Searching for Clarity

Yesterday’s huge morning gap failed to find follow-through buyers as volatility weary traders choose to sit on their hands searching for clarity to the big issues clouding the path forward. While we could hear of new developments in the trade war at anytime resolution of its uncertainty is likely weeks if months away. Fed Chairman Powell may provide some clarity on the FOMC’s thoughts on interest rates when he speaks on Friday, but until then the market will stay focused on fluctuating bond rates, earnings, and economic reports to try and find inspiration.

Asian markets traded flat but mostly lower as China set new loan prime rates in an attempt to stimulate economic growth. This morning European markets are trading cautiously and mostly flat as recession fears continue to linger. US Futures also point to a flat but slightly lower open this morning as we wait and search for clarity. What comes next is anyone’s guess.

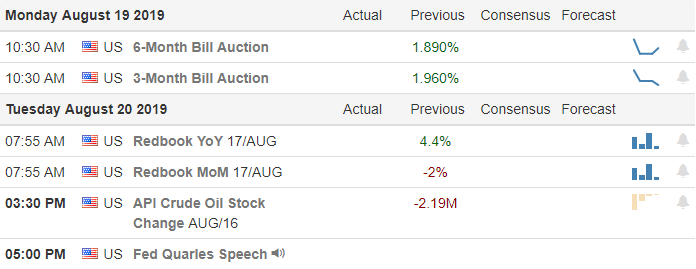

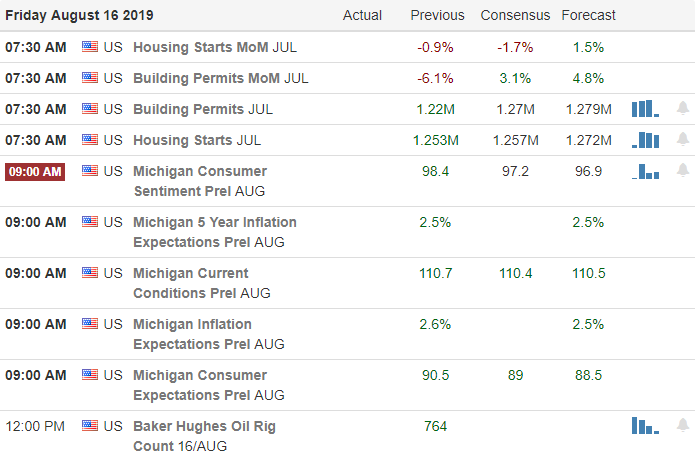

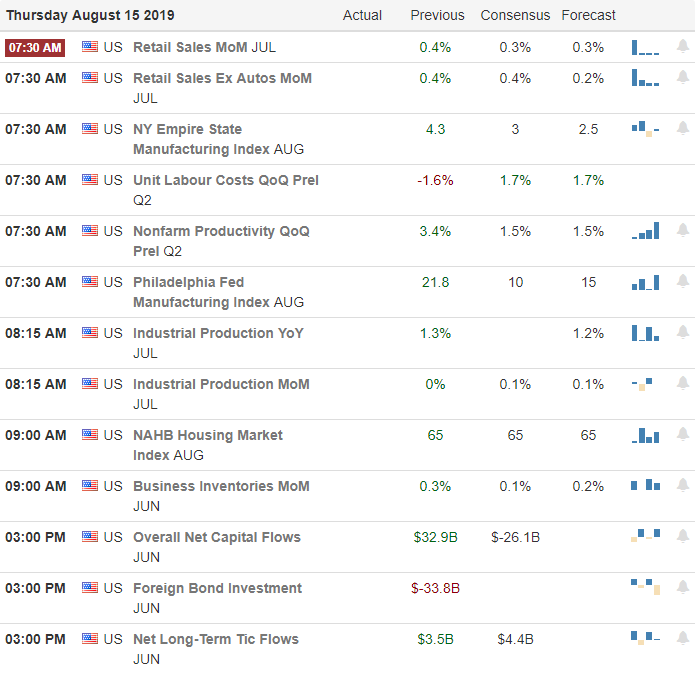

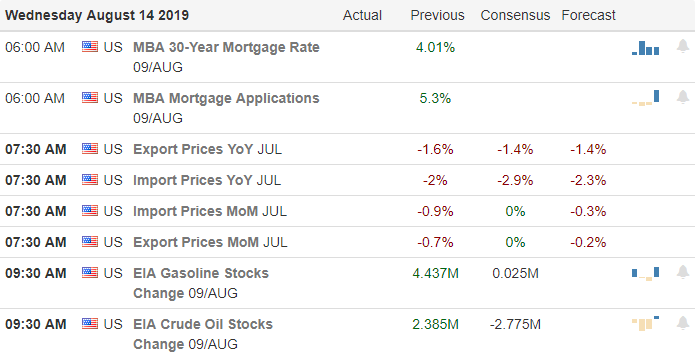

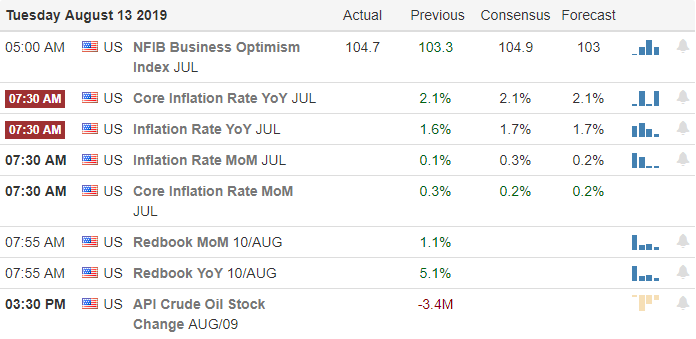

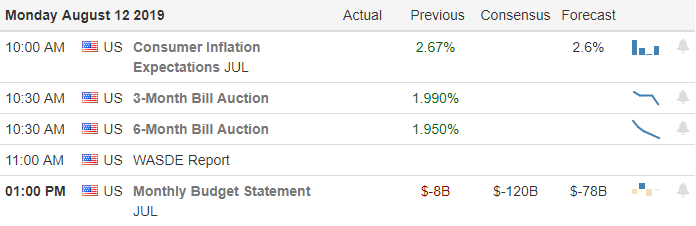

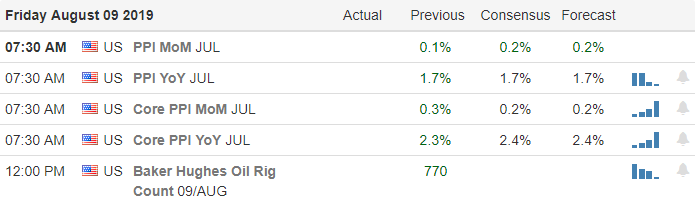

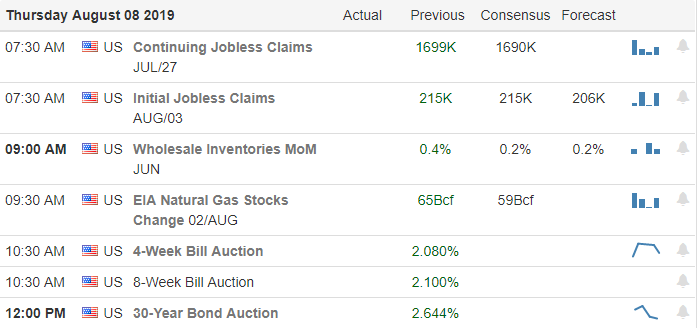

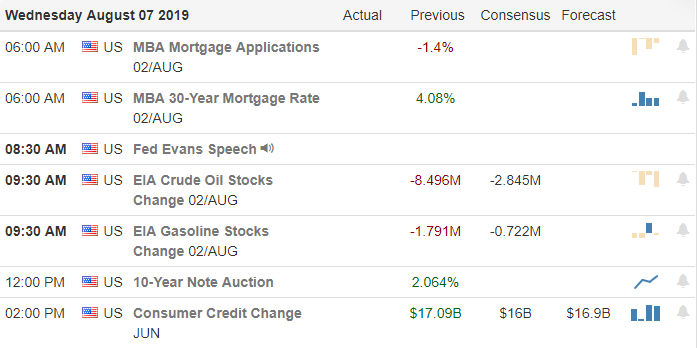

