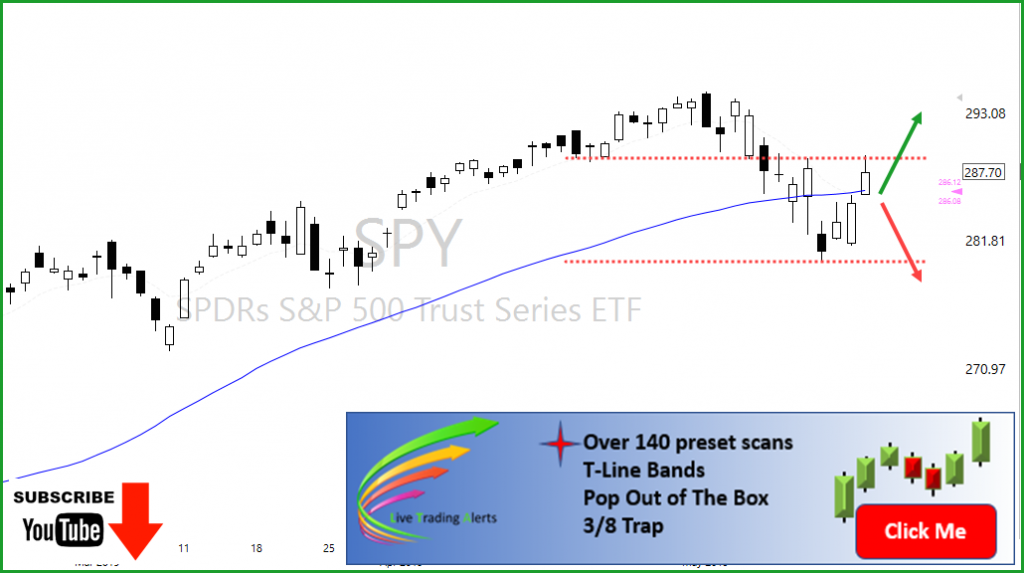

Earlier this week price had closed below the 50-SMA and yesterday (Thursday) the Bulls found a path to close over the 50-SMA. This by no means suggests the bulls are back. A test of the or near the 50-SMA is required and bullish follow-through from there. Below $279.95 the seller will throw a party, and above %289.23 the buyers will dance in the streets. IWM is having a little trouble at the 50-SMA, a bear flag and a Blue Ice Failure at the moment, for this reason, we shorted IWM yesterday looking for a few hundred $$$ in profits. The VXX chart is another reason we took advantage of IWM. On the 15- minute chart the VXX was forming a bottom (“W”) looking like it want to attack its 50-SMA. Pre-market this plan is working, we will see if the open is the same. Yesterday we closed out PEP and PG for nice double-digit profits, could have not done it without our trading tools.

Trade Ideas

Sorry, we do not post trade ideas on Fridays. Friday is the day we clean up our positions. And enjoy being a Trader of the market. We follow the trend, buy near support, profit into strength for solid base hits.

We use 2 of The Worlds Best Trading Tools, TC2000 for charting, LTA-Live Trading Alerts for real-time price action, candle and candle patterns, and western patterns.

👍 A good tool improves the way you work. A great tool 👉 improves the way you think. – Jejj Duntemann

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Comments are closed.