Is the Sky Falling?

Is the Sky Falling?

Listening to the market reports it would be easy to conclude that the sky is falling! However, if you study price action, there is nothing that out of ordinary concerning the current pullback. After more than a 2000 point Dow rally in just 9-days, the oddity is not expecting one to occur! For all traders, this selloff is unnerving and very uncomfortable, but as long as price remains above October low, the sky is not falling.

Listening to the market reports it would be easy to conclude that the sky is falling! However, if you study price action, there is nothing that out of ordinary concerning the current pullback. After more than a 2000 point Dow rally in just 9-days, the oddity is not expecting one to occur! For all traders, this selloff is unnerving and very uncomfortable, but as long as price remains above October low, the sky is not falling.

In fact, the vast majority of market bottoms are formed this way. They take time, and they are always volatile and trying to fight it is a good way to go broke. As always it will be the institutions with their trillions of dollars that will decide when it’s over not the retail traders! If your being chopped to pieces in this volatility, stop trading. Study price, watch and wait for your edge to return. Better days are coming and when it does there well great stock at discounted prices.

On the Calendar

On the Earnings Calendar, we have nearly 250 companies reporting results today. The bad news is this could add to market volatility with the good news is we are beginning to wind down earnings this quarter.

Action Plan

Some pretty wild price action yesterday with Dow swing more than 325 points from high to low in a very volatile session. The possible silver lining I mentioned yesterday didn’t show itself but looking at the major index charts is still possible as long as prices hold above October’s low. Having said that Bears are still in control and we must remember that anything is possible. Sadly IWM has now officially printed the so-called death cross with the 50-day crossing below the 200-day average.

Currently, futures have recovered from overnight lows and currently suggesting a flat to every so slightly bullish open. When the market downturn began in early October, I said the technical damage could take weeks if not months to repair. I have also mentioned several times that the V-bottom that had been forming after a 2000 point rally in the Dow was very rare an that has also proved to be true. That was not a prediction; it was merely a study of typical price action after a selloff. If I can do it, believe me, anyone can read price action as long as you set aside bias and remain disciplined.

Trade Wisely,

Doug

Without question, yesterday’s selling may have been painful, but is there a possible silver lining? If you take a close look at the DIA, SPY, IWM and even the QQQ could be forming a possible bullish inverted head and shoulders patterns. Of course, we will need to buyers come to hold key support levels to complete the formation, but that is still possible to stay focused on price action.

Without question, yesterday’s selling may have been painful, but is there a possible silver lining? If you take a close look at the DIA, SPY, IWM and even the QQQ could be forming a possible bullish inverted head and shoulders patterns. Of course, we will need to buyers come to hold key support levels to complete the formation, but that is still possible to stay focused on price action.

Good morning from the Las Vegas Money Show. Asian markets closed modestly higher across the board overnight, and the European markets are currently mixed but mostly lower this morning. Consequently, US futures are pointing to a mixed open as I write this. Keep in mind that bond and currency markets are closed today in observance of Veterans Day. As a result, don’t be to surprise if price action becomes light and choppy after the morning rush.

Good morning from the Las Vegas Money Show. Asian markets closed modestly higher across the board overnight, and the European markets are currently mixed but mostly lower this morning. Consequently, US futures are pointing to a mixed open as I write this. Keep in mind that bond and currency markets are closed today in observance of Veterans Day. As a result, don’t be to surprise if price action becomes light and choppy after the morning rush. Is your market bias robbing you of profits? As a trading coach, I answer questions almost every day from traders that fail to see the price action clue in the chart due to bias. Perma-bulls dreaming of a Santa Clause rally, fail to see the possibility of a pullback even after a 2000 point rally in just 8-days. Perma-bears are just as negligent believing that the market has gone up so much that it has to come down. Have you ever failed to close position moving strongly against you because, darn it, you have to be right!

