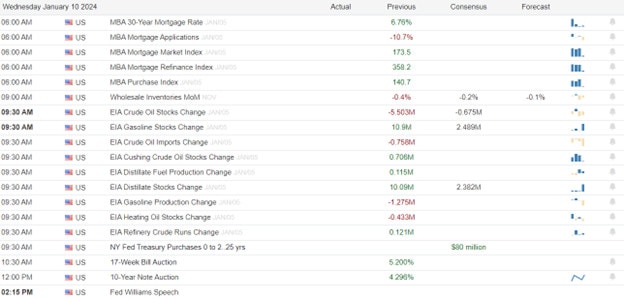

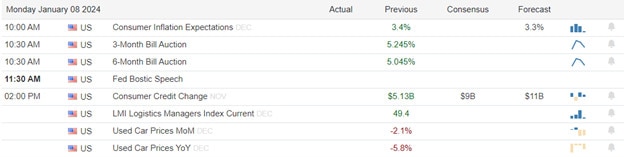

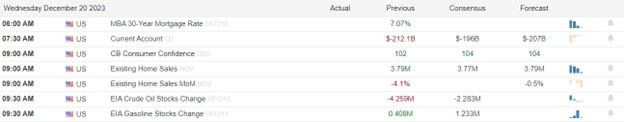

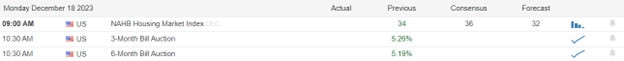

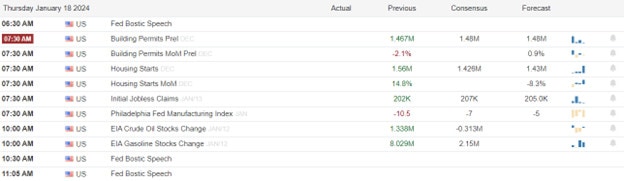

Economic Calendar

Earnings Calendar

Notable reports for Thursday include OZK, FNB, FAST, FHN, HOMB, JBHT, KEY, MTB, NTRS, PPG, TCBI, & WNS.

News & Technicals’

Google’s CEO Sundar Pichai announced in a memo to employees on Wednesday that the company will reduce its workforce this year. Pichai said that the company has big plans in fields such as artificial intelligence and that it needs to invest more in these areas. He also said that to make room for this investment, the company has to make difficult decisions and cut some jobs. He did not specify how many jobs will be affected or which divisions will be impacted.

Apple has decided to scrap the blood oxygen feature from its newest Apple Watches, the company announced on Wednesday. The feature, which measures the oxygen level in the blood, was challenged by Masimo, a medical device maker, who claimed that Apple infringed on its patents. Apple said that by removing the feature, it will be able to keep importing the devices to the U.S. while the legal dispute is ongoing. The revised versions of the Apple Watch Series 9 and Ultra 2, which were launched in September, will be available for purchase on Thursday.

TSMC, the world’s largest contract chipmaker, saw its revenue and net income decline in the fourth quarter of 2023, compared to the same period a year ago. The company reported revenue of NT$625.53 billion, down 1.5% year-on-year, and net income of NT$238.71 billion, down 19.3% year-on-year. The company attributed the lower results to the global chip shortage, which affected its production and delivery. TSMC’s main customers include Apple and Nvidia, who rely on TSMC to make the most advanced processors for their products, such as the iPhones.

Rate uncertainty inspired the bears to be a bit more active as the markets ended the day in the red on Wednesday, extending Tuesday’s losses, but leaving behind some hope clues that a relief rally is possible soon. Investors seem to be adopting a more cautious stance on 2024 rate cuts and the geopolitical tensions that continue to grow. Rates rose on the day, following Fed Governor Waller’s speech which seemed to counter the market’s anticipation of imminent rate cuts. The 10-year yield has risen to 4.1% after beginning the year below 4%. Across the globe, stocks fell after data revealed weak growth in China and higher inflation in the U.K., while oil prices edged up and gold fell on the day. Today investors will look for inspiration in Housing Starts and Permits, Jobless Claims, Philly Fed Mfg., Natural Gas, and Petrolem figures. We also have several notable earnings and more Fed member speeches to keep traders guessing.

Trade Wisely,

Doug