It’s always nice after such a strong sell-off when a relief rally begins. However, with so much technical damage to the charts, I would be carefully finding too much comfort in the rally. Trader’s should stay vigilant watching for clues of potential price failures at or near price resistance levels and key moving averages. We should also be on guard for the possibility of overnight reversals as we plan our risk forward. There can be an opportunity in high volatility times for experienced day-traders, but the path ahead for swing and position traders could be very challenging.

Asian markets closed mixed but mostly lower as China followed-through stabilizing the Yuan at a level slightly lower than expected. European markets are embracing the calming of the currency fluctuations with their indexes seeing green across the board. The early evening futures bearish reversed during the night now suggesting a modestly bullish open ahead of a very busy day of earnings reports that may prove to support the relief rally or bring back the bears is the result disappoint. Plan your risk carefully in this fragile market environment.

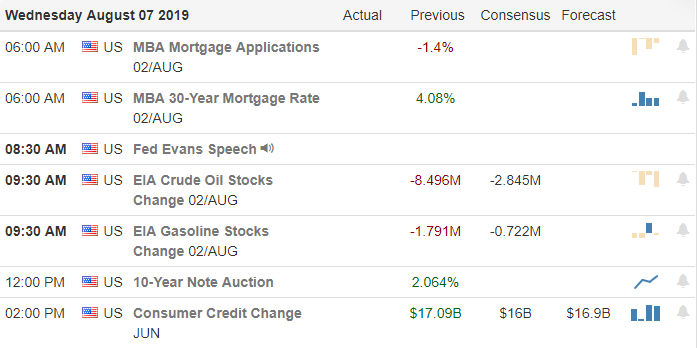

On the Calendar

We have another very busy day on the Earnings Calendar with over 430 companies reporting quarterly results. Among the notable are, LYFT, STMP, DDD, UHAL, AIG, CVNA, CTL, CDE, CVS, FOXA, HL, LAMR, LBYTA, LL, NRG, OMI, PAAS, DOC, RYN, RCII, SFLY, SWKS, TEVA, TRIP, UPWK, and VER.

Action Plan

During the early evening, futures were moving lower after some disappointing earnings results from DIS. However, things began to improve after the Asian markets opened, and China followed through stabilizing the Yuan. As a result of the escalating trade war tensions, Morgan Stanley is the first to lower earnings expectations for the next 2-years. It would seem in the eyes of Morgan Stanley the trade war uncertainty is here to stay.

Although the relief rally that began yesterday appears to be following through with more bullishness ahead to the open, I’m not sure we can gain much comfort in the move due to the tremendous technical damage in the charts. As the indexes try to recover, we must stay on our toes watching for clues of potential lower high failures at or near price resistance levels or key moving averages. The huge number of earnings reports, yet this week could help the price recover, but it could also trigger the next wave of selling should the results disappoint. The high volatility can provide opportunities for adept day-traders; however, swing and position traders are likely to find the price action very challenging. Remember trading every day is not a requirement, and Cash is a position often underutilized in times of market turmoil such as this.

Trade Wisely,

Doug

Comments are closed.