According to new reports the futures are down this morning because investors are seeking clarity on the US / China trade deal. How can there be clarity when have been no details and no deal has yet not yet finished? Would it not be more likely that the market is merely needing a rest after the Dow has rallied nearly 4500 points in just over ten weeks? After an extraordinary run a rest or pullback is normal and healthy price action to confirm or build price support.

The trend is still up and but there are warnings signs that this run is a bit overextended. However, at this time there are no clues of failure and the bulls have proven to be remarkably resilient fending off bear attacks quite easily of late. I would not expect them to give up easily now but stay focused on price action clues waiting to see if the sellers show up in support or the morning gap down or if buyers step in rejecting the low.

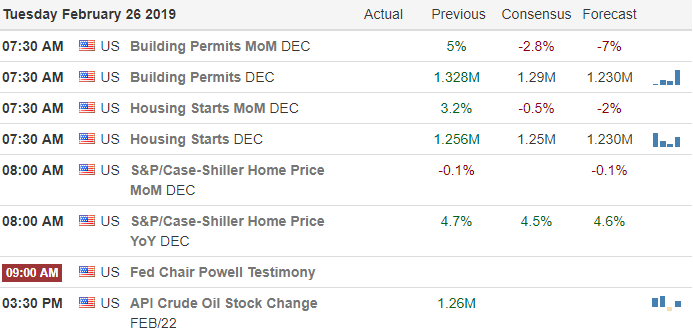

On the Calendar

On the Earnings Calendar we have over 200 companies reporting today. Among the most notable are, HD, M, BGS, BMO, BNS, LNG, CSGP, CBRL, DISCA, ELF, EV, FTR, GWPH, HTZ, SJM, TREE, MELI, MYL, PANW, PZZA, PSA, SDRL, SSTK, TIVO, VSI, and WTW.

Action Plan

If we are to believe the news CNBC is citing that the futures are lower because investors want clarity on the US / China deal! Hmm, all along there has little to know details and the fact is there has been no official deal as of now. Seems more likely is down because simply because it needs a rest after Dow rally of nearly 4500 points! Nonetheless, Asian and European markets are lower this morning and it doesn’t help the situation with HD missed on earnings early this morning.

The President is on his way to Vietnam to meet with Kim Jong-un to discuss nuclear disarmament. Don’t be surprised if news reports from the meeting create a little market volatility. Keep an eye on the Housing numbers this morning at 8:30 AM Eastern. Let’s hope they show a better result than the existing home sales numbers last week or the open today could be a little rough. The trend is still up but there are several danger signs so stay focused on price. There may be nothing at all to worry about but let’s have the bull prove that before taking additional long risk.

Trade Wisely,

Doug

Comments are closed.