Is your market bias robbing you of profits? As a trading coach, I answer questions almost every day from traders that fail to see the price action clue in the chart due to bias. Perma-bulls dreaming of a Santa Clause rally, fail to see the possibility of a pullback even after a 2000 point rally in just 8-days. Perma-bears are just as negligent believing that the market has gone up so much that it has to come down. Have you ever failed to close position moving strongly against you because, darn it, you have to be right!

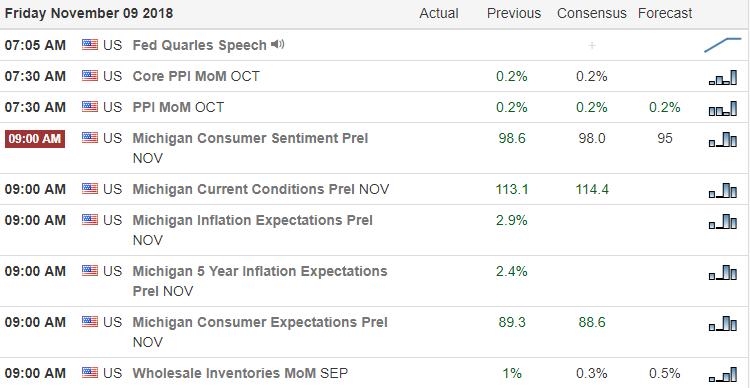

Today is the last really big day of reports this quarter, and with the election behind us, the market is free to react to earnings and the FOMC decision. Asian markets were mixed but mostly higher overnight, and the European markets are currently flat to mostly lower. The US Futures are only pointing to a modest gap down this morning but after such a huge rally don’t be surprised to see some profit-taking.

Today is the last really big day of reports this quarter, and with the election behind us, the market is free to react to earnings and the FOMC decision. Asian markets were mixed but mostly higher overnight, and the European markets are currently flat to mostly lower. The US Futures are only pointing to a modest gap down this morning but after such a huge rally don’t be surprised to see some profit-taking.

Judging by the bullishness of the US Futures the market is pleased with the election results. At the open, the Dow will have recovered more than 1700 points in just 7-days to test its 50-day average as resistance. Truly an amazing accomplishment but raises the questions is it too much to fast and are we overextended in short-term? Only time will tell but be careful chasing the morning gap at the open in case profit-takers capitalize on the bullish windfall.

Judging by the bullishness of the US Futures the market is pleased with the election results. At the open, the Dow will have recovered more than 1700 points in just 7-days to test its 50-day average as resistance. Truly an amazing accomplishment but raises the questions is it too much to fast and are we overextended in short-term? Only time will tell but be careful chasing the morning gap at the open in case profit-takers capitalize on the bullish windfall.

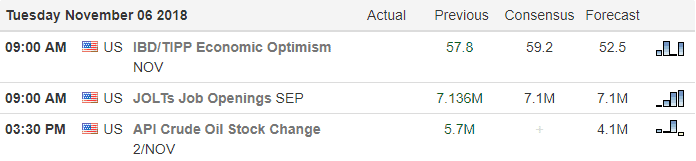

Everywhere I look I see another talking head trying to predict the outcome of the mid-term election. To be honest, that’s far easier to do that than trying to predict how the market will react to the results! What I can say with 100% certainty is that no one knows what that reaction will be and trying to trade it is straight up gambling. As traders, we all gamble from time to time but let’s be honest with ourselves and have our eyes wide open if you choose to do so today.

Everywhere I look I see another talking head trying to predict the outcome of the mid-term election. To be honest, that’s far easier to do that than trying to predict how the market will react to the results! What I can say with 100% certainty is that no one knows what that reaction will be and trying to trade it is straight up gambling. As traders, we all gamble from time to time but let’s be honest with ourselves and have our eyes wide open if you choose to do so today. On the Earnings Calendar, we have more than 350 companies reporting today. Keep checking and stay focused on the number of reports grows even more through Thursday.

