Wild Price Volatility

In one fell swoop virus fears wiped out 2020 market gains with the biggest day of price volatility the market has experienced in a very long time. Though it may have been an overreaction the growing uncertainty of coming economic impacts is likely to keep the market on edge and price volatility very challenging for the near future. We should expect very fast price action, news-driven intra-day reversals and whipsaws as the market grapples with not only the virus fall-out but the rising candidacy of Birnie Sanders.

Asian markets closed mixed but mostly lower with Japan plunging more than 3% overnight. European markets are once again negative across the board after a turbulent day of selling on Monday. US Futures have been all over the map in the last 12 hours as they try to sort out what comes next. However, with some positive earning reports the bulls have found some inspiration and currently point to bullish open.

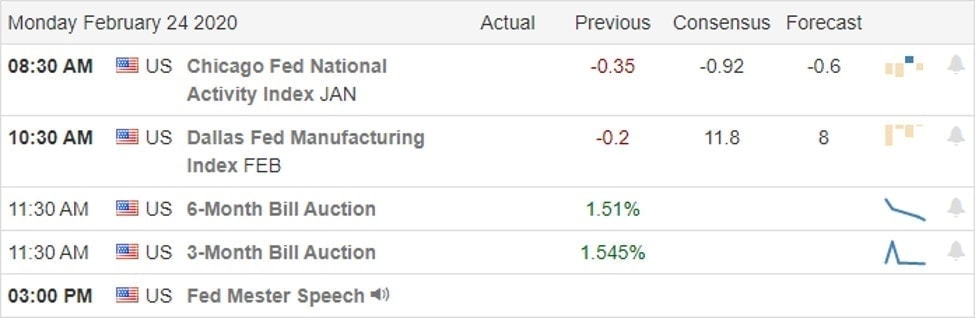

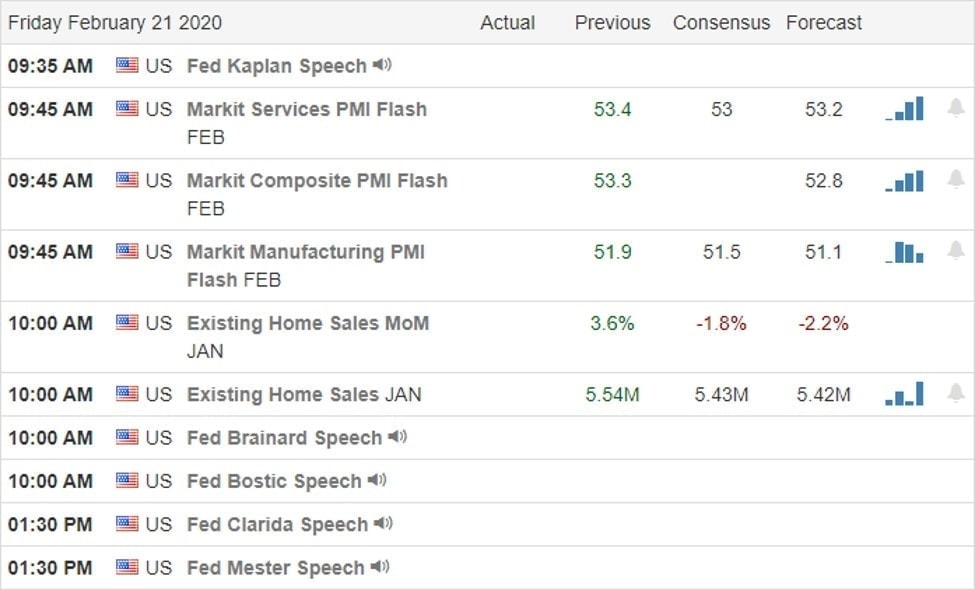

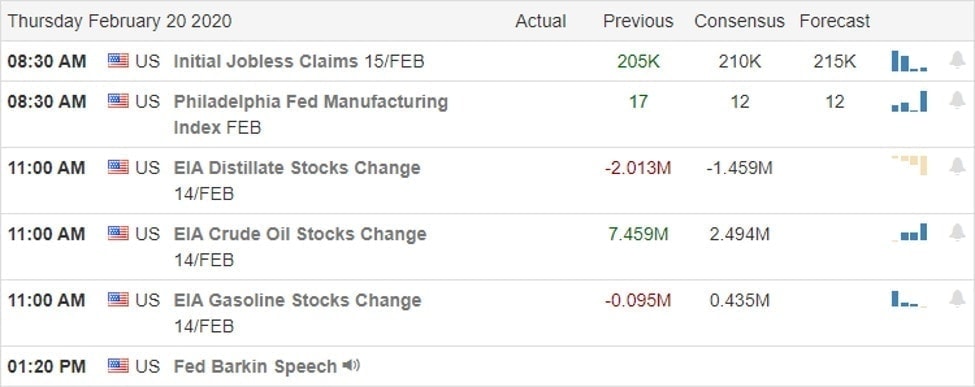

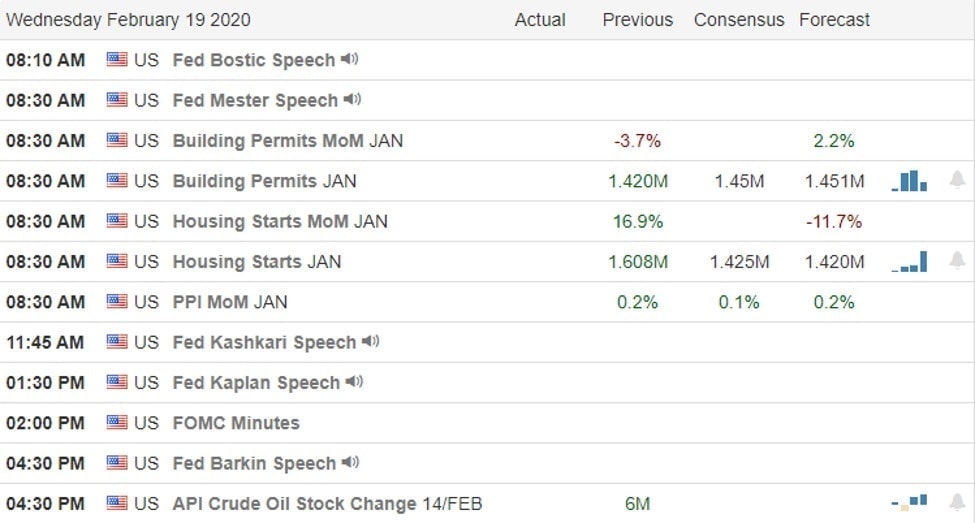

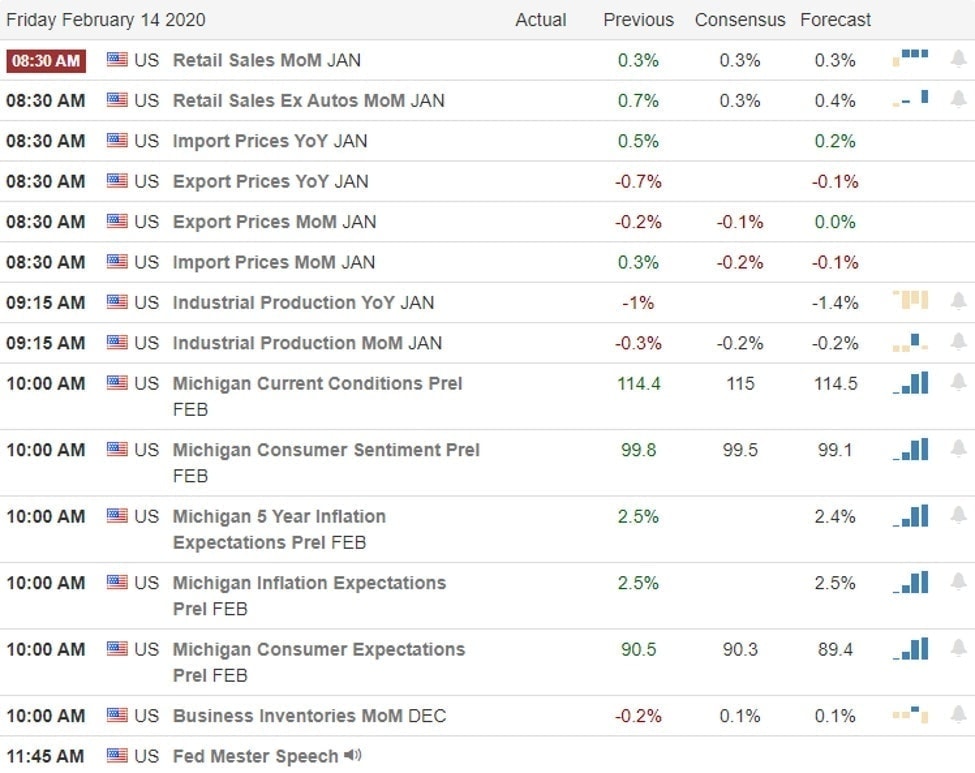

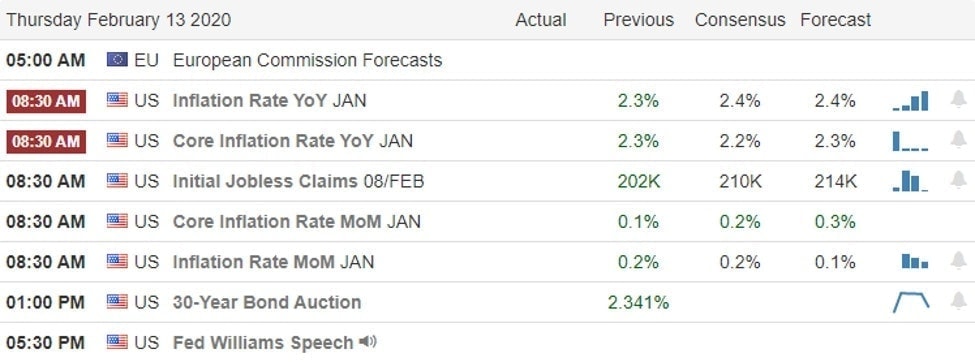

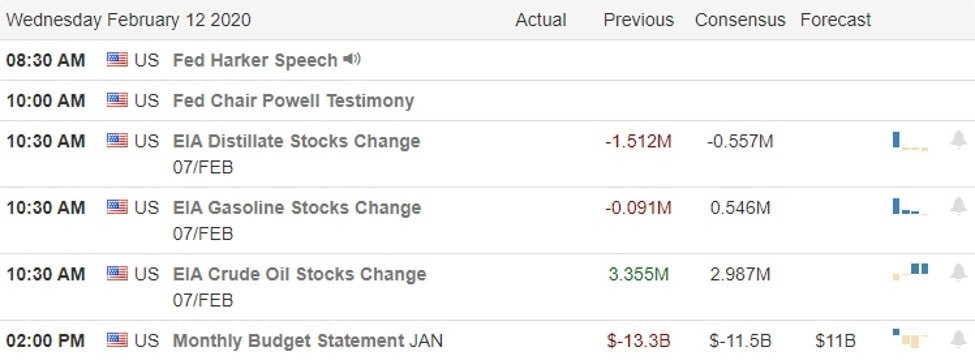

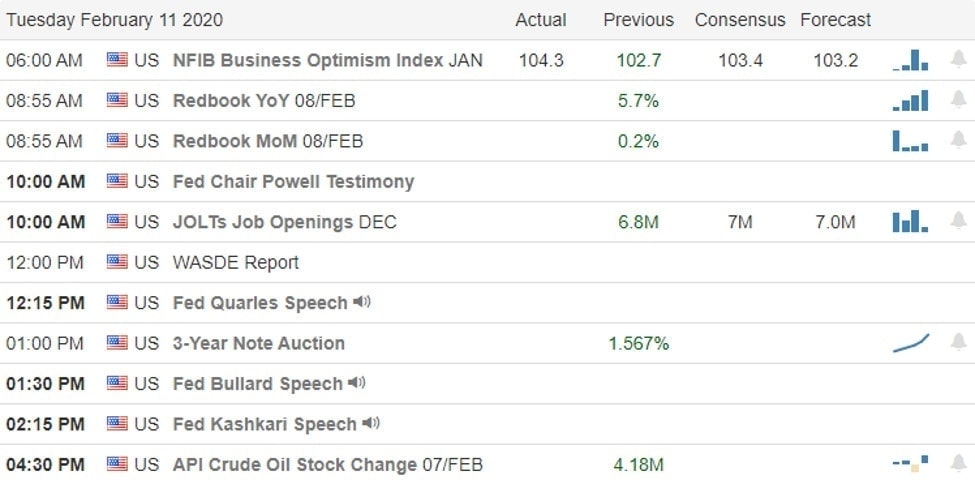

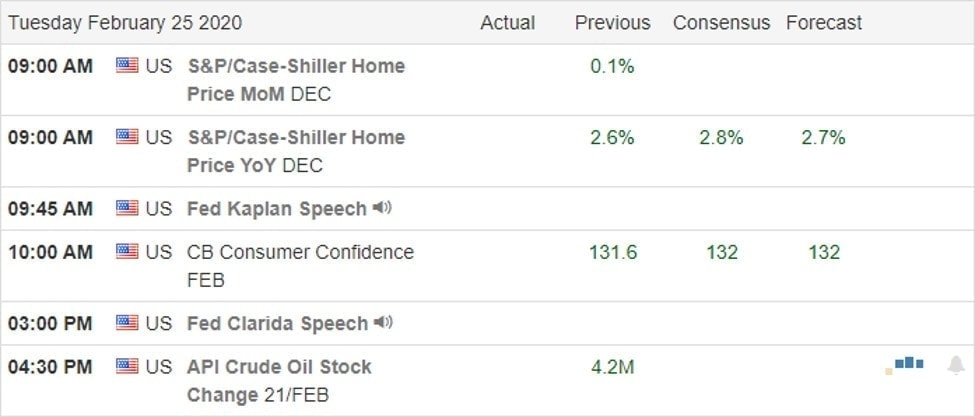

On the Calendar

On the Tuesday earnings calendar, we have nearly 200 companies fessing up to quarterly results. Notable reports include SPCE, ALRM, AMRN, AMT, AGR, BGS, BMO, BNS, BCC, CZR, CSGP, CBRL, FRPT, GWPH, HD, TREE, LL, M, MNK, MANU, PLNT, PBPB, PSA, RLGY, RRGB, RHP, CRM, SDC, REAL, TRI, TOL, TUP, WWW & WW.

Action Plan

Yesterday selling wiped out this year’s gains in one fell swoop in reaction to the potential economic impacts of the spreading virus outbreak which has now reached 22 countries. As the number of infections seems to be in decline in China, outbreaks in Italy, Iran and a rapidly expanding infections in South Korea have investors on edge. Oil prices fell sharply on Monday as world demand continues to decline with factory closures and massive travel restrictions extend. Another area hit hard yesterday was the healthcare and insurance sector with investors reacting negatively as Birnie Sanders gains traction in his campaign. A spreading virus and a socialist agenda combined energized the bears spiking price volatility making a very dangerous trading condition at least for the short-term.

After the bell the futures market tried to bounce back sharply but the pressure of the markets around the world continuing to slip south those early gains eroded during the night. However, with a big day of earnings reports futures markets are once again trying to rebound now pointing to modest gains at the open. That said, the pre-market price action is very volatile and traders should prepare for just about anything with a market highly emotional and growing uncertainty. This is not a market for inexperienced traders! Even very experienced traders may find today’s price action very challenging with very quick reversals and whipsaws as virus news continues to roll out. If you do decide to trade it may be wise to consider smaller than normal positions and as always plan your risk carefully.

Trade Wisely,

Doug