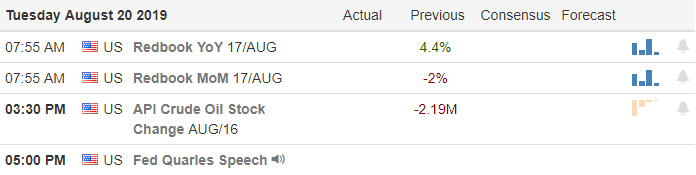

On the Calendar

On the Tuesday Earnings Calendar, we have less than 50 companies reporting today. Notable reports include CREE, TOL, URBN, HD, KSS, MDT, and TJX.

Action Plan

With markets responding to improving bond rates, the market gapped strongly higher yesterday but failed to find follow-through buyers as the market chopped sideways the rest of the day. Traders are finding it difficult to trust the recent price action with so much uncertainty clouding the path forward. Perhaps yesterday’s price action was a prelude to a resting consolidation relieving some of the intense volatility of late as we wait for clarity.

Technically the indexes remain in a downtrend with price challenged by overhead resistance as well as moving average resistance. Unfortunately, we are unlikely to get much clarity this week in the trade war, but perhaps the Fed Chairman will help clarify the FOMC’s next move when he speaks on Friday. With earnings season winding down the market will turn to economic reports to try and find inspiration and will likely continue to be very sensitive to the political spin as it searches for answers. Choppy consolidating price action, though very boring, maybe just what we need calm the nerves of traders after a will couple weeks of trading.

Trade Wisley,

Doug