The virus outbreak grows and more and more companies warn of future impacts, but the bulls keep marching higher without fear. Yesterday, Guggenheim Partners Global CIO, said that the GDP Growth in China’s first-quarter could be as a negative 6% and went on to say, “We are in a ludicrous season.” If he right, we may have trouble time ahead, but for now, the bulls are in control and buying is all they seem to have on their minds.

Overnight Asian markets closed mixed but mostly higher as Singapore warns of recession risk, and more than 4000 new cases of infection reported. European markets are trading cautiously mixed but mostly higher this morning. US Futures are green across the board but modestly so ahead of earnings and a big economic calendar data dump. With the uncertainty of the 3-day weekend, will the bulls continue to drive upward or might there be some profit-taking?

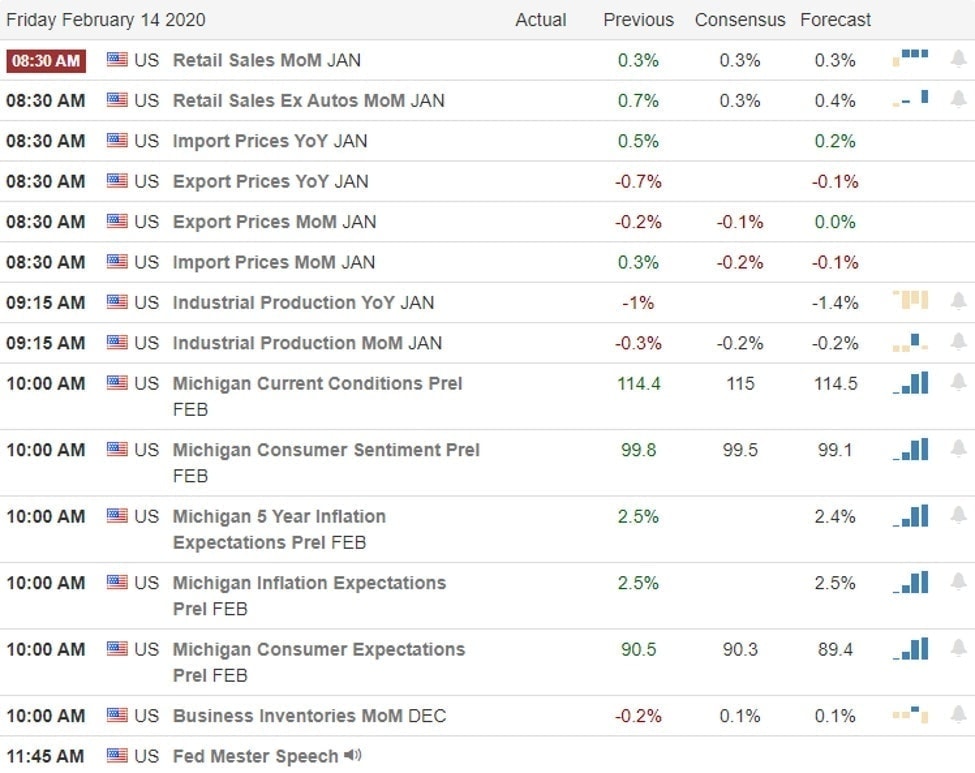

On the Calendar

On the Friday earnings calendar, we get a little break with less than 50 companies reporting results today. Notable reports include AL, ABR, AZN, CGC, MGP, NWL, PPL, TRTN, & YNDX.

Action Plan

What is there about this market? Bulls are in control and they seem to be on a mission to push the Dow to 30,000 no matter what. Companies continue to issue warning after warning that the virus outbreak will have and impact going forward but prices continue to increase as if there is no price too high to buy. The quote below says it much better than I.

Guggenheim Partners Global CIO Scott Minerd said in a letter to clients that the elevated prices in financial markets show a “cognitive dissonance” from economic reality that has created a dangerous bubble among debt assets.

“This will eventually end badly. I have never in my career seen anything as crazy as what’s going on right now,” Minerd said.

Guggenheim Partners Global CIO Scott Minerd said in a letter to clients that the elevated prices in financial markets show a “cognitive dissonance” from economic reality that has created a dangerous bubble among debt assets.

“This will eventually end badly. I have never in my career seen anything as crazy as what’s going on right now,” Minerd said.

“We are either moving into a completely new paradigm, or the speculative energy in the market is incredibly out of control. I think it is the latter. I have said before that we have entered the silly season, but I stand corrected,” Minerd said at the end of his letter. “We are in the ludicrous season.”

My question, ss we head into a 3-day weekend will the bulls continue to drive higher without regard to coming impacts or will traders and investors take profits due to the uncertainty. As for me, I plan to go into the weekend very light in my accounts.

Trade Wisely,

Doug

Comments are closed.