On the Earnings Calendar, we have more than 350 companies reporting today. Keep checking and stay focused on the number of reports grows even more through Thursday. This morning the US Futures are trying to put on a brave face before the mid-term election indicating a bullish open. While the water may seem calm on the surface, there is likely significant turbulence lurking just below. Futures were lower most of the night so don’t rule out the possible test of the overnight lows during the day.

This morning the US Futures are trying to put on a brave face before the mid-term election indicating a bullish open. While the water may seem calm on the surface, there is likely significant turbulence lurking just below. Futures were lower most of the night so don’t rule out the possible test of the overnight lows during the day.

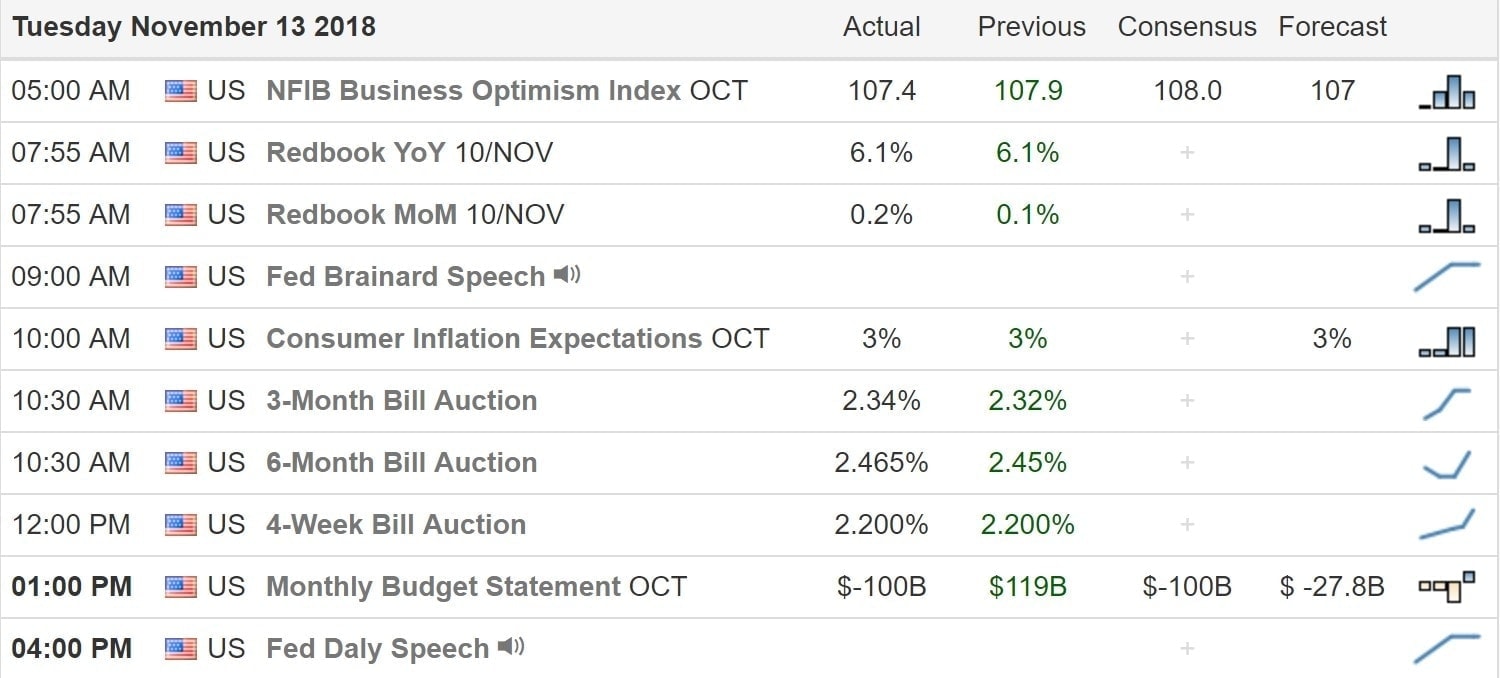

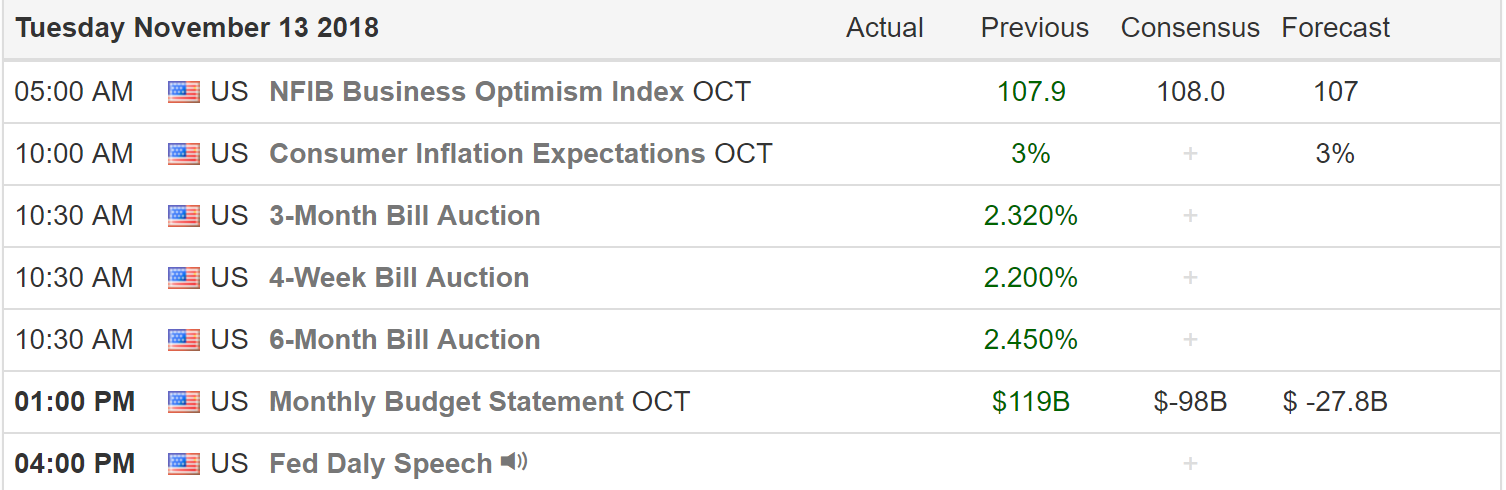

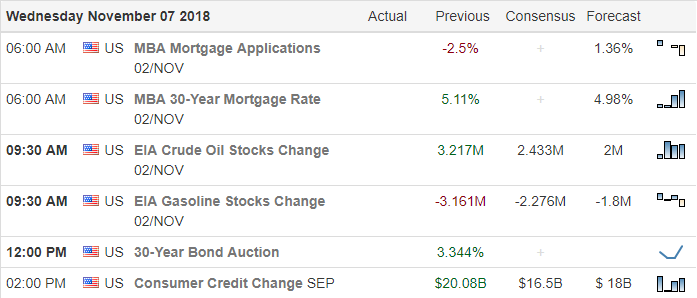

Markets are once again gaping higher this morning as this wild ride of volatility continues. With nearly 450 companies reporting earnings today and a busy economic calendar, anything is possible. Price resistance did its job yesterday rejecting the days high. This mornings gap brings the price right back up to those same price resistance levels. I intend to very cautious this morning and will watch price action closely to see if this gap is actually going to be supported by buyers.

Markets are once again gaping higher this morning as this wild ride of volatility continues. With nearly 450 companies reporting earnings today and a busy economic calendar, anything is possible. Price resistance did its job yesterday rejecting the days high. This mornings gap brings the price right back up to those same price resistance levels. I intend to very cautious this morning and will watch price action closely to see if this gap is actually going to be supported by buyers.