Fear of Recession Heats Up

From Open to close yesterday the SPY had a $4.10 day, not bad at all. Now the buyers need to keep their bulls focused in the right direction. With the fear of rescission heating up, the bulls will likely catch a little wind that smells like fear. At some point, enough fear will cause selling in the market. MKE being down and the BA troubles will weigh on the DOW today. (Caution). The buyers produced a nice Bullish Engulf on the SPY chart closing at $284.73; A Bullish Engulf is just one gear in the machine. Now the buyers need to show they have what it takes to drive the price action higher. So far our Red Green Trend is working, the question is will the buyers be able to push the 50SMA over the 200SMA?

Yesterday (Thursday) was a nice profitable day, and I suspect today will be the same because we typically take profits of Fridays and lighten up going into the weekend.

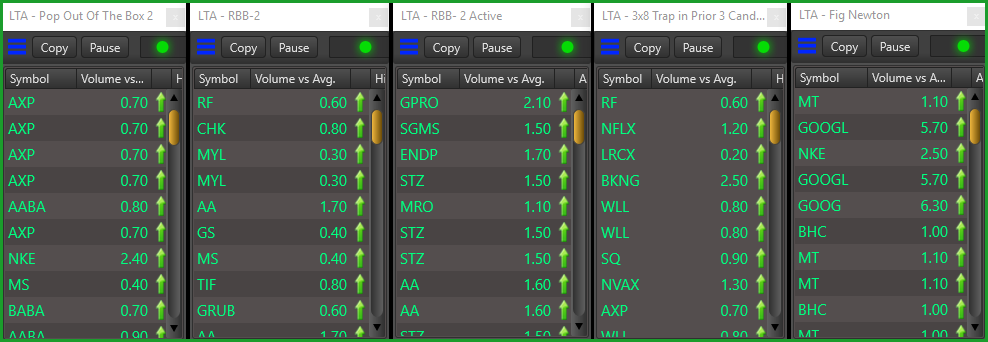

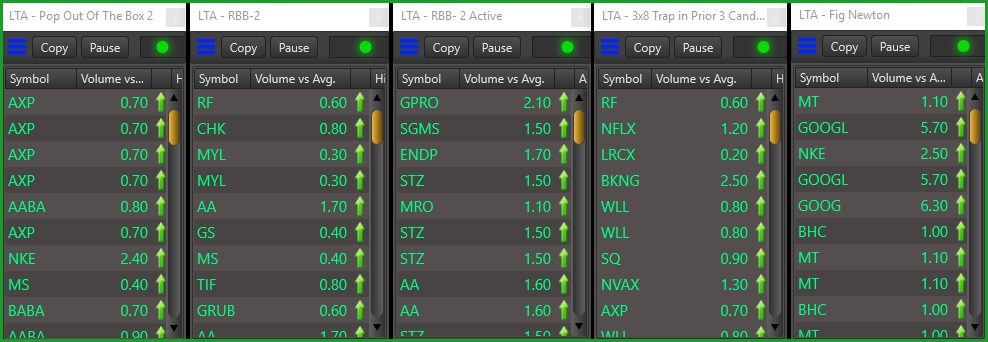

This past week the LTA scanner proved it’s value to traders helping with

HRC/RWO Team News

✅ Member LTA Live Scanner Discount Code: Can be found on the member’s login page down toward the bottom. BIG SAVINGS

✅ Trade-Ideas for considerations: No trade ideas on Friday’s. Have a great weekend!

✅ 50% Discount Available: Hit and Run Candlesticks • Right Way Options • Use Promo Code: SAVE50

Live Trading Alerts News

Testimonial

Took 20% on WIX puts! Thank you LTA- Live Trading Alerts

Jerry G.

Testimonial

I have hit for over $300 this morning using your LTA scanner, I think I have found my niche!

Coach B.

✅Save time reviewing hundreds of charts. ✅Find EXACTLY the right set up by being alerted for only those tickers that qualify. ✅Stop “Chasing trades” by being alerted of the move (not finding out later.) ✅Eliminate “trouble pulling the trigger” (be sure when a ticker is moving.) ✅Stop “leaving money on the table” (manage your exits with lower-time alerts.) ✅Stop “Predicting” by trading alerts that show the turn, not forecast it. ✅Stop ignoring the overall market (by watching alerts on DIA, SPY, IWM, QQQ.) ✅Gain massive efficiency over flipping through charts (hoping to find them at just the right time) or waiting on someone to feed you trade ideas.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service