The bull trend continues despite the rate of uncertainty fueled by earnings results and a remarkable willingness to chase the very extended tech titians higher. I think we can expect more of the same as we roll out a huge number of earnings reports through the end of the week. That said, manage your positions closely because the bears are beginning to act a bit more aggressively, and if the bulls stumble or run out of energy an attack could begin quickly. Plan for considerable price volatility as the market reacts to all the pending reports.

While we slept Asian markets closed mixed but mostly higher as China pushed hard to stimulate buying confidence as manufacturing and real-estate woes continue. European markets trade modestly lower across the board this morning as the rate uncertainty continues. Although U.S. futures traded lower overnight once again they are working hard in the premarket to recover losses as earnings results roll out.

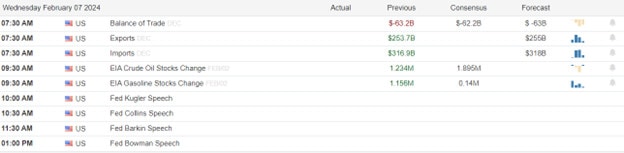

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include DIS, ADNT, BABA, ALL, ARCC, ARM, ASGN, ACLS, BTG, BHK, BG, CCJ, CG, CFLT, CXW, COTY, CVS, DAY, EMR, EHC, ENS, NVST, EFX, EG, FAF, FLT, FOX, FNV, GL, GRPO, GPRE, GFF, HAIN, HLT, KMT, KGC, KN, KGS, MANU, MCFT, MAT, MCK, MOH, MPWR, MUSA, NFG, NTGR, NYT, NWSA, OHI, ORLY, PAYC, PYCR, PYPL, PAG, PFGC, RDN, RDWR, REYN, RBLX, SMG, SLAB, TTGT, TRI, TTMI, VSH, XPO, & YUM.

News & Technicals’

Snap, the maker of the popular social media app Snapchat, reported a modest increase in its fourth-quarter revenue, while its net loss shrank from a year ago. However, the company’s revenue and forecast fell short of the market expectations, sending its shares lower. Snap blamed the Middle East conflict for slowing down its growth, as it said in a letter to investors on Tuesday that the geopolitical turmoil hurt its advertising business.

Chipotle, the fast-casual Mexican restaurant chain, reported strong earnings and revenue for the fourth quarter, exceeding the market forecasts. The chain’s same-store sales, which measure the performance of its existing locations, also surpassed expectations, showing healthy growth. Chipotle attributed its success to the increase in its customer traffic, which defied the general decline in the restaurant industry. Chipotle said that its digital and delivery initiatives, as well as its menu innovations, helped attract more customers and boost its sales.

Ford, one of the leading car manufacturers in the world, is revising its plans for investing in electric vehicles (EVs). According to its CEO Jim Farley, the company is facing challenges in making EVs affordable and profitable for the average customer. While Ford remains optimistic about the future of EVs, it has decided to reduce its spending on this segment by $12 billion. This move reflects the uncertainty and complexity of the EV market, which is still evolving and developing.

Despite beating analysts’ estimates for its fourth-quarter performance, CVS Health delivered a disappointing outlook for 2024. The healthcare giant blamed rising medical expenses for its lower earnings guidance, which reflects the challenges faced by the insurance sector amid the pandemic. CVS Health, which operates pharmacies, clinics, and health plans, said it expects to earn at least $8.30 per share in 2024, down from its previous projection of at least $8.50 per share.

Earnings results continue to help the indexes push higher to close mostly in the green on Tuesday. The S&P 500 and the NASDAQ, edged up by about 0.2% and 0.1%, respectively. However, after the morning pop, the market largely chopped sideways on relatively low volume. The best-performing sectors in the S&P 500 were real estate and materials, each gaining about 1.5%. After dropping by about 2% in the previous two days, U.S. small-cap stocks bounced back by about 0.6%. Today traders will look for inspiration in the huge number of earnings reports as well as Mortgage Apps, International Trade, Petroleum Status, several Fed speakers, and bond auctions. The trend remains bullish but the hint of uncertainty could bring the bears in quickly so continue to manage your positions carefully to protect profit if the bull begins to stumble.

Trade Wisely,

Doug

Comments are closed.