Futures are pointing to a modestly lower open this morning as the market faces a day of historical events. First are the decisions of nuclear disbarment of North Korean a feat no sitting president has been able to accomplish. Secondly a congressional hearing where the president’s former attorney is expected to testify that is boss broke the law while holding the highest office in the nation. Add to that a big day of earnings reports and full economic calendar and I think it’s safe to say the market has a lot a lot on its plate to digest.

The bulls have proven to be very resilient and the trend is up so expect them to fight hard to defend against any bear attack. However, we also have to respect the price resistance in the index charts and plan for the possibility that the political drama could impact the market with higher volatility. Saying that anything is possible would not be an understatement and you never know exactly how the market could react with so much to chew on today.

On the Calendar

On the Earnings Calendar we have a big day with more than 210 companies reporting quarterly results. Some of the notable earnings are, AMT, APA, BBY, BKNG, BOX, CPB, CHK, DF, FIT, TWNK, HPQ, LB, LOW, ODP, PK, PBR, SQ, TDOC, TJX and WING.

Action Plan

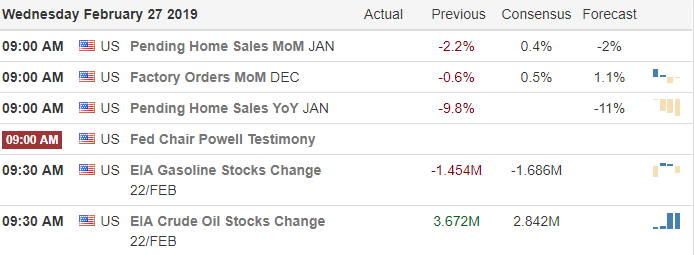

As the US and North Korean try to make nice while discussing nuclear disarmament abroad the president himself will be under attack in a congressional hearing right here at home. Putting the president’s challenges aside we should plan for the possibility of serious market impacts. As I write this morning note the futures are pointing to only a modest decline at the open. With a big day of earnings reports, important economic reports and a distracting political drama anything is possible.

In our 11th week of rally and testing index price resistance it would not be out of the question to see some profit-taking begin or some price consolidation to reinforce a new level of support. However, the bulls have proven to be remarkably tenacious and with the market trend strongly in their favor I would expect them to fight hard for higher prices. Avoid predicting, stay focused on price, remain flexible, stay disciplined to your trading rules and prepare for a very interesting day.

Trade Wisley,

Doug

Comments are closed.