My curiousness about how the markets would open as we enter the 11th week of this market rally disappeared after the Presidential tweet energized the bulls. About 10 minutes before the futures market opened it was reported that the President would delay the Chinese tariff increase. As you might expect Asian markets rallied strongly on that news last night and the bullish spread to European markets which are higher across the board this morning.

Following a trip point gap and run on Friday the US futures point to yet another gap of nearly 150 points this morning. Although global economic stories continue to populate the news the bulls appear to have no concern and there is even some speculation that new market record highs are on the way. Though the trend is up please keep in mind there are clues that the market is overbought as we test resistance levels. That certainly does not mean that selling will soon begin but it does suggest we need to be watchful and prepared in case the bull stumbles.

On the Calendar

On the Earnings Calendar we have 130 companies reporting earnings today. Notable reports, TWOU, AWR, APLE, CLDT, ETSY, LSI, MOS, OKE, PBPB, APTS, RCII, SHAK, THC & VCYT.

Action Plan

About 20 minutes before the Futures markets reopened yesterday I was checking the news and wondered how the markets would respond after ten weeks of rally and closing in the Friday tariff increase. That curiosity went away when about 10 minutes before the futures open the President tweeted he would delay hiking the China tariffs and referenced the negotiations as productive. As you might imagine when the Asian markets began to open 2 hours later they made significant gains on the news. European markets are currently higher and the US futures are suggesting about a 150 point gap higher this morning.

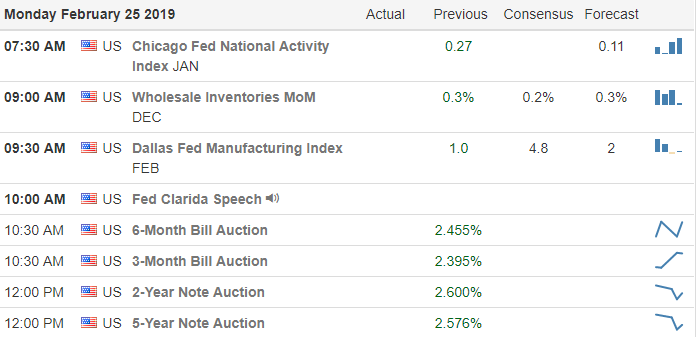

As we enter the 11th week of this amazing rally there is now speculation that the market will reach out for new record highs in the near future. Although it seems a fruitless endeavor I will once again point out the significant resistance levels just above and suggest caution as we rally to test them. We have another big week of earnings this week and several very important economic reports for the market to digest as well.

Trade Wisely,

Doug

Comments are closed.